Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Start with All Stores: use the prior year gross profit percentage calculated in Exhibit 2 as your estimate and compare it to the current

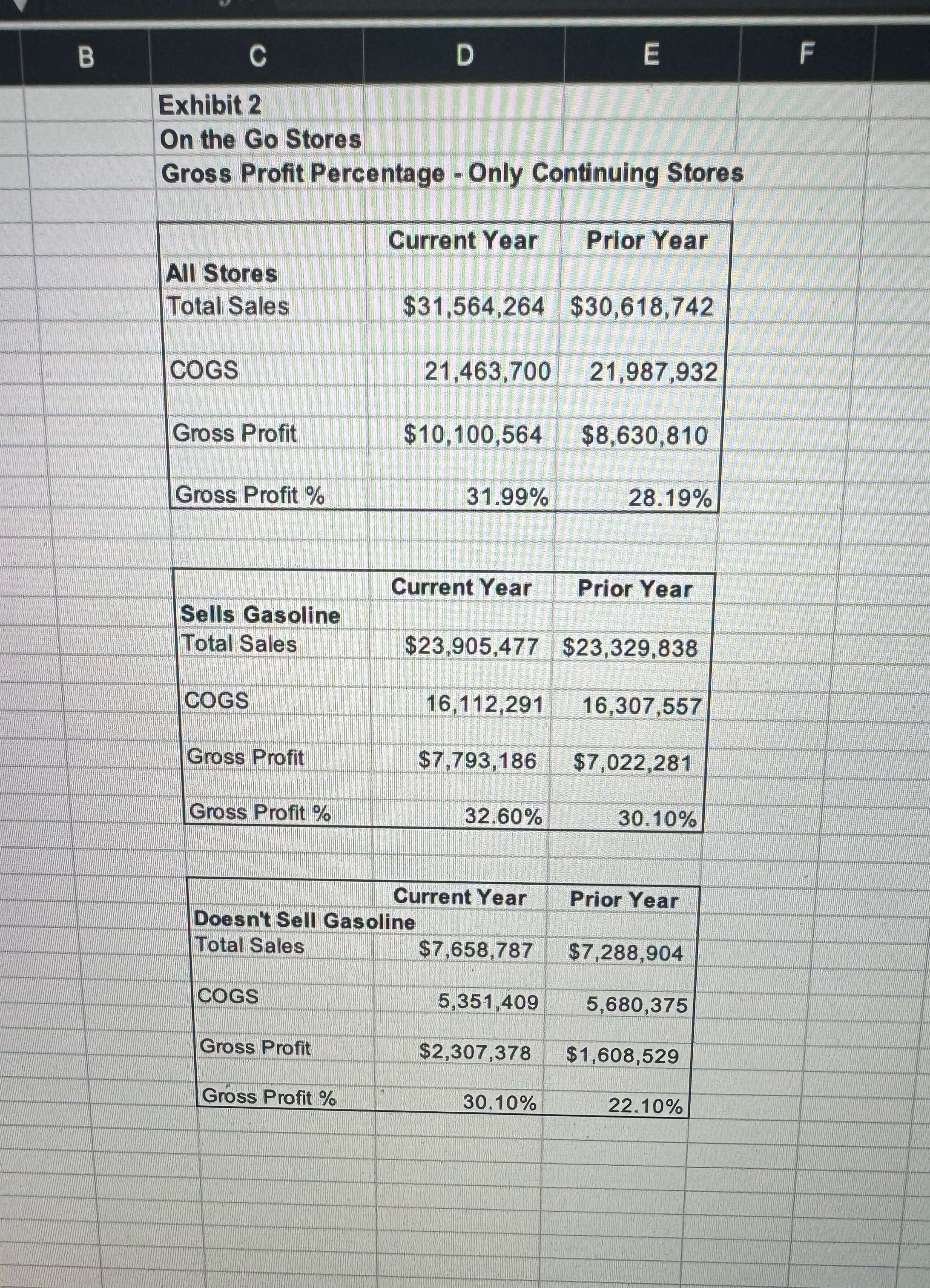

Start with "All Stores": use the prior year gross profit percentage calculated in Exhibit 2 as your estimate and compare it to the current year gross profit percentage. Calculate both the change in percentages and the percent change in percentages. Determine and document your conclusion on the likelihood of a material misstatement in sales revenue (low, moderate, or high) being sure to include appropriate numbers in your discussion. Note - subtracting two percentages gives you a "change in percentages"; it does not give you the percent change in percentages. To calculate the percent change, you must divide the change in percentages by the prior year percentage. Question 6 Because gasoline is sold at a different mark-up than other types of products, we might expect stores that sell gasoline to have a different gross profit percentage than stores that do not sell gasoline. Therefore, using the additional data in Exhibit 2 and appropriate calculations you perform, conclude on which stores might be more at risk of having materially misstated sales revenue being sure to include appropriate numbers in your discussion. Use 10% as a reasonable tolerable misstatement for this test. B C Exhibit 2 D LU E On the Go Stores Gross Profit Percentage - Only Continuing Stores Current Year Prior Year All Stores Total Sales $31,564,264 $30,618,742 COGS 21,463,700 21,987,932 Gross Profit $10,100,564 $8,630,810 Gross Profit % 31.99% 28.19% Current Year Prior Year Sells Gasoline Total Sales $23,905,477 $23,329,838 COGS 16,112,291 16,307,557 Gross Profit $7,793,186 $7,022,281 Gross Profit % 32.60% 30.10% Current Year Prior Year Doesn't Sell Gasoline Total Sales $7,658,787 $7,288,904 COGS 5,351,409 5,680,375 Gross Profit $2,307,378 $1,608,529 Gross Profit % 30.10% 22.10% LL F

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started