Answered step by step

Verified Expert Solution

Question

1 Approved Answer

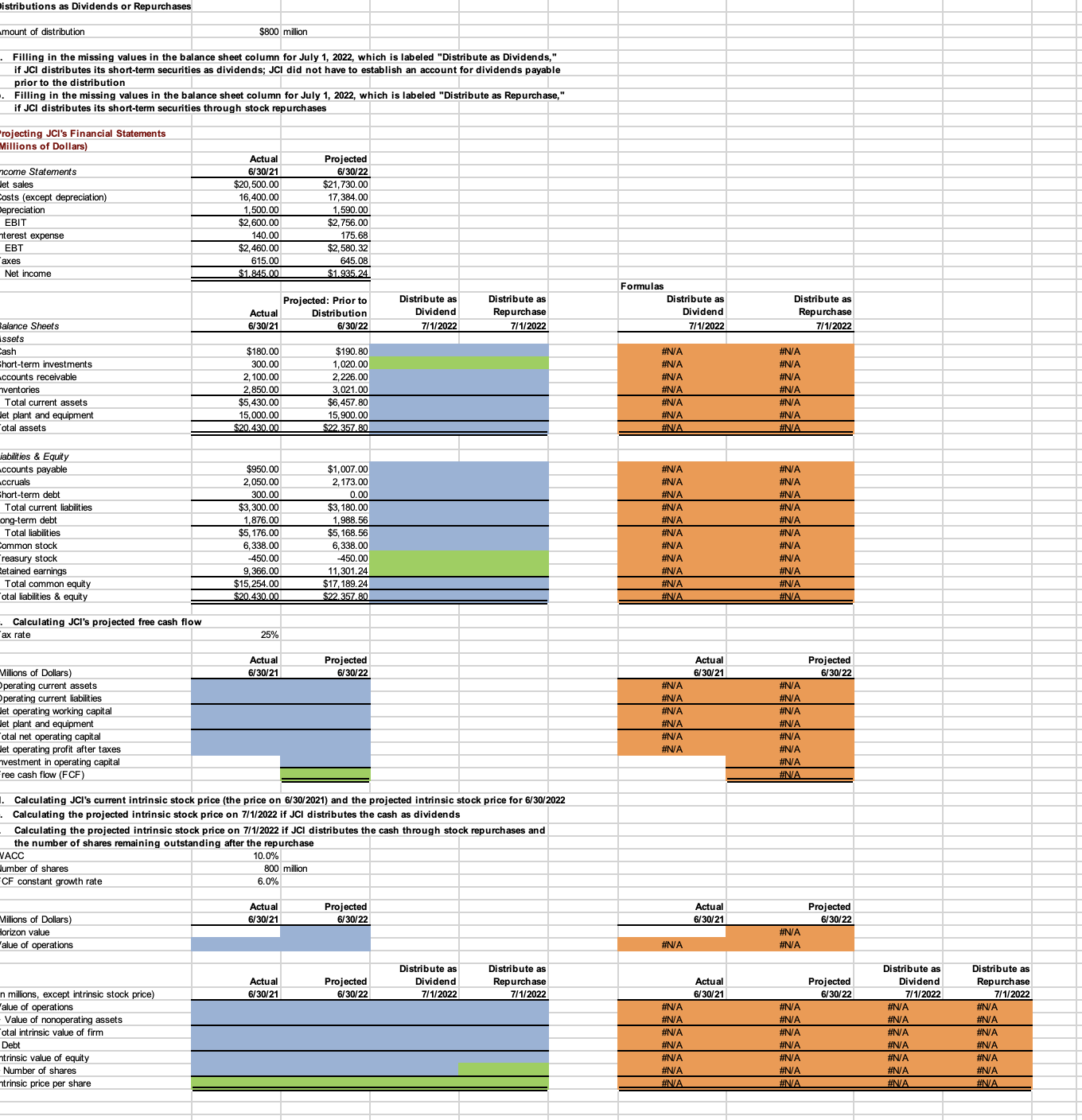

Start with the partial model in the file Ch 1 5 P 1 3 Build a Model.xlsx . J . Clark Inc. ( JCI )

Start with the partial model in the file Ch P Build a Model.xlsx J Clark Inc. JCI a manufacturer and distributor of sports equipment, has grown until it has become a stable, mature company. Now JCI is planning its first distribution to shareholders. See the file for the most recent year's financial statements and projections for the next year, ; JCI's fiscal year ends on June JCI plans to liquidate and distribute $ million of its shortterm securities on July the first day of the next fiscal year, but it has not yet decided whether to distribute with dividends or with stock repurchases.

The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter a negative value, if any.

Download spreadsheet Ch P Build a Modeleaxlsx

Assume first that JCI distributes the $ million as dividends. Fill in the missing values in the file's balance sheet column for July which is labeled "Distribute as Dividends." Hint: Be sure that the balance sheets balance after you fill in the missing items. Assume that JCI did not have to establish an account for dividends payable prior to the distribution. Enter your answers in millions. For example, an answer of $ million should be entered as not Round your answers to two decimal places.

Distribute as Dividend

Shortterm investments $ fill in the blank

million

Treasury stock $ fill in the blank

million

Retained earnings $ fill in the blank

million

Now assume that JCI distributes the $ million through stock repurchases. Fill in the missing values in the file's balance sheet column for July which is labeled "Distribute as Repurchase." Hint: Be sure that the balance sheets balance after you fill in the missing items. Enter your answers in millions. For example, an answer of $ million should be entered as not Round your answers to two decimal places.

Distribute as Repurchase

Shortterm investments $ fill in the blank

million

Treasury stock $ fill in the blank

million

Retained earnings $ fill in the blank

million

Calculate JCI's projected free cash flow; the tax rate is Enter your answer in millions. For example, an answer of $ million should be entered as not Round your answer to two decimal places.

$ fill in the blank

million

What is JCI's current intrinsic stock price the price on What is the projected intrinsic stock price for FCF is expected to grow at a constant rate of and JCI's WACC is The firm has million shares outstanding. Round your answers to the nearest cent.

Intrinsic stock price on : $ fill in the blank

Intrinsic stock price on : $ fill in the blank

What is the projected intrinsic stock price on if JCI distributes the cash as dividends? Round your answer to the nearest cent.

$ fill in the blank

What is the projected intrinsic stock price on if JCI distributes the cash through stock repurchases? Round your answer to the nearest cent.

$ fill in the blank

How many shares will remain outstanding after the repurchase? Enter your answer in millions. For example, an answer of million should be entered as not Round your answer to two decimal places.

fill in the blank

million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started