Answered step by step

Verified Expert Solution

Question

1 Approved Answer

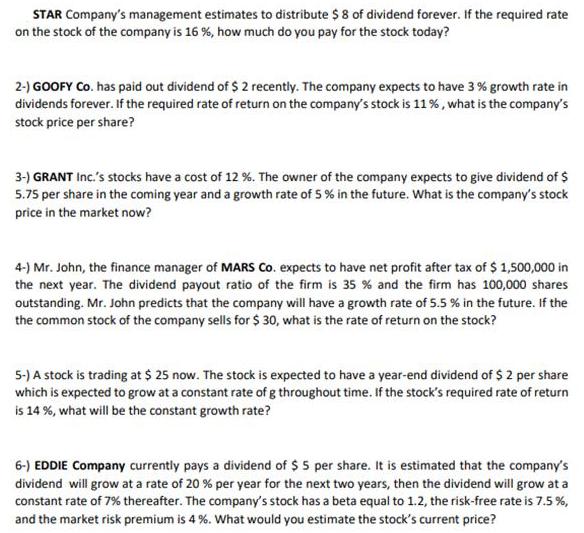

STAR Company's management estimates to distribute $ 8 of dividend forever. If the required rate on the stock of the company is 16 %,

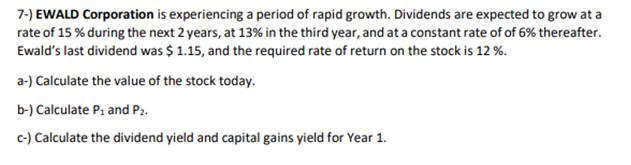

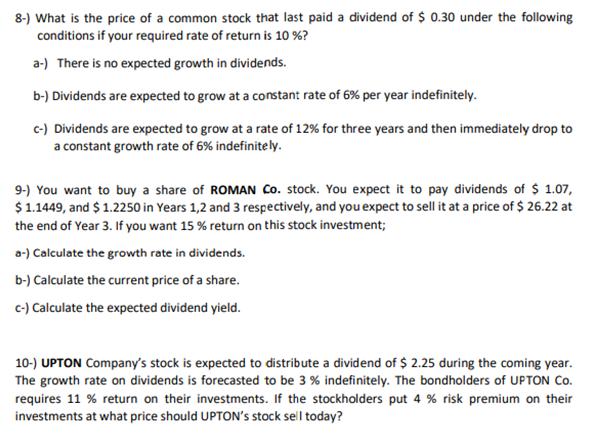

STAR Company's management estimates to distribute $ 8 of dividend forever. If the required rate on the stock of the company is 16 %, how much do you pay for the stock today? 2-) GOOFY Co. has paid out dividend of $ 2 recently. The company expects to have 3 % growth rate in dividends forever. If the required rate of return on the company's stock is 11%, what is the company's stock price per share? 3-) GRANT Inc.'s stocks have a cost of 12 %. The owner of the company expects to give dividend of $ 5.75 per share in the coming year and a growth rate of 5 % in the future. What is the company's stock price in the market now? 4-) Mr. John, the finance manager of MARS Co. expects to have net profit after tax of $ 1,500,000 in the next year. The dividend payout ratio of the firm is 35 % and the firm has 100,000 shares outstanding. Mr. John predicts that the company will have a growth rate of 5.5 % in the future. If the the common stock of the company sells for $30, what is the rate of return on the stock? 5-) A stock is trading at $ 25 now. The stock is expected to have a year-end dividend of $ 2 per share which is expected to grow at a constant rate of g throughout time. If the stock's required rate of return is 14 %, what will be the constant growth rate? 6-) EDDIE Company currently pays a dividend of $5 per share. It is estimated that the company's dividend will grow at a rate of 20 % per year for the next two years, then the dividend will grow at a constant rate of 7% thereafter. The company's stock has a beta equal to 1.2, the risk-free rate is 7.5 %, and the market risk premium is 4 %. What would you estimate the stock's current price? 7-) EWALD Corporation is experiencing a period of rapid growth. Dividends are expected to grow at a rate of 15 % during the next 2 years, at 13% in the third year, and at a constant rate of of 6% thereafter. Ewald's last dividend was $ 1.15, and the required rate of return on the stock is 12 %. a-) Calculate the value of the stock today. b-) Calculate P and P. c-) Calculate the dividend yield and capital gains yield for Year 1. 8-) What is the price of a common stock that last paid a dividend of $ 0.30 under the following conditions if your required rate of return is 10%? a-) There is no expected growth in dividends. b-) Dividends are expected to grow at a constant rate of 6% per year indefinitely. c-) Dividends are expected to grow at a rate of 12% for three years and then immediately drop to a constant growth rate of 6% indefinitely. 9-) You want to buy a share of ROMAN Co. stock. You expect it to pay dividends of $ 1.07, $ 1.1449, and $ 1.2250 in Years 1,2 and 3 respectively, and you expect to sell it at a price of $ 26.22 at the end of Year 3. If you want 15 % return on this stock investment; a-) Calculate the growth rate in dividends. b-) Calculate the current price of a share. c-) Calculate the expected dividend yield. 10-) UPTON Company's stock is expected to distribute a dividend of $ 2.25 during the coming year. The growth rate on dividends is forecasted to be 3 % indefinitely. The bondholders of UPTON Co. requires 11 % return on their investments. If the stockholders put 4% risk premium on their investments at what price should UPTON's stock sell today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the price of the stock today we can use the formula for the dividend discount model Price Dividend Required rate of return Dividend growth rate Plugging in the values given we get Price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started