Answered step by step

Verified Expert Solution

Question

1 Approved Answer

State by using the words: increase, decrease and/or no-change, the effect that each scenario will have on a company's WACC? (No computation required) (3

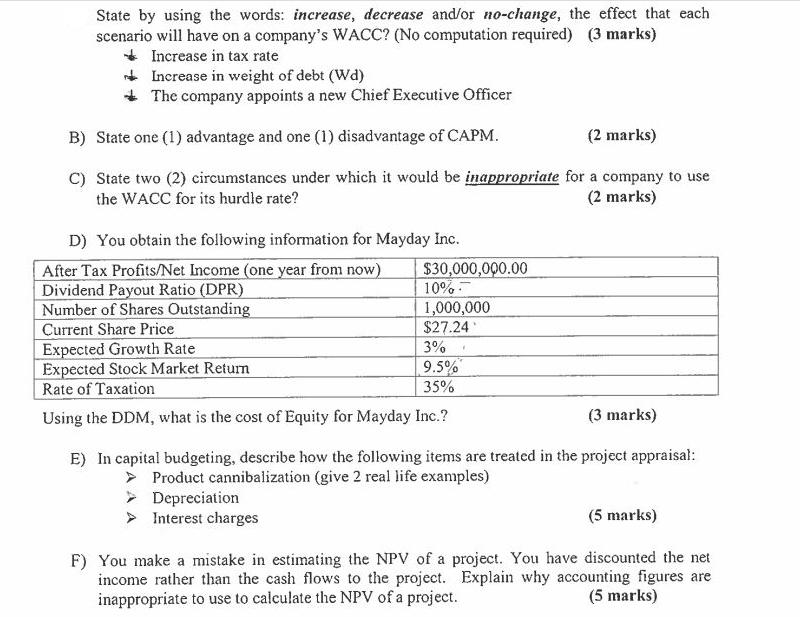

State by using the words: increase, decrease and/or no-change, the effect that each scenario will have on a company's WACC? (No computation required) (3 marks) Increase in tax rate Increase in weight of debt (Wd) The company appoints a new Chief Executive Officer B) State one (1) advantage and one (1) disadvantage of CAPM. (2 marks) C) State two (2) circumstances under which it would be inappropriate for a company to use the WACC for its hurdle rate? (2 marks) D) You obtain the following information for Mayday Inc. After Tax Profits/Net Income (one year from now) Dividend Payout Ratio (DPR) Number of Shares Outstanding Current Share Price $30,000,000.00 10%- 1,000,000 $27.24 Expected Growth Rate 3% Expected Stock Market Return 9.5% Rate of Taxation 35% Using the DDM, what is the cost of Equity for Mayday Inc.? (3 marks) E) In capital budgeting, describe how the following items are treated in the project appraisal: > Product cannibalization (give 2 real life examples) > Depreciation > Interest charges (5 marks) F) You make a mistake in estimating the NPV of a project. You have discounted the net income rather than the cash flows to the project. Explain why accounting figures are inappropriate to use to calculate the NPV of a project. (5 marks)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A Effects on WACC Increase in tax rate The increase in the tax rate will generally decrease the WACC since it reduces the aftertax cost of debt making debt financing relatively cheaper compared to equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started