Question

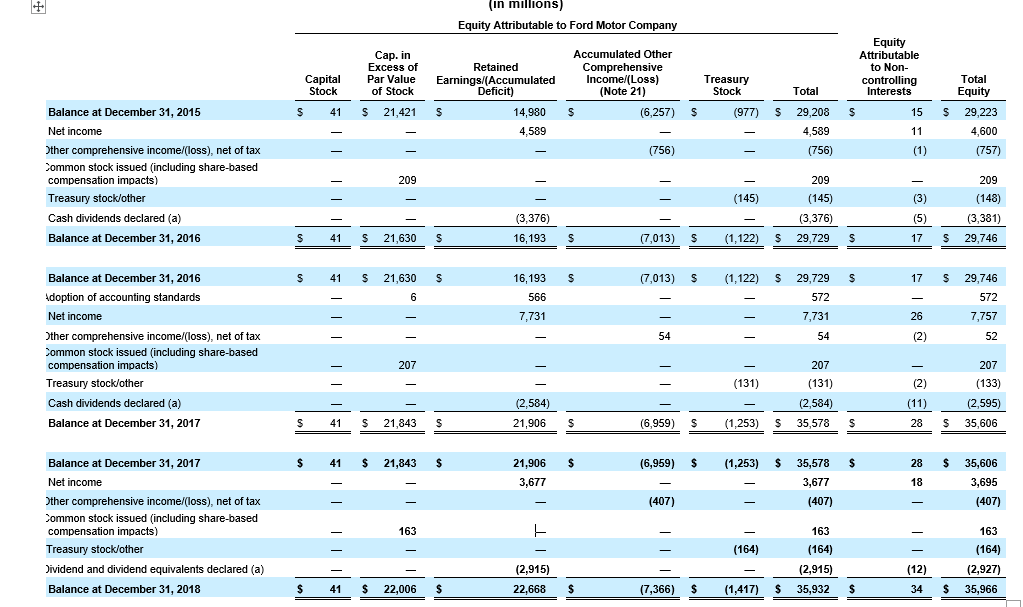

Start with the Capital Stock and Capital in Excess of Par Value columns on the Consolidated Statement of Equity for Ford Motor Company. We see

Start with the Capital Stock and Capital in Excess of Par Value columns on the Consolidated Statement of Equity for Ford Motor Company. We see that Capital in Excess of Part increased $163 mill, but the par value account did not change. We can also see on the cash flow statement that no stock was issued. Since the line item says that the increase to the account includes share-based compensation impacts, we will assume that the entire amount is for share-based compensation. The entry would be similar to Illustration 19-3 and 19-3a. Show the journal entry here.

Balance at December 31, 2015 Net income Other comprehensive income/(loss), net of tax Common stock issued (including share-based compensation impacts) Treasury stock/other Cash dividends declared (a) Balance at December 31, 2016 Balance at December 31, 2016 Adoption of accounting standards Net income Other comprehensive income/(loss), net of tax Common stock issued (including share-based compensation impacts) Treasury stock/other Cash dividends declared (a) Balance at December 31, 2017 Balance at December 31, 2017 Net income Other comprehensive income/(loss), net of tax Common stock issued (including share-based compensation impacts) Treasury stock/other Dividend and dividend equivalents declared (a) Balance at December 31, 2018 Capital Stock 41 $ S S $ - $ 41 Cap. in Excess of Par Value of Stock 21,421 - S 209 $ 21,630 41 $ 41 $ 21,630 S 6 207 $ 41 S 21,843 $ Retained Earnings/(Accumulated Deficit) $ 163 S 41 $ 22,006 21,843 $ (in millions) Equity Attributable to Ford Motor Company $ 14,980 4,589 (3,376) 16,193 16,193 566 7,731 (2,584) 21,906 21,906 3,677 F (2,915) 22,668 Accumulated Other Comprehensive Income/(Loss) (Note 21) $ $ $ $ $ $ Treasury Stock (6,257) S (977) (756) (7,013) $ (7,013) S 54 (6,959) $ (6,959) $ - (407) (7,366) $ (145) (1,122) S (131) $ (3,376) (1,122) $ 29,729 S (1,253) $ (164) - (1,417) Total 29,208 4,589 (756) 209 (145) $ 29,729 572 7,731 54 (1,253) $ 35,578 $ 3,677 $ 207 (131) (2,584) 35,578 $ (407) $ 163 (164) (2,915) 35,932 $ Equity Attributable to Non- controlling Interests 15 11 (1) (3) (5) 17 17 26 (2) (2) (11) 28 (12) 34 $ 29,223 4,600 S $ S 28 $ 18 Total Equity $ (757) 209 (148) (3,381) 29,746 29,746 572 7,757 52 207 (133) (2,595) 35,606 35,606 3,695 (407) 163 (164) (2,927) 35,966

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided the journal entry for the incr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started