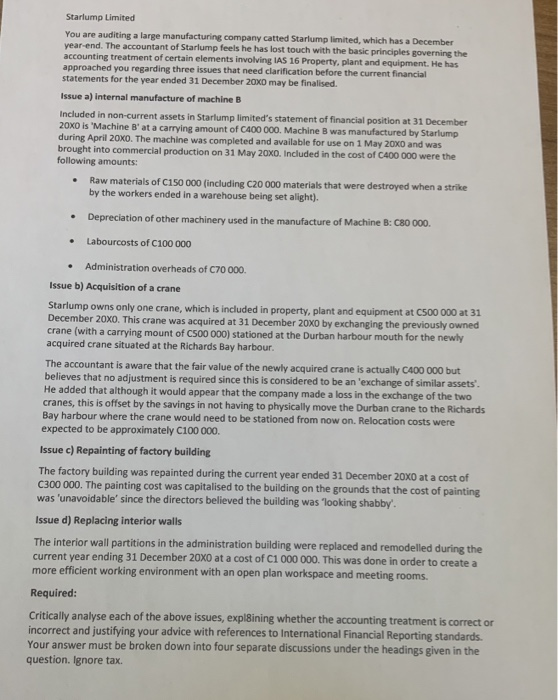

Starlump Limited You are auditing a large manufacturing company catted Starlump limited, which has a December year-end. The accountant of Starlump feels he has lost touch with the basic principles governing the accounting treatment of certain elements involving IAS 16 Property, plant and equipment. He has approached you regarding three issues that need clarification before the current financial statements for the year ended 31 December 20XD may be finalised Issue a) Internal manufacture of machine B Included in non-current assets in Starlump limited's statement of financial position at 31 December 20x0 is Machine B' at a carrying amount of C400 000. Machine B was manufactured by Starlump during April 20X0. The machine was completed and available for use on 1 May 20X0 and was brought into commercial production on 31 May 20X0. Included in the cost of C400 000 were the following amounts: Raw materials of C150 000 (including C20 000 materials that were destroyed when a strike by the workers ended in a warehouse being set alight). Depreciation of other machinery used in the manufacture of Machine B: C80 000 Labourcosts of C100 000 Administration overheads of C70 000 Issue b) Acquisition of a crane Starlump owns only one crane, which is included in property, plant and equipment at C500 000 at 31 December 20X0. This crane was acquired at 31 December 20X0 by exchanging the previously owned crane (with a carrying mount of C500 000) stationed at the Durban harbour mouth for the newly acquired crane situated at the Richards Bay harbour. The accountant is aware that the fair value of the newly acquired crane is actually C400 000 but believes that no adjustment is required since this is considered to be an exchange of similar assets. He added that although it would appear that the company made a loss in the exchange of the two cranes, this is offset by the savings in not having to physically move the Durban crane to the Richards Bay harbour where the crane would need to be stationed from now on. Relocation costs were expected to be approximately C100 000 Issue c) Repainting of factory building The factory building was repainted during the current year ended 31 December 20X0 at a cost of C300 000. The painting cost was capitalised to the building on the grounds that the cost of painting was 'unavoidable since the directors believed the building was looking shabby Issue d) Replacing interior walls The interior wall partitions in the administration building were replaced and remodelled during the current year ending 31 December 20X0 at a cost of C1 000 000. This was done in order to create a more efficient working environment with an open plan workspace and meeting rooms. Required: Critically analyse each of the above issues, explBining whether the accounting treatment is corrector incorrect and justifying your advice with references to International Financial Reporting standards. Your answer must be broken down into four separate discussions under the headings given in the question. Ignore tax. Starlump Limited You are auditing a large manufacturing company catted Starlump limited, which has a December year-end. The accountant of Starlump feels he has lost touch with the basic principles governing the accounting treatment of certain elements involving IAS 16 Property, plant and equipment. He has approached you regarding three issues that need clarification before the current financial statements for the year ended 31 December 20XD may be finalised Issue a) Internal manufacture of machine B Included in non-current assets in Starlump limited's statement of financial position at 31 December 20x0 is Machine B' at a carrying amount of C400 000. Machine B was manufactured by Starlump during April 20X0. The machine was completed and available for use on 1 May 20X0 and was brought into commercial production on 31 May 20X0. Included in the cost of C400 000 were the following amounts: Raw materials of C150 000 (including C20 000 materials that were destroyed when a strike by the workers ended in a warehouse being set alight). Depreciation of other machinery used in the manufacture of Machine B: C80 000 Labourcosts of C100 000 Administration overheads of C70 000 Issue b) Acquisition of a crane Starlump owns only one crane, which is included in property, plant and equipment at C500 000 at 31 December 20X0. This crane was acquired at 31 December 20X0 by exchanging the previously owned crane (with a carrying mount of C500 000) stationed at the Durban harbour mouth for the newly acquired crane situated at the Richards Bay harbour. The accountant is aware that the fair value of the newly acquired crane is actually C400 000 but believes that no adjustment is required since this is considered to be an exchange of similar assets. He added that although it would appear that the company made a loss in the exchange of the two cranes, this is offset by the savings in not having to physically move the Durban crane to the Richards Bay harbour where the crane would need to be stationed from now on. Relocation costs were expected to be approximately C100 000 Issue c) Repainting of factory building The factory building was repainted during the current year ended 31 December 20X0 at a cost of C300 000. The painting cost was capitalised to the building on the grounds that the cost of painting was 'unavoidable since the directors believed the building was looking shabby Issue d) Replacing interior walls The interior wall partitions in the administration building were replaced and remodelled during the current year ending 31 December 20X0 at a cost of C1 000 000. This was done in order to create a more efficient working environment with an open plan workspace and meeting rooms. Required: Critically analyse each of the above issues, explBining whether the accounting treatment is corrector incorrect and justifying your advice with references to International Financial Reporting standards. Your answer must be broken down into four separate discussions under the headings given in the question. Ignore tax