Answered step by step

Verified Expert Solution

Question

1 Approved Answer

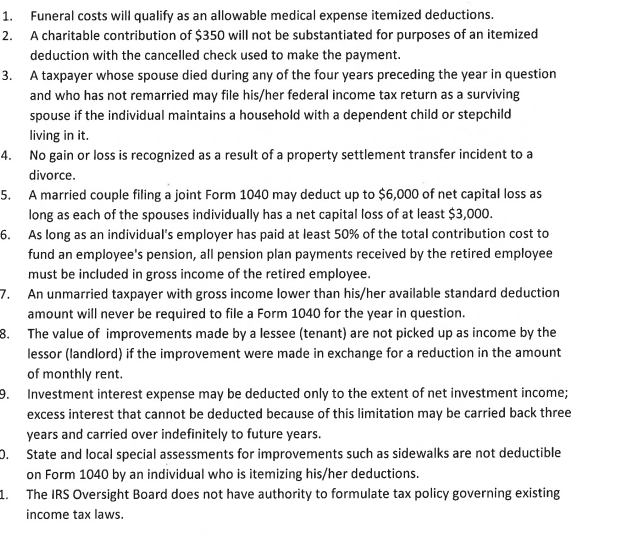

state whether the following statements are true or false 2. 4. Funeral costs will qualify as an allowable medical expense itemized deductions. A charitable contribution

state whether the following statements are true or false

2. 4. Funeral costs will qualify as an allowable medical expense itemized deductions. A charitable contribution of $350 will not be substantiated for purposes of an itemized deduction with the cancelled check used to make the payment. A taxpayer whose spouse died during any of the four years preceding the year in question and who has not remarried may file his/her federal income tax return as a surviving spouse if the individual maintains a household with a dependent child or stepchild living in it. No gain or loss is recognized as a result of a property settlement transfer incident to a divorce. A married couple filing a joint Form 1040 may deduct up to $6,000 of net capital loss as long as each of the spouses individually has a net capital loss of at least $3,000. As long as an individual's employer has paid at least 50% of the total contribution cost to fund an employee's pension, all pension plan payments received by the retired employee must be included in gross income of the retired employee. An unmarried taxpayer with gross income lower than his/her available standard deduction amount will never be required to file a Form 1040 for the year in question. The value of improvements made by a lessee (tenant) are not picked up as income by the lessor (landlord) if the improvement were made in exchange for a reduction in the amount of monthly rent. Investment interest expense may be deducted only to the extent of net investment income; excess interest that cannot be deducted because of this limitation may be carried back three years and carried over indefinitely to future years. State and local special assessments for improvements such as sidewalks are not deductible on Form 1040 by an individual who is itemizing his/her deductions. The IRS Oversight Board does not have authority to formulate tax policy governing existing income tax laws.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started