Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stark Company (SC) manufactures two products, football and soccer balls. For a given period, the direct costs of producing footballs and soccer balls are

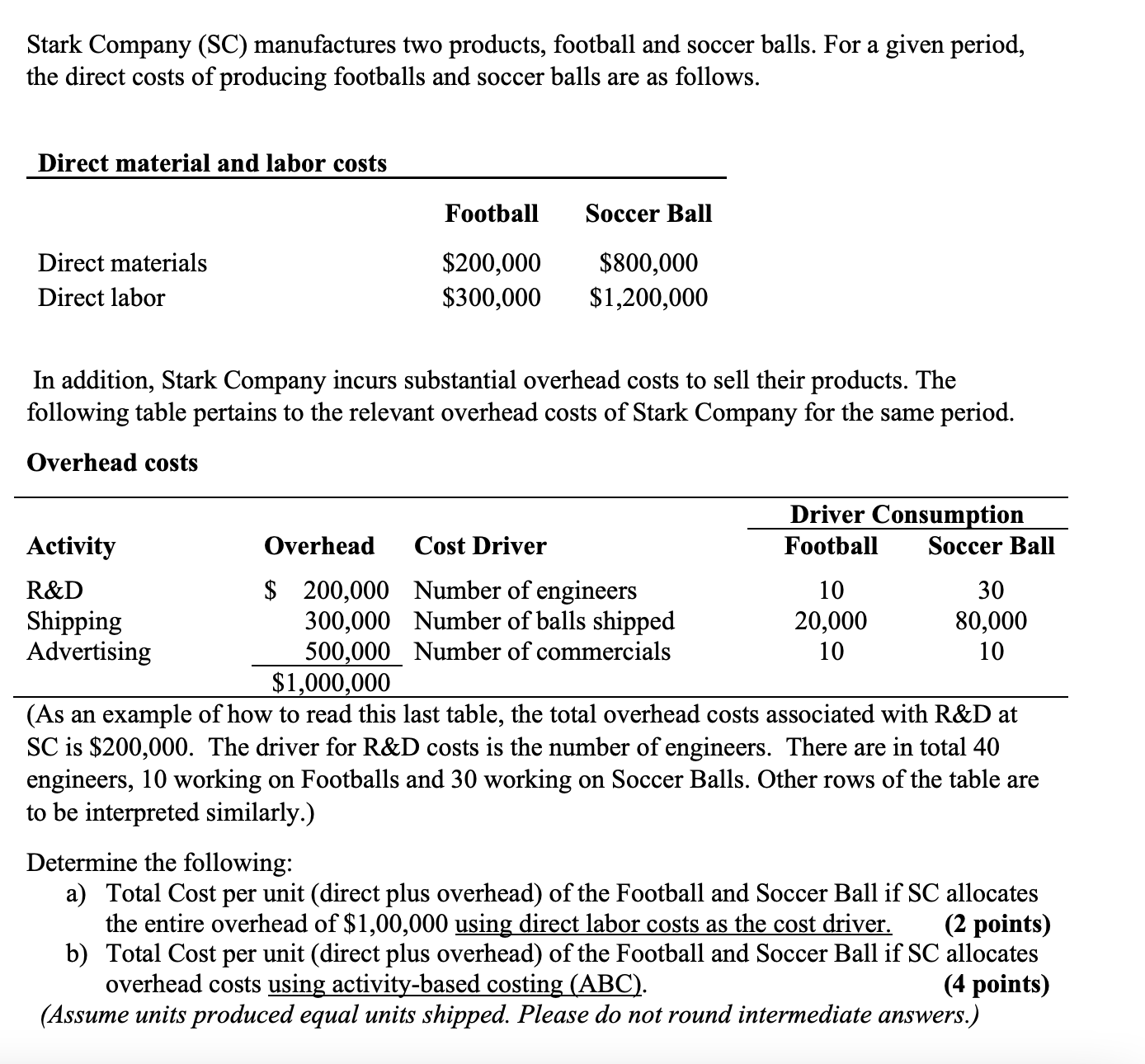

Stark Company (SC) manufactures two products, football and soccer balls. For a given period, the direct costs of producing footballs and soccer balls are as follows. Direct material and labor costs Football Soccer Ball Direct materials Direct labor $200,000 $800,000 $300,000 $1,200,000 In addition, Stark Company incurs substantial overhead costs to sell their products. The following table pertains to the relevant overhead costs of Stark Company for the same period. Overhead costs Activity Overhead Cost Driver R&D Shipping Advertising $ 200,000 Number of engineers 300,000 Number of balls shipped 500,000 Number of commercials $1,000,000 Driver Consumption Football Soccer Ball 10 30 20,000 80,000 10 10 (As an example of how to read this last table, the total overhead costs associated with R&D at SC is $200,000. The driver for R&D costs is the number of engineers. There are in total 40 engineers, 10 working on Footballs and 30 working on Soccer Balls. Other rows of the table are to be interpreted similarly.) Determine the following: a) Total Cost per unit (direct plus overhead) of the Football and Soccer Ball if SC allocates the entire overhead of $1,00,000 using direct labor costs as the cost driver. b) Total Cost per unit (direct plus overhead) of the Football and Soccer Ball if SC allocates overhead costs using activity-based costing (ABC). (4 points) (Assume units produced equal units shipped. Please do not round intermediate answers.) (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started