Answered step by step

Verified Expert Solution

Question

1 Approved Answer

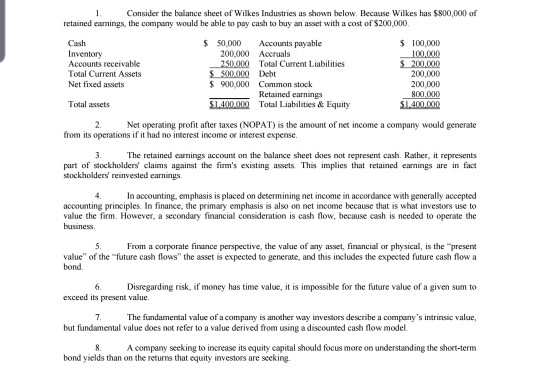

state whether each statement 1-8 if its true or false Consider the balance sheet of Wilkes Industries as shown below. Because Wilkes has $800,000 of

state whether each statement 1-8 if its true or false

Consider the balance sheet of Wilkes Industries as shown below. Because Wilkes has $800,000 of retained carnings, the company would be able to pay cash to buy an asset with a cost of $200.000 Cash Inventory Accounts receivable Total Current Assets Net fixed assets $ 50.000 Accounts payable 200.000 Accruals 250.000 Total Current Liabilities S500.000 Debt $ 900.000 Common stock Retained carnings 51.400.000 Total Liabilities & Equity $ 100.000 100.000 $200.000 200,000 200 000 0 000 S1.400.000 Total assets Net operating profit after taxes (NOPAT) is the amount of net income a company would generate from its operations if it had no interest income or interest expense. The retained earnings account on the balance sheet does not represent cash Rather, it represents part of stockholders' claims against the firm's existing assets. This implies that retained earnings are in fact stockholders reinvested earnings 4. In accounting, emphasis is placed on determining net income in accordance with generally accepted accounting principles. In finance, the primary emphasis is also on net income because that is what investors use to value the firm. However, a secondary financial consideration is cash flow, because cash is needed to operate the business From a corporate finance perspective, the value of any asset, financial or physical, is the present value of the future cash flows the asset is expected to generate, and this includes the expected future cash flow a bond Disregarding risk, if money has time value, it is impossible for the future value of a given sum to exceed its present value The fundamental value of a company is another way investors describe a company's intrinsic value, but fundamental value does not refer to a value derived from using a discounted cash flow model A company seeking to increase its equity capital should focus more on understanding the short-term bond yields than on the returns that equity investors are seekingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started