Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Statement of Cash Flows ( ANSWER ALL Blanks and Drop-down list PLEASE) The ones in the drop down list sections are : Changes in current

Statement of Cash Flows ( ANSWER ALL Blanks and Drop-down list PLEASE)

The ones in the drop down list sections are :

Changes in current operating assets and liabilities: Decrease/Increase Decrease/Increase Decrease/Increase Decrease/Increase Decrease/Increase Cash Flows from investing Activities Purchase or Sale Cash Flows from financing Activities repurchasing or issuing issuing or retiring payment or receipt

Thanks!

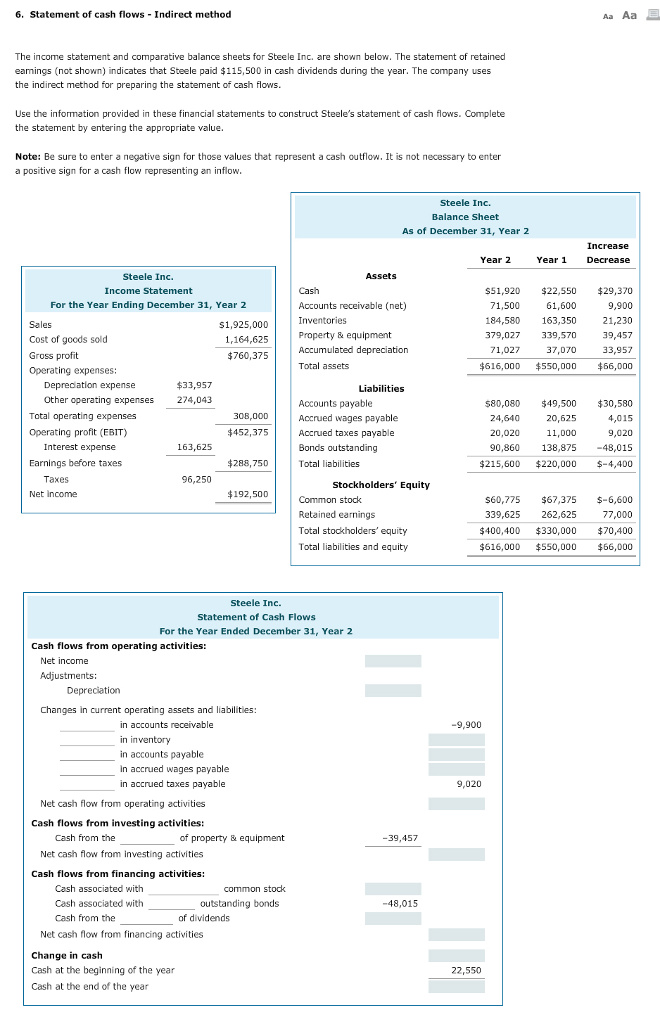

6. Statement of cash flows Indirect method The income statement and comparative balance sheets for Steele Inc. are shown below. The statement of retained eamings (not shown) indicates that Steele paid $115,500 in cash dividends during the year. The company uses the indirect method for preparing the statement of cash flows. Use the information provided in these financial statements to construct Steele's statement of cash flows. Complete the statement by entering the appropriate value. Note: Be sure to enter a negative sign for those values that represent a cash outflow. It is not necessary to enter a positive sign for a cash flow representing an inflow Steele Inc. Balance Sheet As of December 31, Year2 Increase Year 1 Decrease Year 2 Steele Inc. Income Statement For the Year Ending December 31, Year 2 Cash S51,920 $22,550 $29,370 61,600 184,580 163,350 21,230 Accounts receivable (net) 71,500 9,900 Sales Cost of goods sold Gross profit Operating expenses: s1,925,000Inventories 379,027 339,570 1,164,625 $760,375 Accumulated depreciation Total assets 71 ,027 37,070 33,957 $616,000 550,000 $66,000 expense Liabilities Other operating expenses 274,043 Accounts payable Accrued wages payable Accrued taxes payable Bonds outstandin Total liabilities $80,080 24,640 $49,500 20,625 $30,580| Total operating expenses Operating profit (EBIT) Interest expense Earnings before taxes 308,00D 4,015 9,020 90,860 138,875-48,015 $215,600 $220,000 -4,400 $452,375 163,625 $288,750 Taxes Net income 96,250 Stockholders' Equity $192,500 Common stock Retained earnings Total stockholders' equity Total liabilities and equity $60,775 $67,375 $-6,600 77,000 $400,400 $330,000 $70,400 $616,000 $550,000 $66,000 339,625 262,625 Steele Inc. Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: Net income Depreciation Changes in current operating assets and liabilities: in accounts receivable in accounts payable in accrued wages payable in accrued taxes payable Net cash flow from operating activities Cash flows from investing activities: Cash from the of property & equipment -39,457 Net cash flow from investing activities Cash flows from financing activities: Cash associated with stock Cash associated with outstanding bonds -48,015 Cash from the of dividends Net cash flow from financing activities Change in cash Cash at the beginning of the year 22,550 Cash at the end of the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started