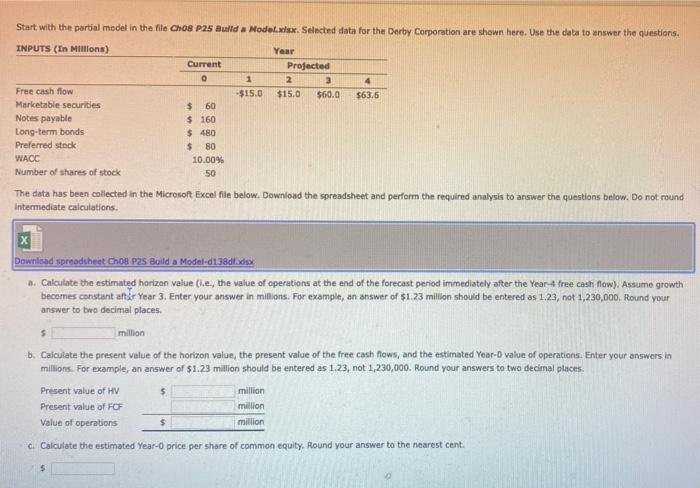

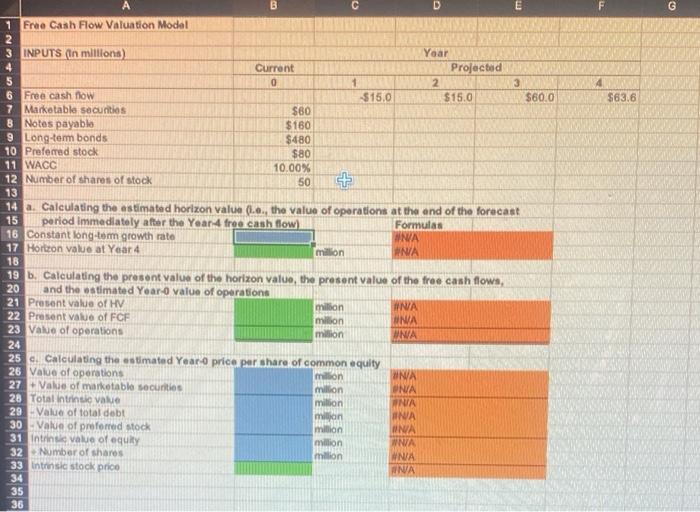

Start with the partial model in the file Chos P25 Build a Nodelwax Selected data for the Derby Corporation are shown here. Use the data to answer the questions. 1 INPUTS (In Millions) Year Current Projected O 2 3 4 Free cash flow -$15.0 $15.0 $60.0 $63.6 Marketable securities $ 60 Notes payable $ 160 Long-term bonds $ 480 Preferred stock $ 80 WAOC 10.00% Number of shares of stock 50 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round Intermediate calculations 5 Download spreadsheet Choe Pas Bulld a Model-d138dt.xx 3. Calculate the estimated horizon value (.e., the value of operations at the end of the forecast period immediately after the Year 4 free cash flow). Assume growth becomes constant and Year 3. Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places. million b. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-O value of operations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places Present value of HV $ million Present value of FOF million Value of operations $ million C Calculate the estimated Year-O price per share of common equity. Round your answer to the nearest cent. F G $63.6 A B D E 1 Free Cash Flow Valuation Model 2 3 INPUTS (In millions) Yoar Current Projected 5 0 1 2 3 6 Free cash flow $15,0 $15.0 $60.0 7 Marketable Securities $60 8 Notes payable $160 9 Long-term bonds $480 10 Preferred stock $80 11 WACC 10.00% 12 Number of shares of stock 50 13 14 a. Calculating the estimated horizon value (0.6., the value of operations at the end of the forecast 15 period Immediately after the Year 4 free cash flow Formulas 16 Constant long-term growth rate WNA 17 Horteon value at Year 4 million NA 18 19 6. Calculating the present value of the horizon value, the present value of the free cash flows, 20 and the estimated Year value of operations 21 Present value of HV milion #NA 22 Present value of FCF mibon UNA 23 Value of operations million UNA 24 25. Calculating the estimated Year price per share of common equity 26 Value of operations million UNA 27 Value of marketable securities million ONA 28 Total Intrinsic value milion ANA 29 Value of total debt milion ANA 30 Value of proferred stock milion NA 31 intrinse value of equity million WNA 32 Number of shares million NA 33 intrinsic stock price AINA 34 35 36