Question

Statement 1: The Court of Tax Appeals has an exclusive original jurisdiction to review the inaction by the Commissioner of Internal Revenue (CIR) in cases

Statement 1: The Court of Tax Appeals has an exclusive original jurisdiction to review the inaction by the Commissioner of Internal Revenue (CIR) in cases involving disputed assessments, refunds of internal revenue taxes, fees or other charges, penalties in relations thereto, or other matters arising under the National Internal Revenue Code or other laws administered by the Bureau of Internal Revenue.

Statement 2: Based on the preceding paragraph, the inaction of the CIR shall be deemed a denial.

a. Both statements are true

b. Both statements are false

c. Only Statement 1 is true

d. Only Statement 2 is true

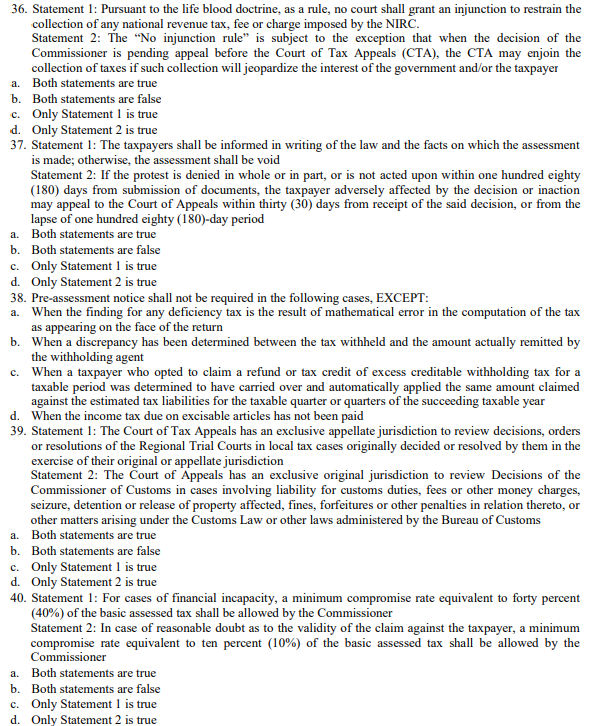

36. Statement 1: Pursuant to the life blood doctrine, as a rule, no court shall grant an injunction to restrain the collection of any national revenue tax, fee or charge imposed by the NIRC. Statement 2: The "No injunction rule" is subject to the exception that when the decision of the Commissioner is pending appeal before the Court of Tax Appeals (CTA), the CTA may enjoin the collection of taxes if such collection will jeopardize the interest of the government and/or the taxpayer Both statements are true a. b. Both statements are false c. Only Statement 1 is true d. Only Statement 2 is true 37. Statement 1: The taxpayers shall be informed in writing of the law and the facts on which the assessment is made; otherwise, the assessment shall be void Statement 2: If the protest is denied in whole or in part, or is not acted upon within one hundred eighty (180) days from submission of documents, the taxpayer adversely affected by the decision or inaction may appeal to the Court of Appeals within thirty (30) days from receipt of the said decision, or from the lapse of one hundred eighty (180)-day period a. Both statements are true b. Both statements are false c. Only Statement 1 is true d. Only Statement 2 is true 38. Pre-assessment notice shall not be required in the following cases, EXCEPT: a. When the finding for any deficiency tax is the result of mathematical error in the computation of the tax as appearing on the face of the return b. When a discrepancy has been determined between the tax withheld and the amount actually remitted by the withholding agent c. When a taxpayer who opted to claim a refund or tax credit of excess creditable withholding tax for a taxable period was determined to have carried over and automatically applied the same amount claimed against the estimated tax liabilities for the taxable quarter or quarters of the succeeding taxable year d. When the income tax due on excisable articles has not been paid 39. Statement 1: The Court of Tax Appeals has an exclusive appellate jurisdiction to review decisions, orders or resolutions of the Regional Trial Courts in local tax cases originally decided or resolved by them in the exercise of their original or appellate jurisdiction Statement 2: The Court of Appeals has an exclusive original jurisdiction to review Decisions of the Commissioner of Customs in cases involving liability for customs duties, fees or other money charges, seizure, detention or release of property affected, fines, forfeitures or other penalties in relation thereto, or other matters arising under the Customs Law or other laws administered by the Bureau of Customs Both statements are true a. b. Both statements are false c. Only Statement 1 is true d. Only Statement 2 is true 40. Statement 1: For cases of financial incapacity, a minimum compromise rate equivalent to forty percent (40%) of the basic assessed tax shall be allowed by the Commissioner Statement 2: In case of reasonable doubt as to the validity of the claim against the taxpayer, a minimum compromise rate equivalent to ten percent (10%) of the basic assessed tax shall be allowed by the Commissioner a. Both statements are true b. Both statements are false c. Only Statement 1 is true d. Only Statement 2 is true

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is c Only Statement 1 is true Heres why Statement 1 This statement is true The Court of Tax Appeals CTA does have exclus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started