Answered step by step

Verified Expert Solution

Question

1 Approved Answer

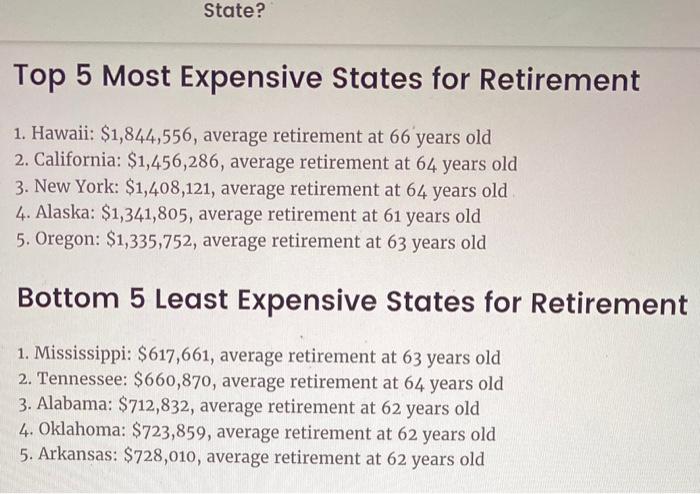

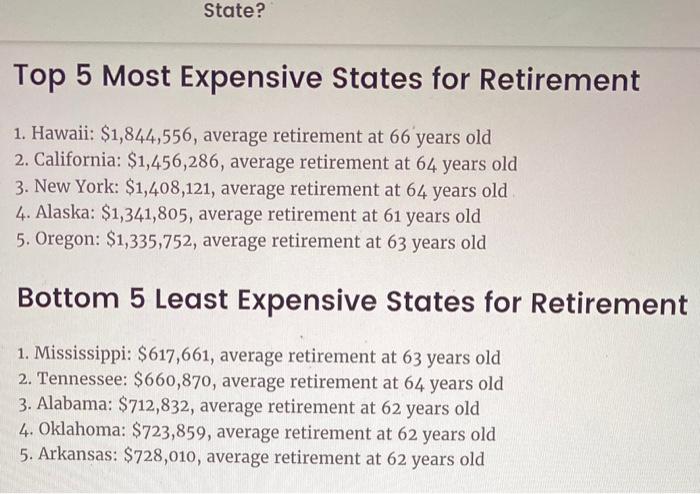

state picked: New York State? Top 5 Most Expensive States for Retirement 1. Hawaii: $1,844,556, average retirement at 66 years old 2. California: $1,456,286, average

state picked: New York

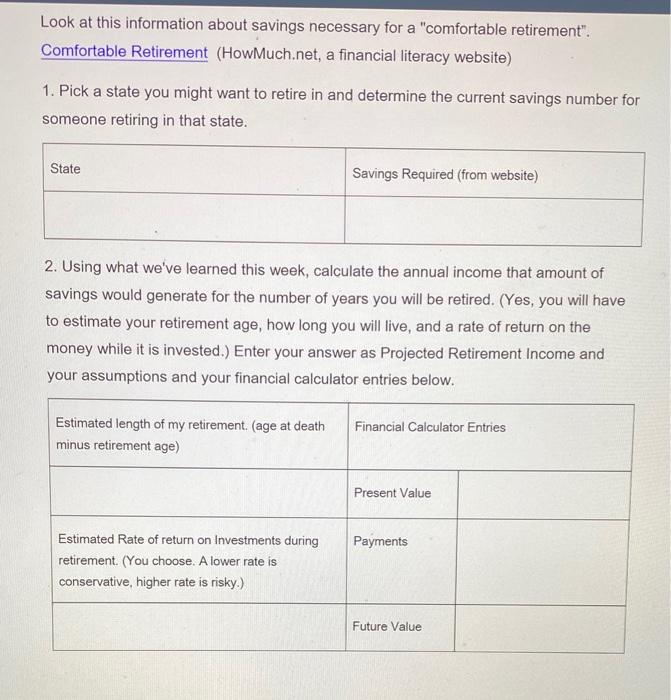

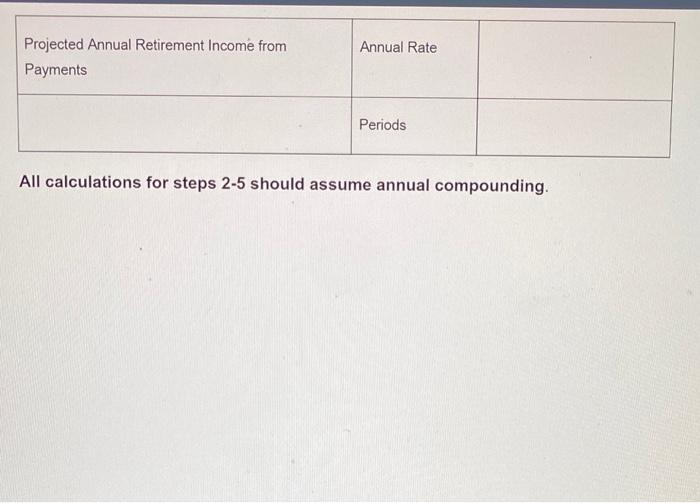

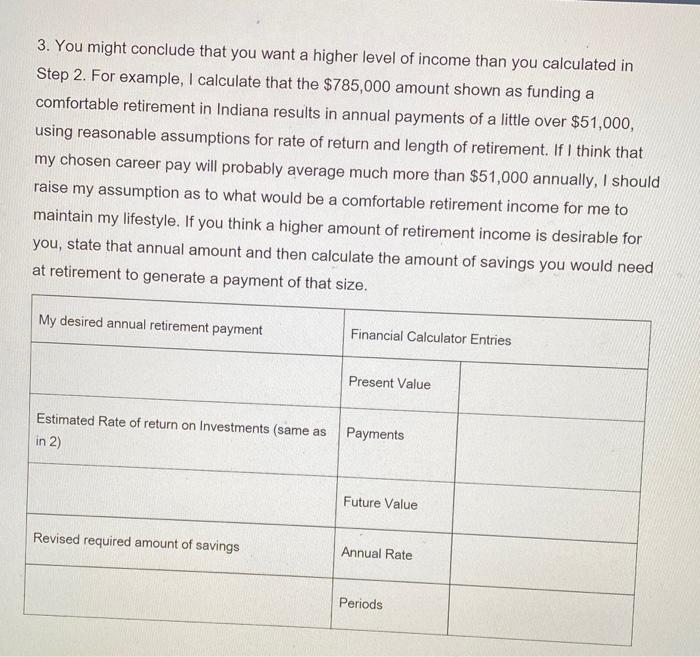

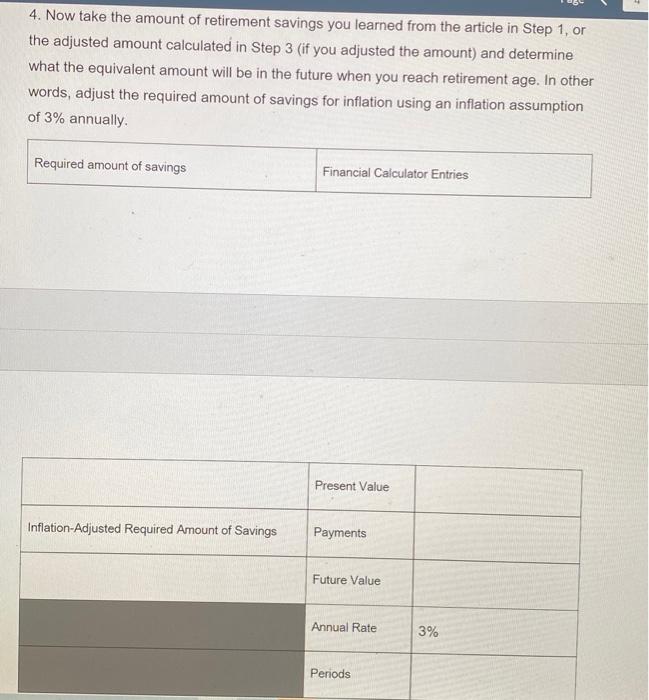

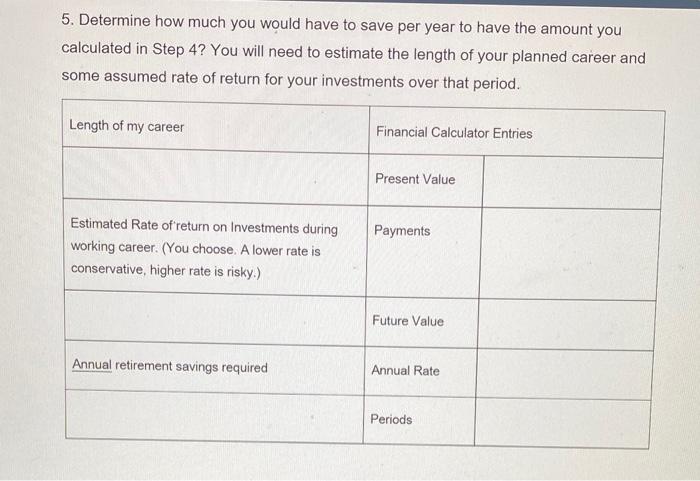

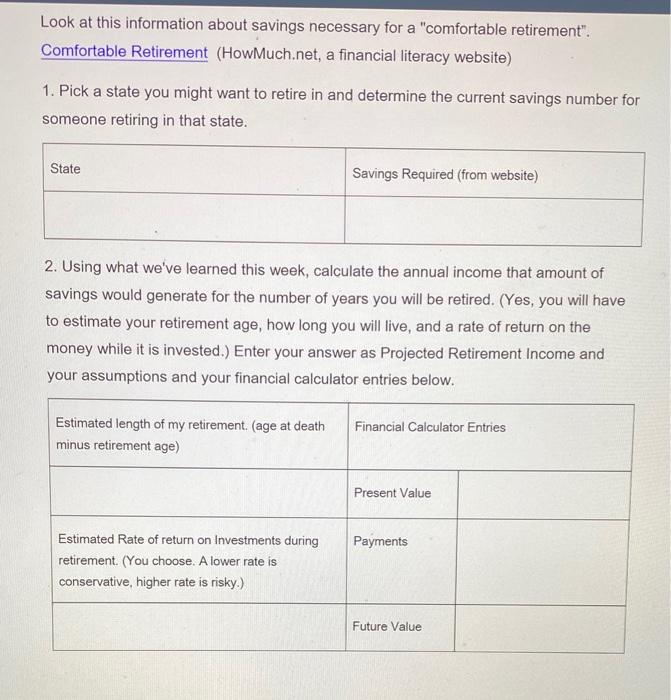

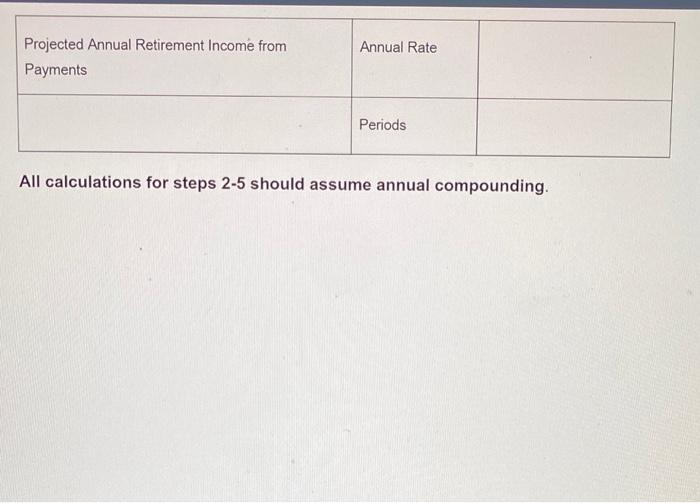

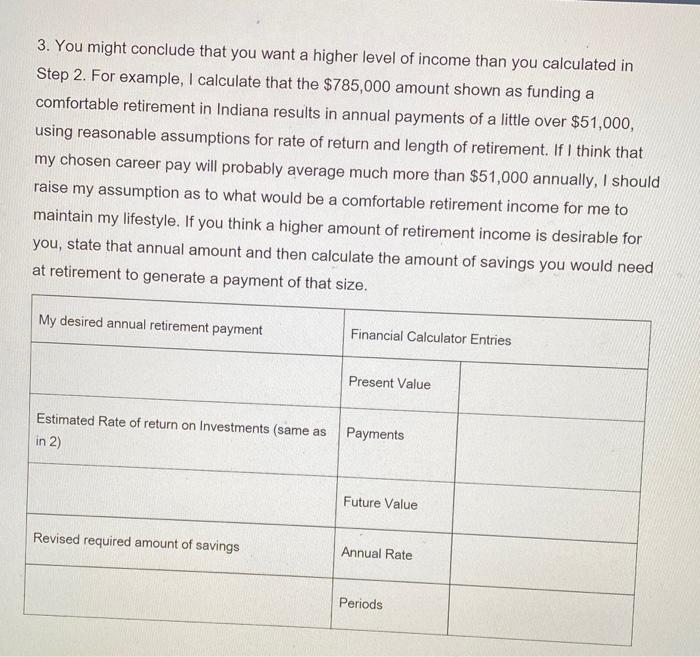

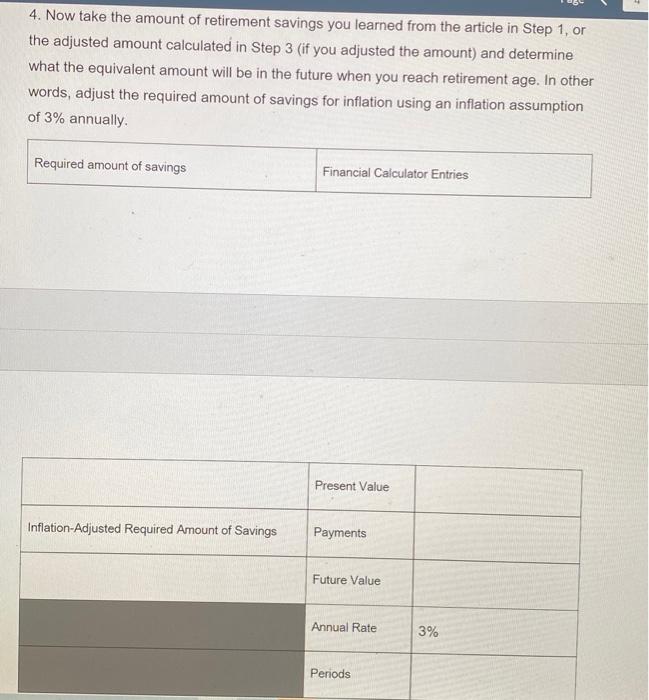

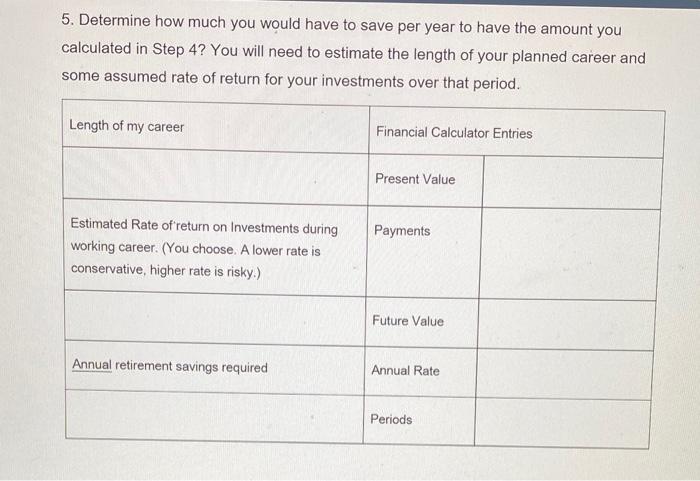

State? Top 5 Most Expensive States for Retirement 1. Hawaii: $1,844,556, average retirement at 66 years old 2. California: $1,456,286, average retirement at 64 years old 3. New York: $1,408,121, average retirement at 64 years old 4. Alaska: $1,341,805, average retirement at 61 years old 5. Oregon: $1,335,752, average retirement at 63 years old Bottom 5 Least Expensive States for Retirement 1. Mississippi: $617,661, average retirement at 63 years old 2. Tennessee: $660,870, average retirement at 64 years old 3. Alabama: $712,832, average retirement at 62 years old 4. Oklahoma: $723,859, average retirement at 62 years old 5. Arkansas: $728,010, average retirement at 62 years old Look at this information about savings necessary for a "comfortable retirement". Comfortable Retirement (How Much.net, a financial literacy website) 1. Pick a state you might want to retire in and determine the current savings number for . someone retiring in that state. State Savings Required (from website) 2. Using what we've learned this week, calculate the annual income that amount of savings would generate for the number of years you will be retired. (Yes, you will have to estimate your retirement age, how long you will live, and a rate of return on the money while it is invested.) Enter your answer as Projected Retirement Income and your assumptions and your financial calculator entries below. Estimated length of my retirement. (age at death minus retirement age) Financial Calculator Entries Present Value Payments Estimated Rate of return on Investments during retirement. (You choose. A lower rate is conservative, higher rate is risky.) Future Value Annual Rate Projected Annual Retirement Income from Payments Periods All calculations for steps 2-5 should assume annual compounding. 3. You might conclude that you want a higher level of income than you calculated in Step 2. For example, I calculate that the $785,000 amount shown as funding a comfortable retirement in Indiana results in annual payments of a little over $51,000, using reasonable assumptions for rate of return and length of retirement. If I think that my chosen career pay will probably average much more than $51,000 annually, I should raise my assumption as to what would be a comfortable retirement income for me to maintain my lifestyle. If you think a higher amount of retirement income is desirable for you, state that annual amount and then calculate the amount of savings you would need at retirement to generate a payment of that size. My desired annual retirement payment Financial Calculator Entries Present Value Estimated Rate of return on Investments (same as in 2) Payments Future Value Revised required amount of savings Annual Rate Periods 4. Now take the amount of retirement savings you learned from the article in Step 1, or the adjusted amount calculated in Step 3 (if you adjusted the amount) and determine what the equivalent amount will be in the future when you reach retirement age. In other words, adjust the required amount of savings for inflation using an inflation assumption of 3% annually. Required amount of savings Financial Calculator Entries Present Value Inflation-Adjusted Required Amount of Savings Payments Future Value Annual Rate 3% Periods 5. Determine how much you would have to save per year to have the amount you calculated in Step 4? You will need to estimate the length of your planned career and some assumed rate of return for your investments over that period. Length of my career Financial Calculator Entries Present Value Payments Estimated Rate of return on Investments during working career. (You choose. A lower rate is conservative, higher rate is risky.) Future Value Annual retirement savings required Annual Rate Periods State? Top 5 Most Expensive States for Retirement 1. Hawaii: $1,844,556, average retirement at 66 years old 2. California: $1,456,286, average retirement at 64 years old 3. New York: $1,408,121, average retirement at 64 years old 4. Alaska: $1,341,805, average retirement at 61 years old 5. Oregon: $1,335,752, average retirement at 63 years old Bottom 5 Least Expensive States for Retirement 1. Mississippi: $617,661, average retirement at 63 years old 2. Tennessee: $660,870, average retirement at 64 years old 3. Alabama: $712,832, average retirement at 62 years old 4. Oklahoma: $723,859, average retirement at 62 years old 5. Arkansas: $728,010, average retirement at 62 years old Look at this information about savings necessary for a "comfortable retirement". Comfortable Retirement (How Much.net, a financial literacy website) 1. Pick a state you might want to retire in and determine the current savings number for . someone retiring in that state. State Savings Required (from website) 2. Using what we've learned this week, calculate the annual income that amount of savings would generate for the number of years you will be retired. (Yes, you will have to estimate your retirement age, how long you will live, and a rate of return on the money while it is invested.) Enter your answer as Projected Retirement Income and your assumptions and your financial calculator entries below. Estimated length of my retirement. (age at death minus retirement age) Financial Calculator Entries Present Value Payments Estimated Rate of return on Investments during retirement. (You choose. A lower rate is conservative, higher rate is risky.) Future Value Annual Rate Projected Annual Retirement Income from Payments Periods All calculations for steps 2-5 should assume annual compounding. 3. You might conclude that you want a higher level of income than you calculated in Step 2. For example, I calculate that the $785,000 amount shown as funding a comfortable retirement in Indiana results in annual payments of a little over $51,000, using reasonable assumptions for rate of return and length of retirement. If I think that my chosen career pay will probably average much more than $51,000 annually, I should raise my assumption as to what would be a comfortable retirement income for me to maintain my lifestyle. If you think a higher amount of retirement income is desirable for you, state that annual amount and then calculate the amount of savings you would need at retirement to generate a payment of that size. My desired annual retirement payment Financial Calculator Entries Present Value Estimated Rate of return on Investments (same as in 2) Payments Future Value Revised required amount of savings Annual Rate Periods 4. Now take the amount of retirement savings you learned from the article in Step 1, or the adjusted amount calculated in Step 3 (if you adjusted the amount) and determine what the equivalent amount will be in the future when you reach retirement age. In other words, adjust the required amount of savings for inflation using an inflation assumption of 3% annually. Required amount of savings Financial Calculator Entries Present Value Inflation-Adjusted Required Amount of Savings Payments Future Value Annual Rate 3% Periods 5. Determine how much you would have to save per year to have the amount you calculated in Step 4? You will need to estimate the length of your planned career and some assumed rate of return for your investments over that period. Length of my career Financial Calculator Entries Present Value Payments Estimated Rate of return on Investments during working career. (You choose. A lower rate is conservative, higher rate is risky.) Future Value Annual retirement savings required Annual Rate Periods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started