Value Mapping Use the attached information to map the current state map and future state map. Jack's Taxes Jack is a CPA and maintains a

Value Mapping

Use the attached information to map the current state map and future state map.

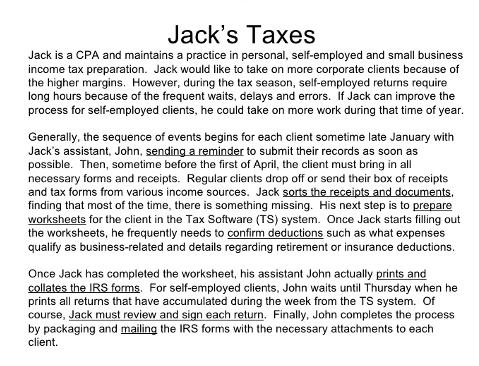

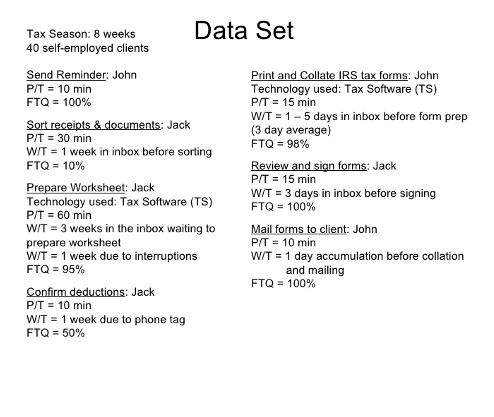

Jack's Taxes Jack is a CPA and maintains a practice in personal, self-employed and small business income tax preparation. Jack would like to take on more corporate clients because of the higher margins. However, during the tax season, self-employed returns require long hours because of the frequent waits, delays and errors. If Jack can improve the process for self-employed clients, he could take on more work during that time of year. Generally, the sequence of events begins for each client sometime late January with Jack's assistant, John, sending a reminder to submit their records as soon as possible. Then, sometime before the first of April, the client must bring in all necessary forms and receipts. Regular clients drop off or send their box of receipts and tax forms from various income sources. Jack sorts the receipts and documents. finding that most of the time, there is something missing. His next step is to prepare worksheets for the client in the Tax Software (TS) system. Once Jack starts filling out the worksheets, he frequently needs to confirm deductions such as what expenses qualify as business-related and details regarding retirement or insurance deductions. Once Jack has completed the worksheet, his assistant John actually prints and collates the IRS forms. For self-employed clients, John waits until Thursday when he prints all returns that have accumulated during the week from the TS system. Of course, Jack must review and sign each return. Finally, John completes the process by packaging and mailing the IRS forms with the necessary attachments to each client.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Ans The simplest way is to differentiate between being selfemployed and being a small business owner ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started