Answered step by step

Verified Expert Solution

Question

1 Approved Answer

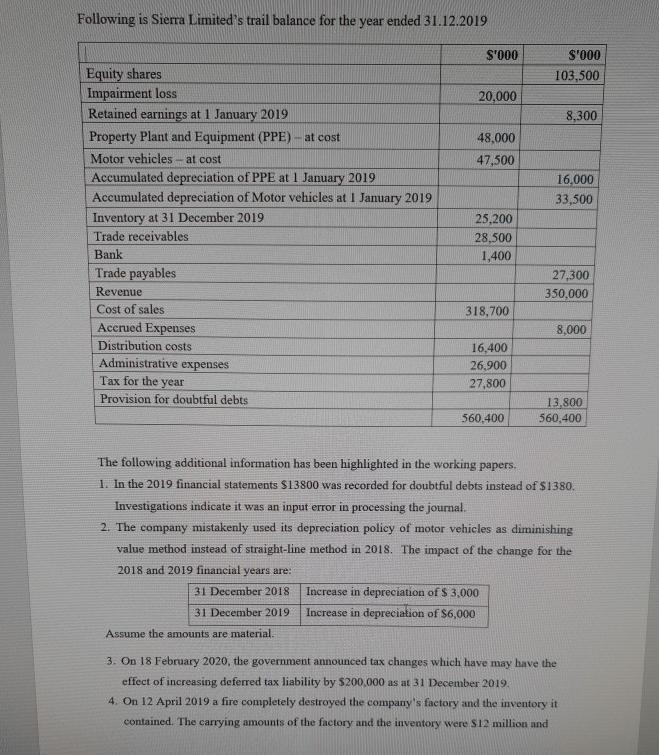

Following is Sierra Limited's trail balance for the year ended 31.12.2019 Equity shares Impairment loss Retained earnings at 1 January 2019 Property Plant and

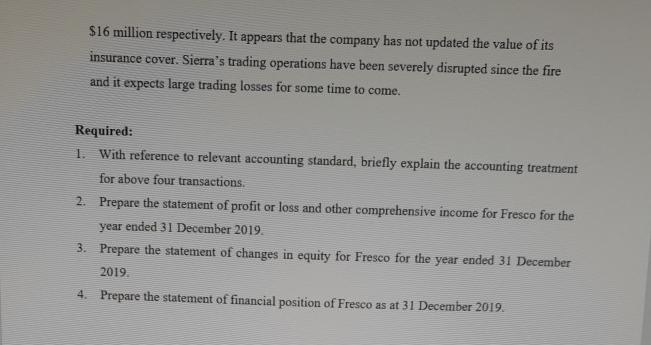

Following is Sierra Limited's trail balance for the year ended 31.12.2019 Equity shares Impairment loss Retained earnings at 1 January 2019 Property Plant and Equipment (PPE) - at cost Motor vehicles-at cost Accumulated depreciation of PPE at 1 January 2019 Accumulated depreciation of Motor vehicles at 1 January 2019 Inventory at 31 December 2019 Trade receivables Bank Trade payables Revenue Cost of sales Accrued Expenses Distribution costs Administrative expenses Tax for the year Provision for doubtful debts $'000 20,000 48,000 47,500 25,200 28,500 1,400 318,700 16,400 26,900 27,800 560,400 Increase in depreciation of $3,000 Increase in depreciation of $6,000 $'000 103,500 8,300 16,000 33,500 27,300 350,000 8,000 13,800 560,400 The following additional information has been highlighted in the working papers. 1. In the 2019 financial statements $13800 was recorded for doubtful debts instead of $1380. Investigations indicate it was an input error in processing the journal. 2. The company mistakenly used its depreciation policy of motor vehicles as diminishing value method instead of straight-line method in 2018. The impact of the change for the 2018 and 2019 financial years are: 31 December 2018 31 December 2019 Assume the amounts are material. 3. On 18 February 2020, the government announced tax changes which have may have the effect of increasing deferred tax liability by $200,000 as at 31 December 2019. 4. On 12 April 2019 a fire completely destroyed the company's factory and the inventory it contained. The carrying amounts of the factory and the inventory were $12 million and $16 million respectively. It appears that the company has not updated the value of its insurance cover. Sierra's trading operations have been severely disrupted since the fire and it expects large trading losses for some time to come. Required: 1. With reference to relevant accounting standard, briefly explain the accounting treatment for above four transactions. 2. Prepare the statement of profit or loss and other comprehensive income for Fresco for the year ended 31 December 2019. 3. Prepare the statement of changes in equity for Fresco for the year ended 31 December 2019. 4. Prepare the statement of financial position of Fresco as at 31 December 2019.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Accounting Treatment for the Four Transactions Correction of Doubtful Debts Recording Error The correction of the input error for doubtful debts should be made by adjusting the provision for doubtful ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started