Answered step by step

Verified Expert Solution

Question

1 Approved Answer

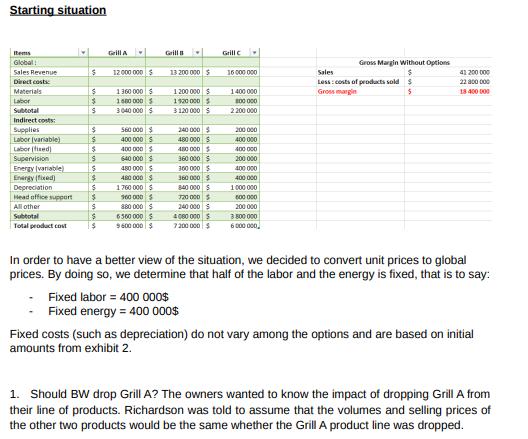

Starting situation Items Global Sales Revenue Direct costs Materials Labor Subtotal Indirect costs: Supplies Labor (variable) Labor (fixed) Supervision Energy (variable) Energy (fixed) Depreciation

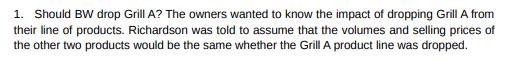

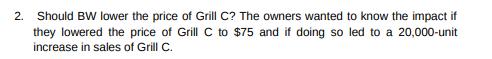

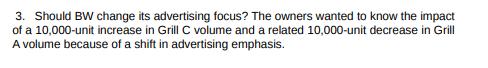

Starting situation Items Global Sales Revenue Direct costs Materials Labor Subtotal Indirect costs: Supplies Labor (variable) Labor (fixed) Supervision Energy (variable) Energy (fixed) Depreciation Head office support All other Subtotal Total product cost M $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Grill A 12 000 000 $ 1360 000 $ 1500 000 $ 3040 000 $ 560 000 $ 400 000 $ 400 000 $ 640 000 $ 450 000 $ 480 000 $ 1760 000 $ 960 000 $ 880 000 $ 6550 000 $ 9600 000 $ 13 200 000 $ 1 200 000 $ 1920 000 $ 3120 000 $ 240 000 $ 480 000 $ 400 000 $ 360 000 $ 360 000 $ 360 000 $ 840 000 $ $ 720 000 $ 240 000 4 000 000 $ 7200 000 $ Grill C Fixed labor = 400 000$ Fixed energy = 400 000$ 16000000 1400 000 800 000 2200 000 200 000 400 000 400 000 200 000 400 000 400,000 1000000 600 000 200 000 3800 000 6000 000, Gross Margin Without Options Sales Less: costs of products sold $ Gross margin 41 200 000 22 800 000 18 400 000 In order to have a better view of the situation, we decided to convert unit prices to global prices. By doing so, we determine that half of the labor and the energy is fixed, that is to say: Fixed costs (such as depreciation) do not vary among the options and are based on initial amounts from exhibit 2. 1. Should BW drop Grill A? The owners wanted to know the impact of dropping Grill A from their line of products. Richardson was told to assume that the volumes and selling prices of the other two products would be the same whether the Grill A product line was dropped. 1. Should BW drop Grill A? The owners wanted to know the impact of dropping Grill A from their line of products. Richardson was told to assume that the volumes and selling prices of the other two products would be the same whether the Grill A product line was dropped. 2. Should BW lower the price of Grill C? The owners wanted to know the impact if they lowered the price of Grill C to $75 and if doing so led to a 20,000-unit increase in sales of Grill C. 3. Should BW change its advertising focus? The owners wanted to know the impact of a 10,000-unit increase in Grill C volume and a related 10,000-unit decrease in Grill A volume because of a shift in advertising emphasis. 4. Should BW lower the price of Grill C and change its advertising focus? The owners wanted to know the impact of lowering the price of Grill C to $75 and shifting the advertising focus more to Grill C, thereby decreasing Grill A volume by 10,000 units and increasing Grill C volume by 30,000 units.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer C 77 Explanation The detailed e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started