Answered step by step

Verified Expert Solution

Question

1 Approved Answer

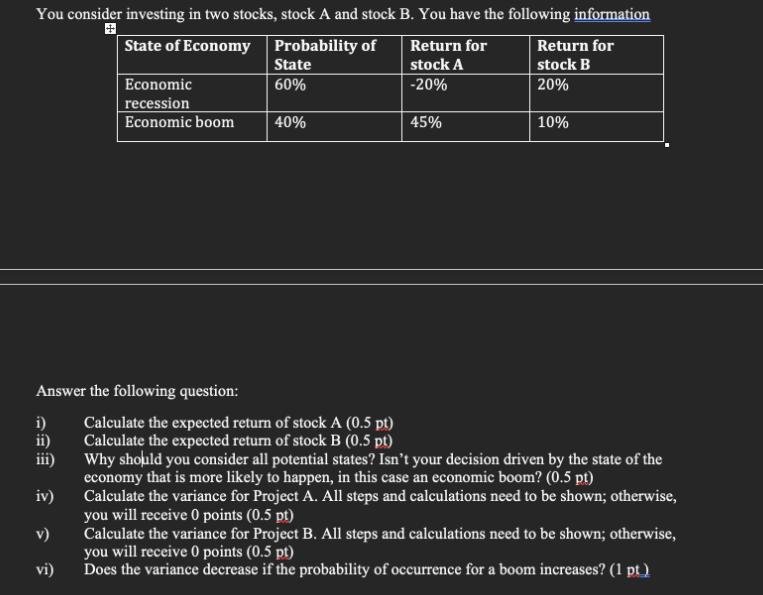

State of Economy You consider investing in two stocks, stock A and stock B. You have the following information Probability of State Return for

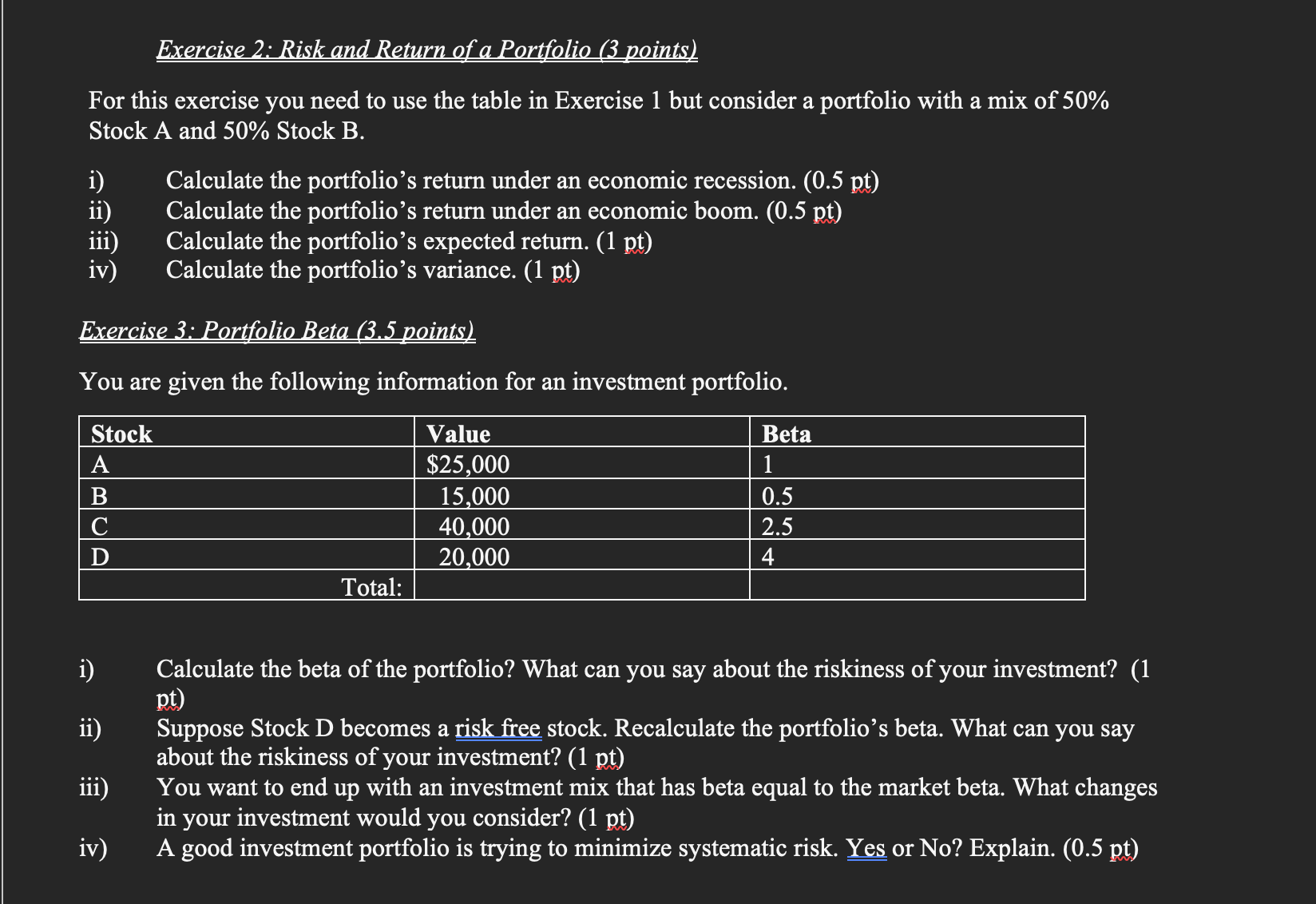

State of Economy You consider investing in two stocks, stock A and stock B. You have the following information Probability of State Return for stock A Return for stock B Economic 60% -20% 20% recession Economic boom 40% 45% 10% Answer the following question: i) ii) iii) iv) v) vi) Calculate the expected return of stock A (0.5 pt) Calculate the expected return of stock B (0.5 pt) Why should you consider all potential states? Isn't your decision driven by the state of the economy that is more likely to happen, in this case an economic boom? (0.5 pt) Calculate the variance for Project A. All steps and calculations need to be shown; otherwise, you will receive 0 points (0.5 pt) Calculate the variance for Project B. All steps and calculations need to be shown; otherwise, you will receive 0 points (0.5 pt) Does the variance decrease if the probability of occurrence for a boom increases? (1 pt) Exercise 2: Risk and Return of a Portfolio (3 points) For this exercise you need to use the table in Exercise 1 but consider a portfolio with a mix of 50% Stock A and 50% Stock B. i) Calculate the portfolio's return under an economic recession. (0.5 pt) ii) Calculate the portfolio's return under an economic boom. (0.5 pt) iii) Calculate the portfolio's expected return. (1 pt) iv) Calculate the portfolio's variance. (1 pt) Exercise 3: Portfolio Beta (3.5 points) You are given the following information for an investment portfolio. Stock A B C Value $25,000 15,000 40,000 20,000 Total: Beta 1 0.5 2.5 4 i) ii) iii) iv) Calculate the beta of the portfolio? What can you say about the riskiness of your investment? (1 pt) Suppose Stock D becomes a risk free stock. Recalculate the portfolio's beta. What can you say about the riskiness of your investment? (1 pt) You want to end up with an investment mix that has beta equal to the market beta. What changes in your investment would you consider? (1 pt) A good investment portfolio is trying to minimize systematic risk. Yes or No? Explain. (0.5 pt)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started