Started answering some but I'm stuck!

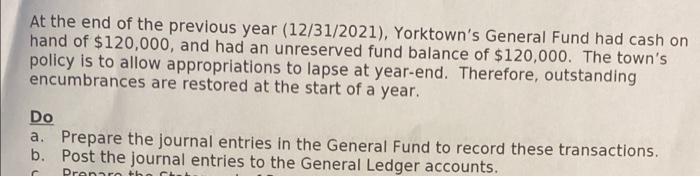

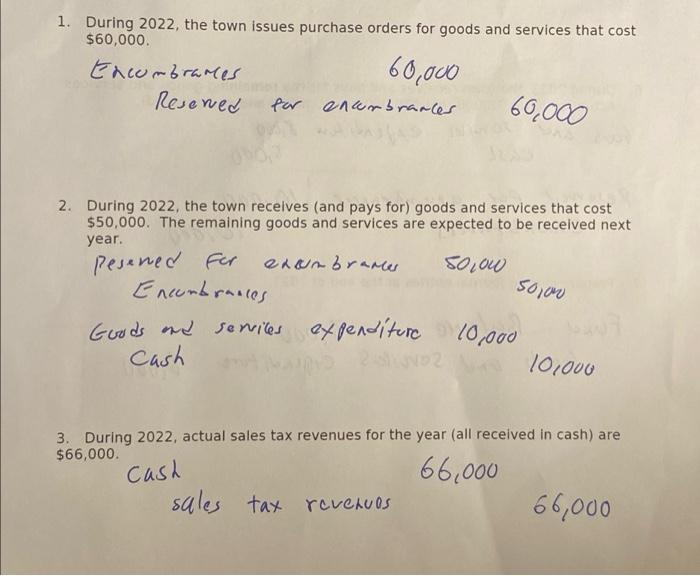

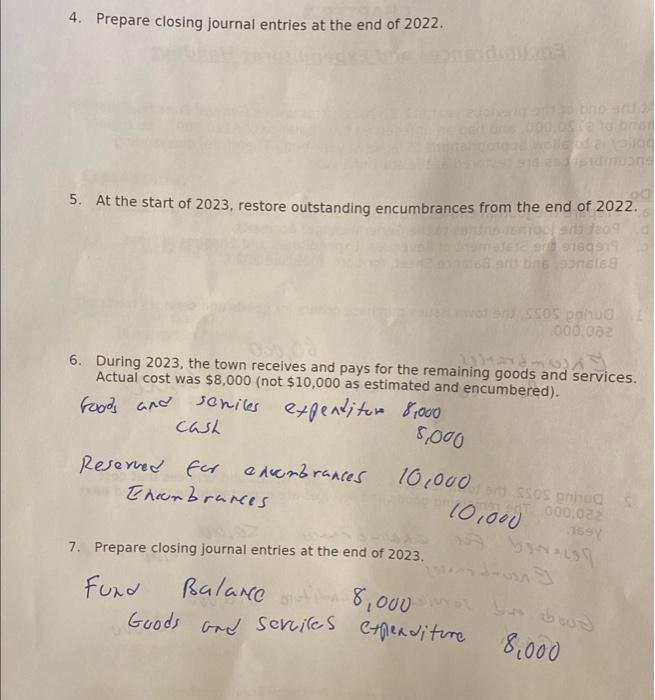

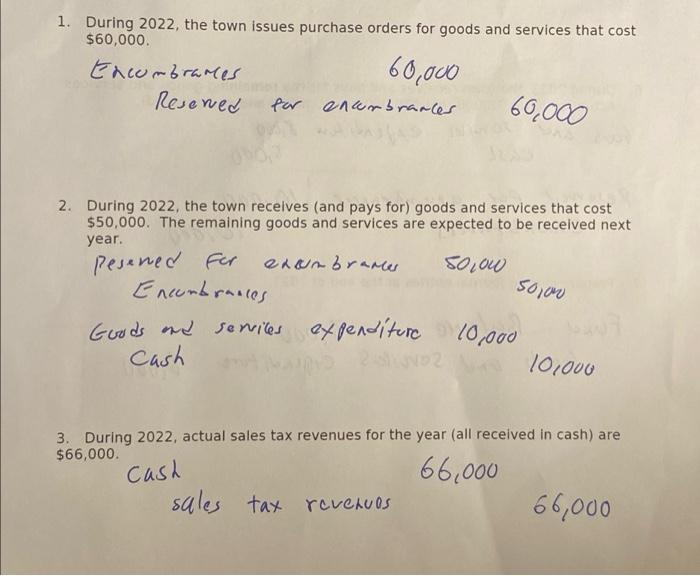

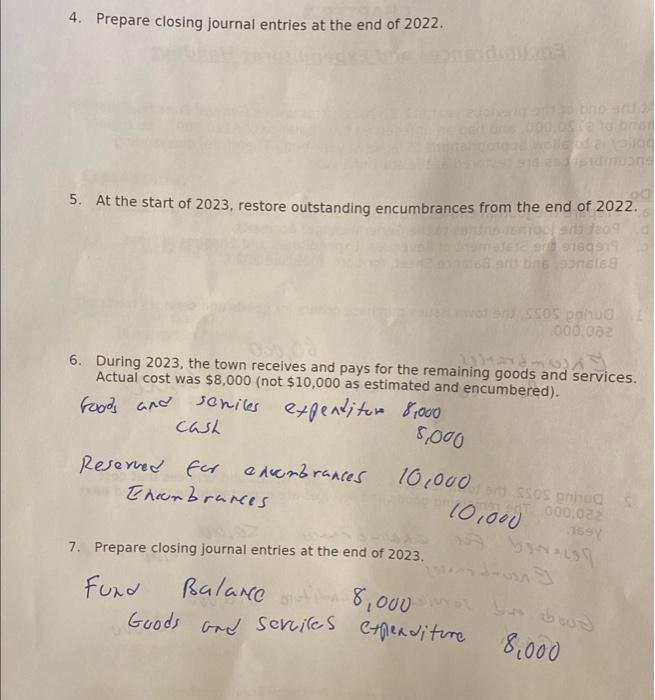

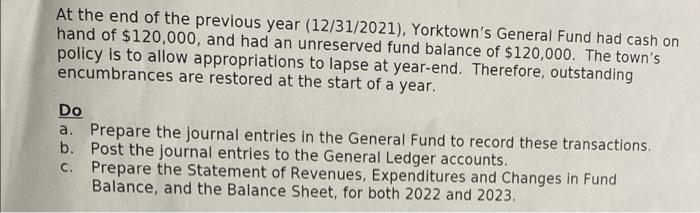

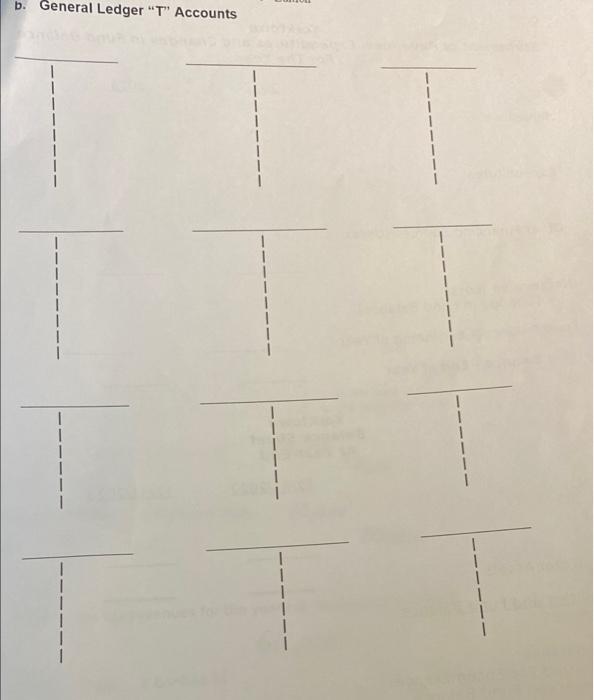

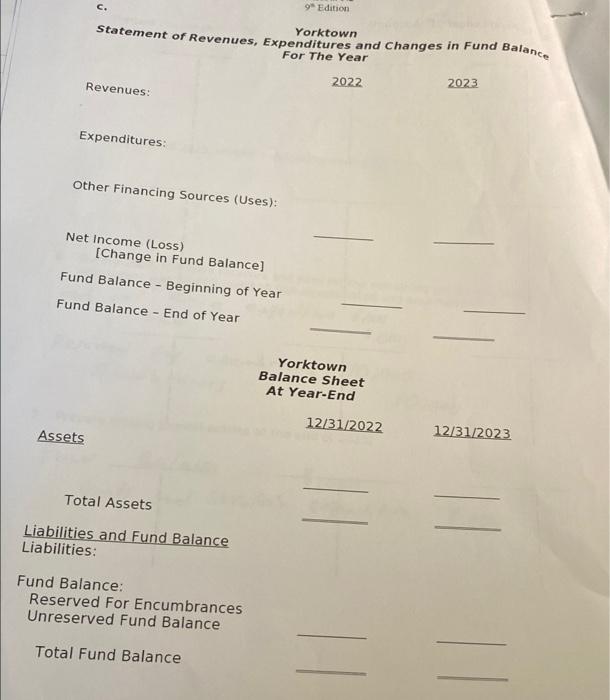

At the end of the previous year (12/31/2021), Yorktown's General Fund had cash on hand of $120,000, and had an unreserved fund balance of $120,000. The town's policy is to allow appropriations to lapse at year-end. Therefore, outstanding encumbrances are restored at the start of a year. Do a. Prepare the journal entries in the General Fund to record these transactions. b. Post the journal entries to the General Ledger accounts. Pronare the stal 1. During 2022, the town issues purchase orders for goods and services that cost $60,000. 60,000 Encombrames. Reserved for encombrances. 60,000 2. During 2022, the town receives (and pays for) goods and services that cost $50,000. The remaining goods and services are expected to be received next year. Peserved for For exambranes. 80,00 50,00 Encombrances Goods and services expenditure 10,000 Cash 2-102 10,000 3. During 2022, actual sales tax revenues for the year (all received in cash) are $66,000. Cash 66,000 sales tax revenues 66,000 4. Prepare closing journal entries at the end of 2022. 130 bino su d 000,05 re to brist 100 5. At the start of 2023, restore outstanding encumbrances from the end of 2022. 1209 90 9160919 bne pons168 SSOS pohua 000,002 575859 6. During 2023, the town receives and pays for the remaining goods and services. Actual cost was $8,000 (not $10,000 as estimated and encumbered). seniles expenditure 8,000 Goods and seniles cash 8,000 Reserved for excembrances Ehembrances 10,000 or ssos enhed S 10,000 T 000,022 159V bawa 7. Prepare closing journal entries at the end of 2023. Fund Balance 8,000 or bus boud 8,000 Goods and services expenditure At the end of the previous year (12/31/2021), Yorktown's General Fund had cash on hand of $120,000, and had an unreserved fund balance of $120,000. The town's policy is to allow appropriations to lapse at year-end. Therefore, outstanding encumbrances are restored at the start of a year. Do a. Prepare the journal entries in the General Fund to record these transactions. b. Post the journal entries to the General Ledger accounts. c. Prepare the Statement of Revenues, Expenditures and Changes in Fund Balance, and the Balance Sheet, for both 2022 and 2023. b. General Ledger "T" Accounts I 9 Edition C. Yorktown Statement of Revenues, Expenditures and Changes in Fund Balance For The Year 2023 2022 Revenues: Expenditures: Other Financing Sources (Uses): Net Income (Loss) [Change in Fund Balance] Fund Balance - Beginning of Year Fund Balance - End of Year Assets Total Assets Liabilities and Fund Balance Liabilities: Fund Balance: Reserved For Encumbrances Unreserved Fund Balance Total Fund Balance Yorktown Balance Sheet At Year-End 12/31/2022 12/31/2023