Answered step by step

Verified Expert Solution

Question

1 Approved Answer

State whether each of the following payment is subject to withholding tax. If your answer is 'Yes', state the type of income and calculate

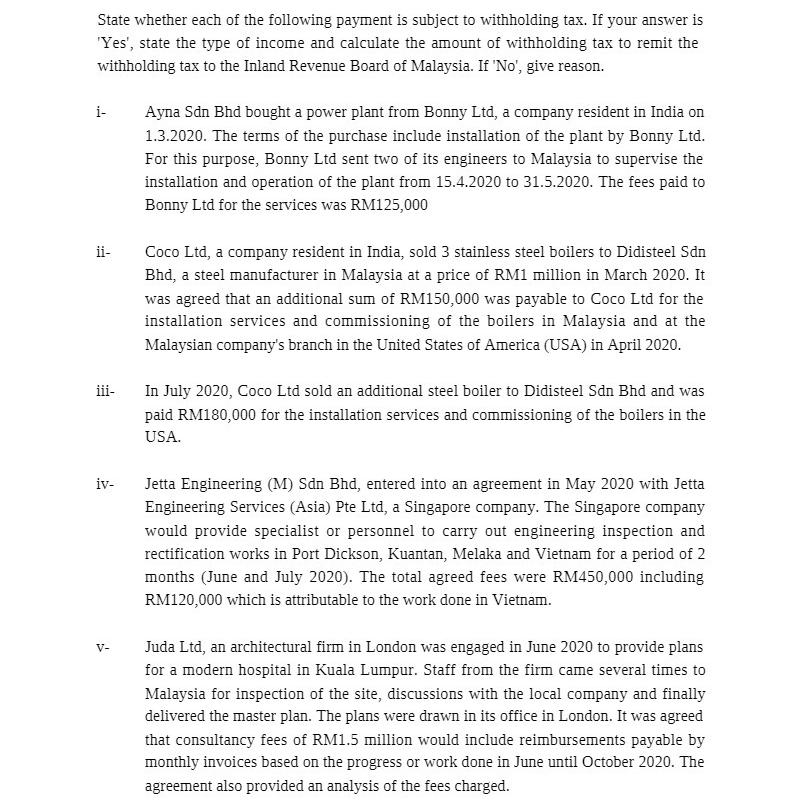

State whether each of the following payment is subject to withholding tax. If your answer is 'Yes', state the type of income and calculate the amount of withholding tax to remit the withholding tax to the Inland Revenue Board of Malaysia. If 'No', give reason. i- ii- iii- Ayna Sdn Bhd bought a power plant from Bonny Ltd, a company resident in India on 1.3.2020. The terms of the purchase include installation of the plant by Bonny Ltd. For this purpose, Bonny Ltd sent two of its engineers to Malaysia to supervise the installation and operation of the plant from 15.4.2020 to 31.5.2020. The fees paid to Bonny Ltd for the services was RM125,000 Coco Ltd, a company resident in India, sold 3 stainless steel boilers to Didisteel Sdn Bhd, a steel manufacturer in Malaysia at a price of RM1 million in March 2020. It was agreed that an additional sum of RM150,000 was payable to Coco Ltd for the installation services and commissioning of the boilers in Malaysia and at the Malaysian company's branch in the United States of America (USA) in April 2020. In July 2020, Coco Ltd sold an additional steel boiler to Didisteel Sdn Bhd and was paid RM180,000 for the installation services and commissioning of the boilers in the USA. iv- V- Jetta Engineering (M) Sdn Bhd, entered into an agreement in May 2020 with Jetta Engineering Services (Asia) Pte Ltd, a Singapore company. The Singapore company would provide specialist or personnel to carry out engineering inspection and rectification works in Port Dickson, Kuantan, Melaka and Vietnam for a period of 2 months (June and July 2020). The total agreed fees were RM450,000 including RM120,000 which is attributable to the work done in Vietnam. Juda Ltd, an architectural firm in London was engaged in June 2020 to provide plans for a modern hospital in Kuala Lumpur. Staff from the firm came several times to Malaysia for inspection of the site, discussions with the local company and finally delivered the master plan. The plans were drawn in its office in London. It was agreed that consultancy fees of RM1.5 million would include reimbursements payable by monthly invoices based on the progress or work done in June until October 2020. The agreement also provided an analysis of the fees charged.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Yes the payment to Bonny Ltd for supervising the power plant installation in Malaysia is subject to withholding tax The type of income is for servic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66430b5abfe52_952801.pdf

180 KBs PDF File

66430b5abfe52_952801.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started