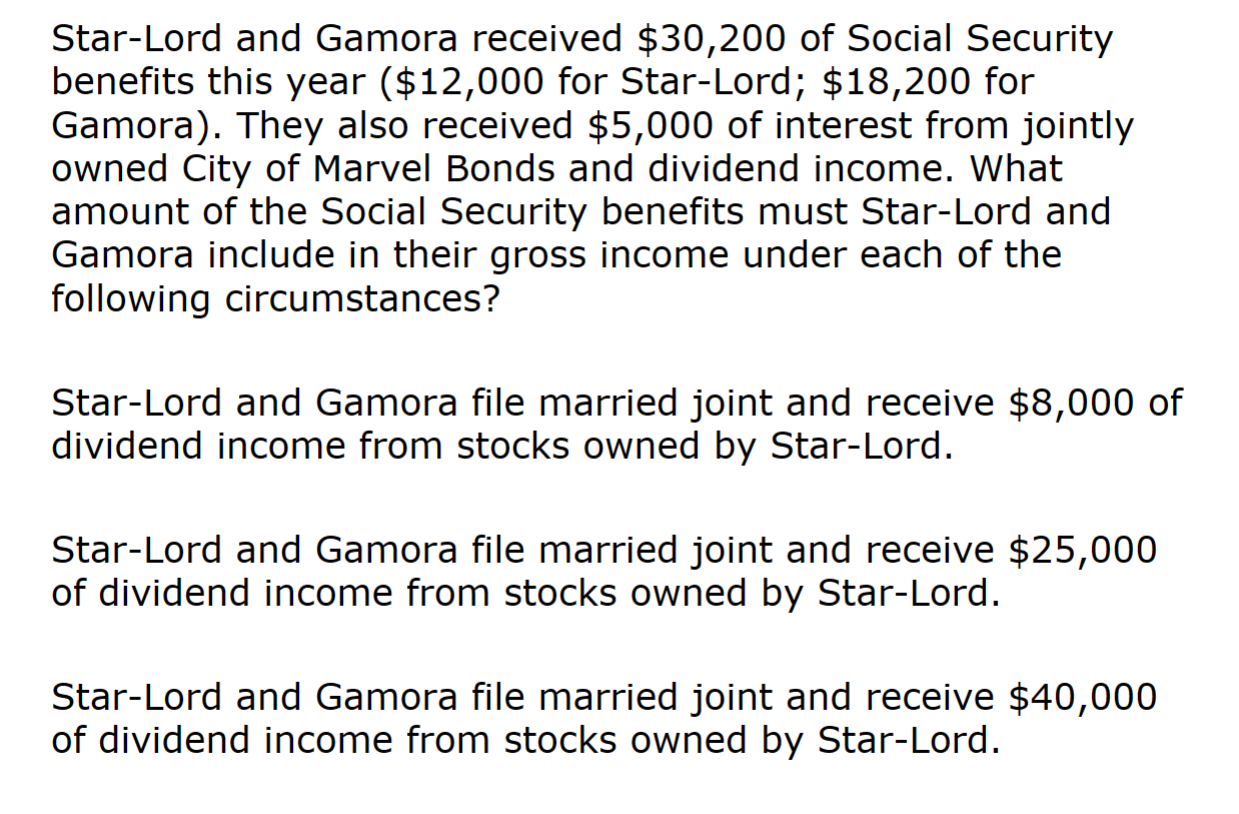

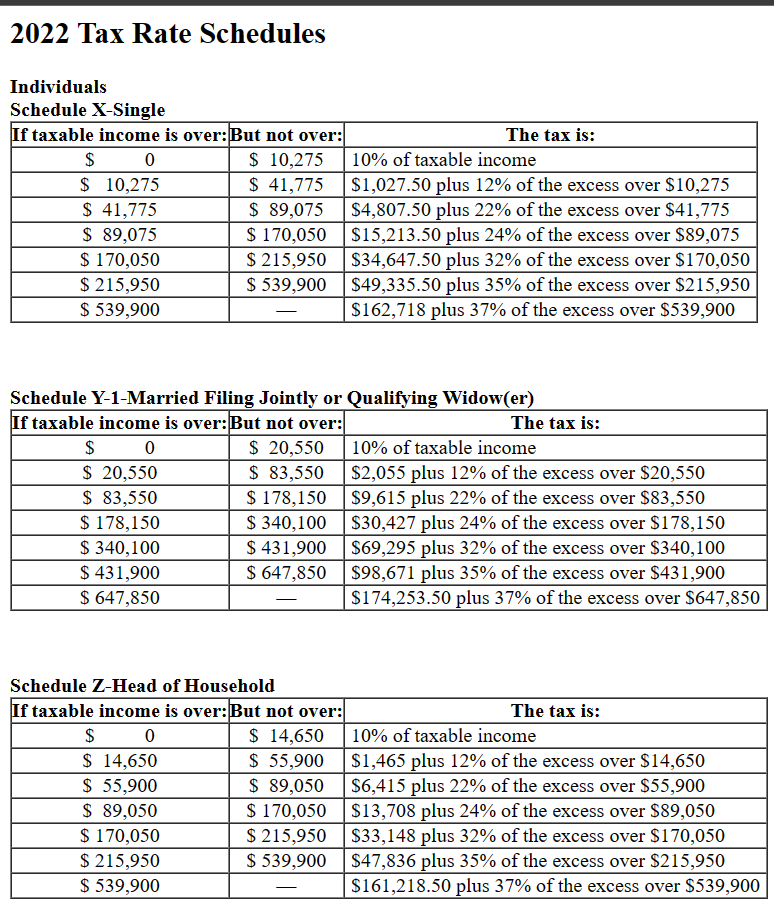

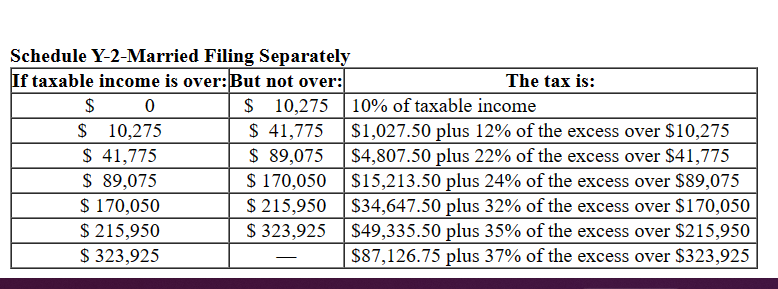

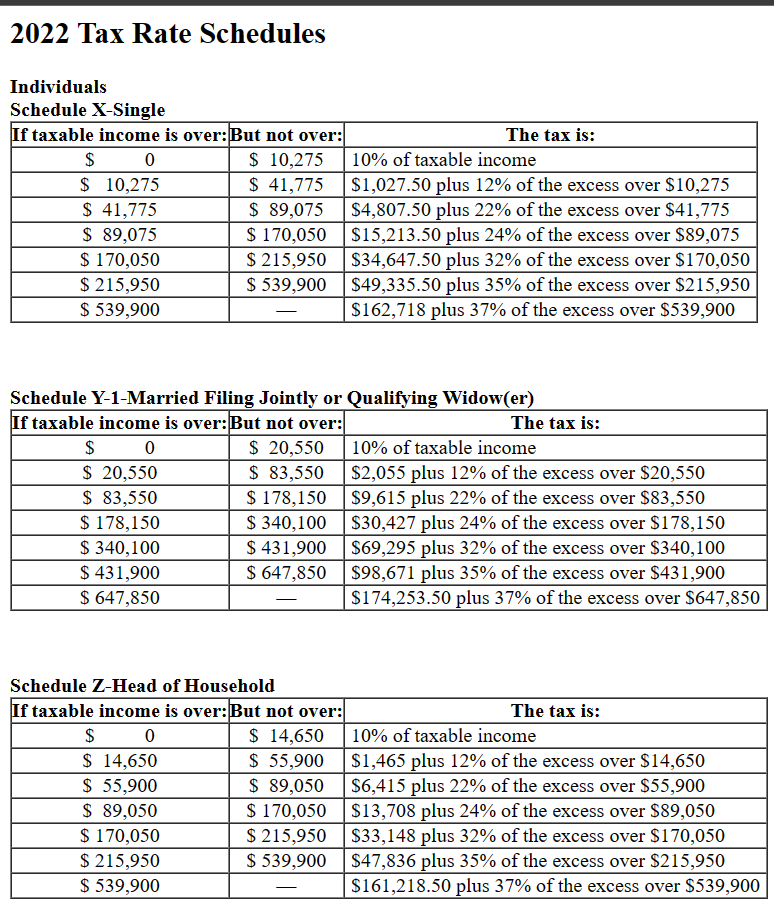

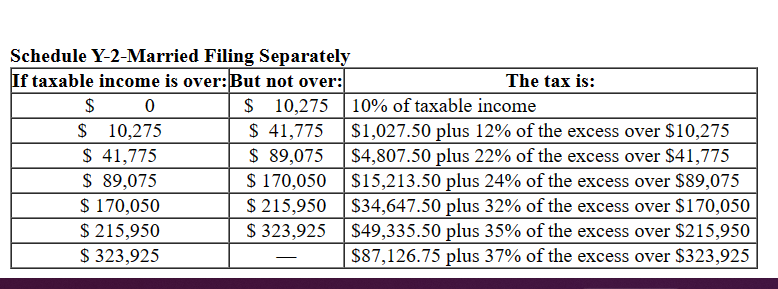

Star-Lord and Gamora received $30,200 of Social Security benefits this year ($12,000 for Star-Lord; $18,200 for Gamora). They also received $5,000 of interest from jointly owned City of Marvel Bonds and dividend income. What amount of the Social Security benefits must Star-Lord and Gamora include in their gross income under each of the following circumstances? Star-Lord and Gamora file married joint and receive $8,000 of dividend income from stocks owned by Star-Lord. Star-Lord and Gamora file married joint and receive $25,000 of dividend income from stocks owned by Star-Lord. Star-Lord and Gamora file married joint and receive $40,000 of dividend income from stocks owned by Star-Lord. 2022 Tax Rate Schedules Individuals Srhadula Y_Sinala Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$ & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Star-Lord and Gamora received $30,200 of Social Security benefits this year ($12,000 for Star-Lord; $18,200 for Gamora). They also received $5,000 of interest from jointly owned City of Marvel Bonds and dividend income. What amount of the Social Security benefits must Star-Lord and Gamora include in their gross income under each of the following circumstances? Star-Lord and Gamora file married joint and receive $8,000 of dividend income from stocks owned by Star-Lord. Star-Lord and Gamora file married joint and receive $25,000 of dividend income from stocks owned by Star-Lord. Star-Lord and Gamora file married joint and receive $40,000 of dividend income from stocks owned by Star-Lord. 2022 Tax Rate Schedules Individuals Srhadula Y_Sinala Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$ & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular}