Answered step by step

Verified Expert Solution

Question

1 Approved Answer

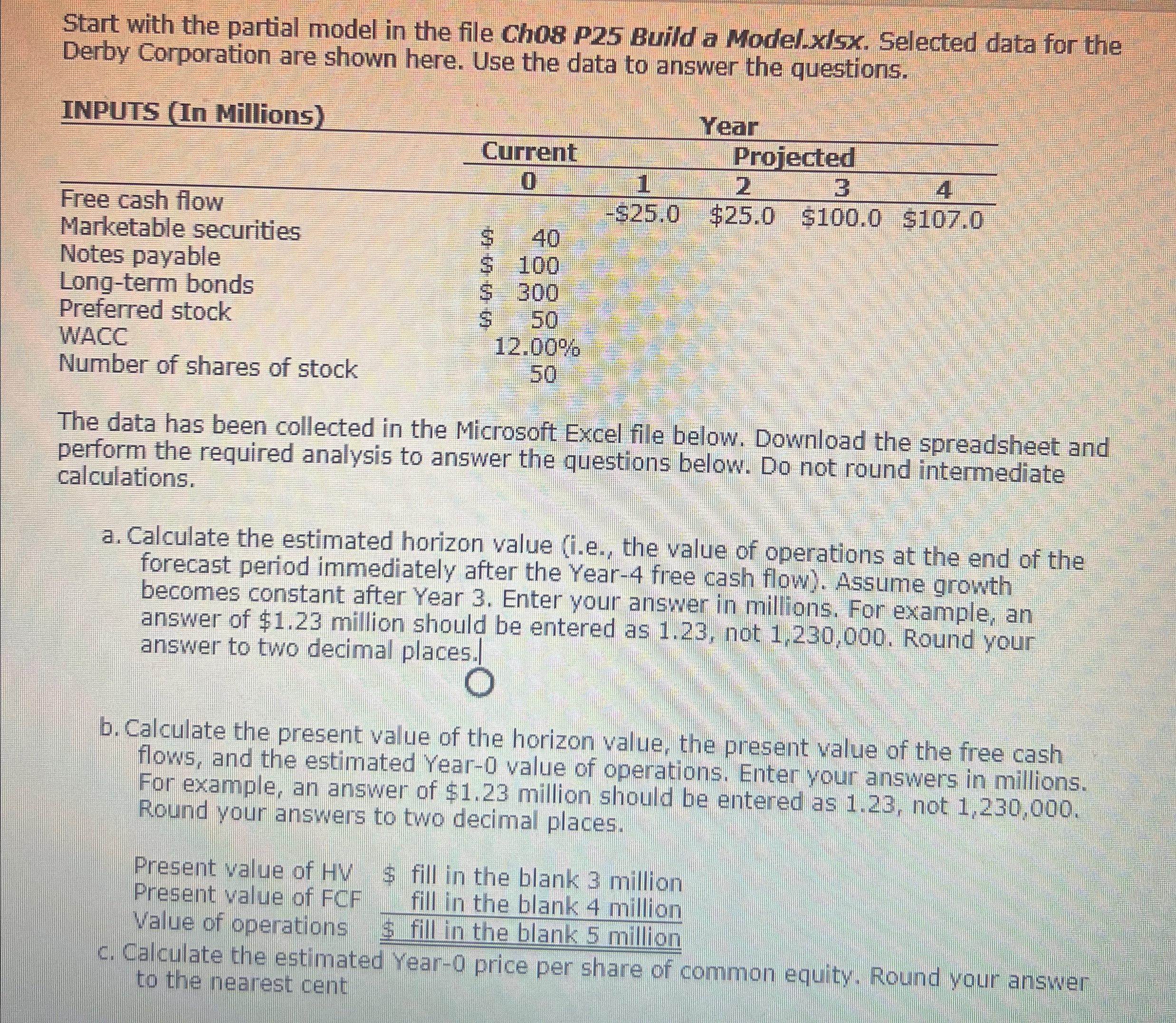

Start with the partial model in the file Ch08 P25 Build a Model.xlsx. Selected data for the Derby Corporation are shown here. Use the

Start with the partial model in the file Ch08 P25 Build a Model.xlsx. Selected data for the Derby Corporation are shown here. Use the data to answer the questions. INPUTS (In Millions) Year Current 0 Projected 1 2 Free cash flow -$25.0 3 $25.0 $100.0 $107.0 4 Marketable securities $ 40 Notes payable $ 100 Long-term bonds $ 300 Preferred stock $ 50 WACC Number of shares of stock 12.00% 50 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. a. Calculate the estimated horizon value (i.e., the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume growth becomes constant after Year 3. Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places. b. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-0 value of operations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places. Present value of FCF Present value of HV $ fill in the blank 3 million fill in the blank 4 million $ fill in the blank 5 million Value of operations c. Calculate the estimated Year-0 price per share of common equity. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started