State whether the following activities will affect the balance sheet (i.e., assets or liabilities) of the Bank of Canada (not chartered/commercial banks). In cases

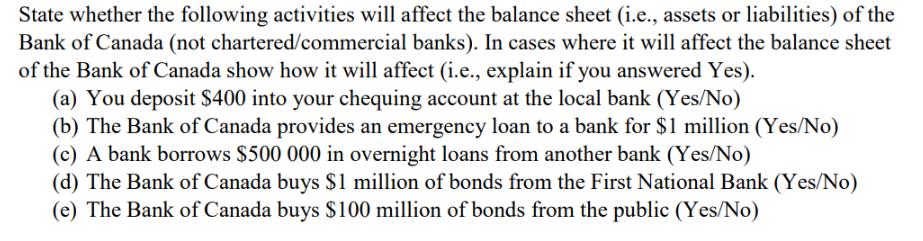

State whether the following activities will affect the balance sheet (i.e., assets or liabilities) of the Bank of Canada (not chartered/commercial banks). In cases where it will affect the balance sheet of the Bank of Canada show how it will affect (i.e., explain if you answered Yes). (a) You deposit $400 into your chequing account at the local bank (Yes/No) (b) The Bank of Canada provides an emergency loan to a bank for $1 million (Yes/No) (c) A bank borrows $500 000 in overnight loans from another bank (Yes/No) (d) The Bank of Canada buys $1 million of bonds from the First National Bank (Yes/No) (e) The Bank of Canada buys $100 million of bonds from the public (Yes/No) Explain the meanings of the following concepts which are widely used in the money supply literature. (i) (ii) Quantitative easing Credit easing

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Bank of Canada ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started