Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Start up Integrated Accounting 8e and then open the file named IA8 Problem 9-A Create the following 6 financial analysis reports for Casey Corporation

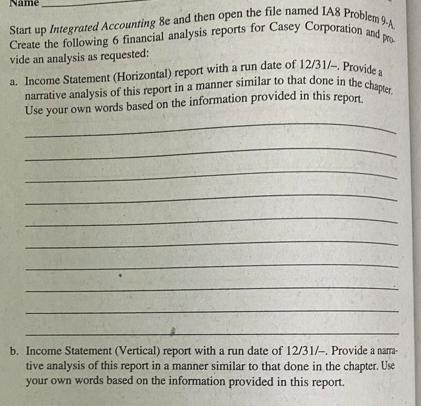

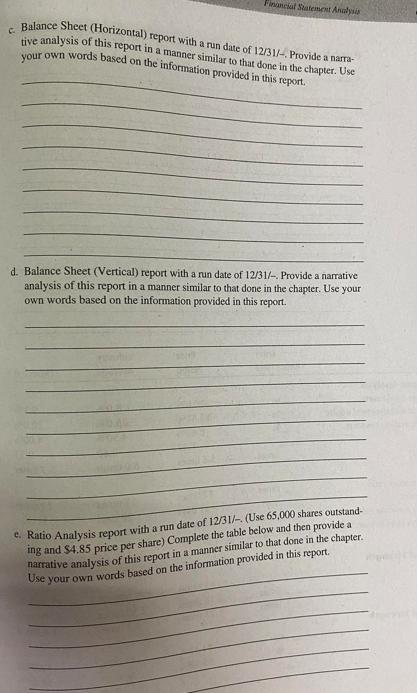

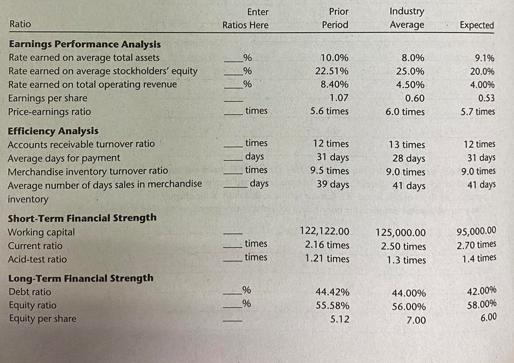

Start up Integrated Accounting 8e and then open the file named IA8 Problem 9-A Create the following 6 financial analysis reports for Casey Corporation and p vide an analysis as requested: pro- a. Income Statement (Horizontal) report with a run date of 12/31/-. Provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report. b. Income Statement (Vertical) report with a run date of 12/31/-. Provide a narra- tive analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report. Financial Statement Analys c. Balance Sheet (Horizontal) report with a run date of 12/31/-. Provide a narra- tive analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report. d. Balance Sheet (Vertical) report with a run date of 12/31/-. Provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report. e. Ratio Analysis report with a run date of 12/31/-. (Use 65,000 shares outstand- ing and $4.85 price per share) Complete the table below and then provide a narrative analysis of this report in a manner similar to that done in the chapter. your own words based on the information provided in this report. Use Ratio Enter Prior Industry Ratios Here Period Average Expected Earnings Performance Analysis Rate earned on average total assets % 10.0% 8.0% 9.1% Rate earned on average stockholders' equity % 22.51% 25.0% 20.0% Rate earned on total operating revenue 96 8.40% 4.50% 4.00% Earnings per share 1.07 0.60 0.53 Price-earnings ratio times 5.6 times 6.0 times 5.7 times Efficiency Analysis Accounts receivable turnover ratio times 12 times 13 times 12 times Average days for payment days 31 days 28 days 31 days Merchandise inventory turnover ratio times 9.5 times 9.0 times 9.0 times Average number of days sales in merchandise days 39 days 41 days 41 days inventory Short-Term Financial Strength Working capital Current ratio Acid-test ratio 122,122.00 times. 2.16 times times 1.21 times 2.50 times 1.3 times 125,000.00 95,000.00 2.70 times 1.4 times Long-Term Financial Strength Debt ratio % 44.42% 44.00% 42.00% Equity ratio % 55.58% 56.00% 58.00% Equity per share 5.12 7.00 6.00 f. Statement of Cash Flows report with a run date of 12/31/-. Provide a narrative analysis of this report in a manner similar to that done in the chapter. Use your own words based on the information provided in this report.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started