Answered step by step

Verified Expert Solution

Question

1 Approved Answer

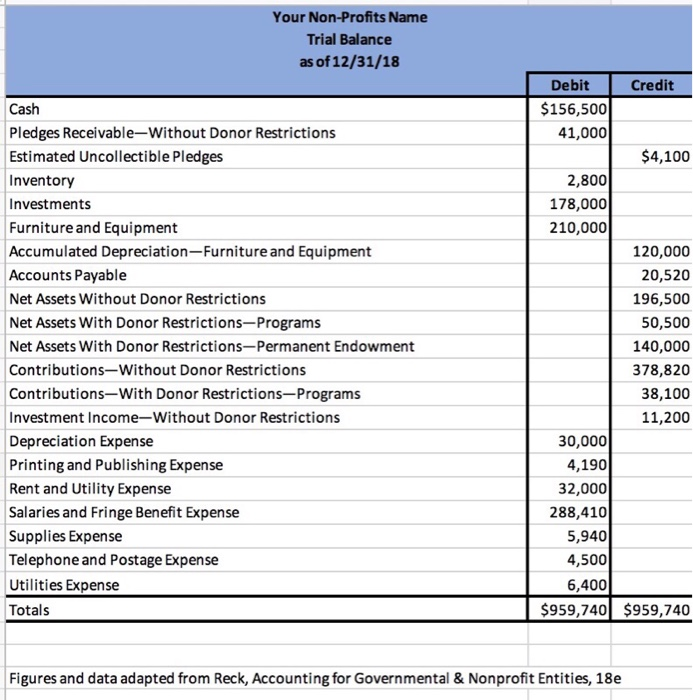

Statement of Activities In addition to the information provided from the Trial Balance tab, use the following information about your nonprofit to prepare the Statement

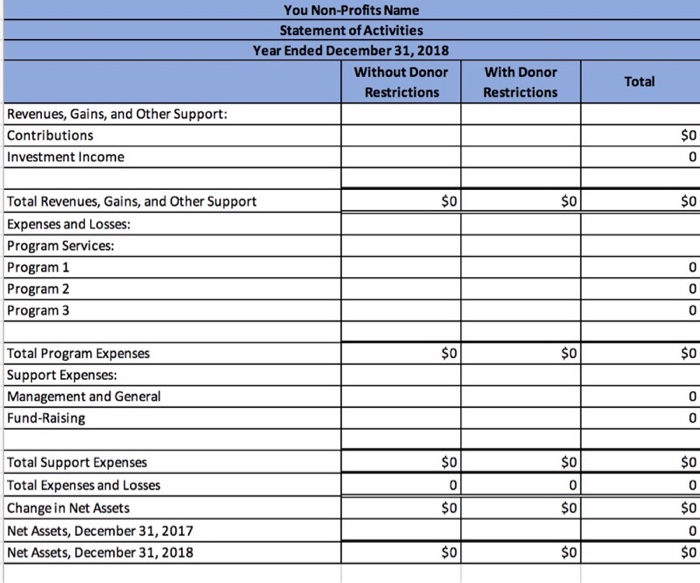

Statement of Activities

In addition to the information provided from the Trial Balance tab, use the following information about your nonprofit to prepare the Statement of Activities.

a. Salaries and Fringe Benefit Expenses were allocated to Program Services and Supporting Expenses in the following percentages:

i. Program 1: 40%

ii. Program 2: 20%

iii. Program 3: 10%

iv. Management and General: 20%

v. Fund-Raising: 10%

b. Rent and Utility, Supplies, Printing and Publishing, and Telephone and Postage Expenses were allocated in the same manner as Salaries and Fringe Benefit Expenses.

c. Depreciation Expense was divided equally to each functional expense category.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started