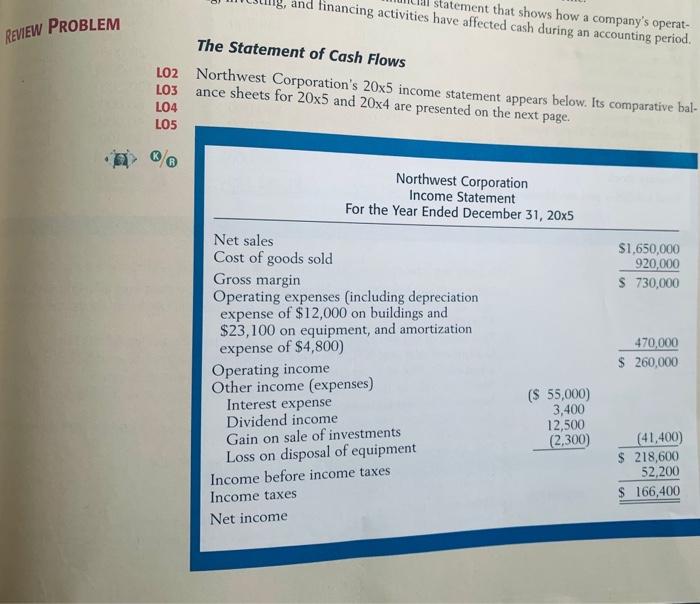

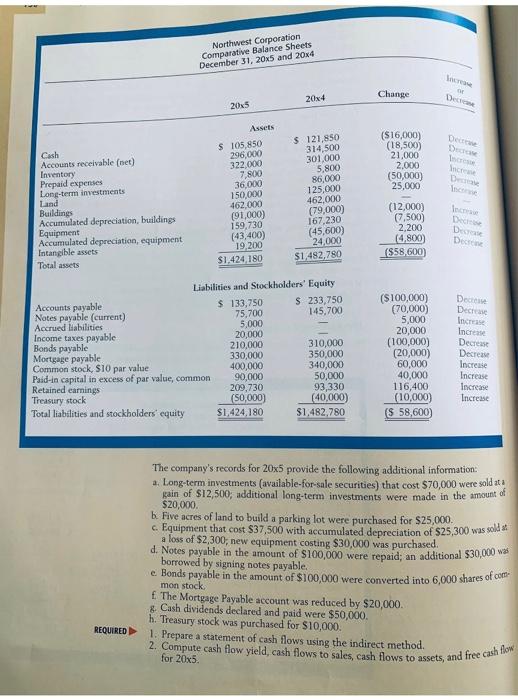

Statement of Cash Flows Northwest Corporation's 205 income statement appears below. Its comparative balance sheets for 205 and 204 are presented on the next page. The company's records for 205 provide the following additional information: a. Long-term investments (available-for-sale securities) that cost $70,000 were sold ata gain of $12,500; additional long-term investments were made in the amount of $20,000. b. Five acres of land to buald a parking lot were purchased for $25,000. c. Equipment that cost $37,500 with accumulated depreciation of $25,300 was sold 8 a loss of $2,300; new equipment costing $30,000 was purchased. d. Notes payable in the amount of $100,000 were repaid; an additional $30,000 wo borrowed by signing notes payable. c. Bonds payable in the amount of $100,000 were converted into 6,000 shares of cort mon stock: f. The Mortgage Payable account was reduced by $20,000. 8. Cash dividends declared and paid were $50,000. h. Treasury stock was purchased for $10,000. REQUIRED - 1. Prepare a statement of cash flows using the indirect method. 2. Compute cash flow yield, cash flows to sales, cash flows to assets, and free cash fow for 205. Statement of Cash Flows Northwest Corporation's 205 income statement appears below. Its comparative balance sheets for 205 and 204 are presented on the next page. The company's records for 205 provide the following additional information: a. Long-term investments (available-for-sale securities) that cost $70,000 were sold ata gain of $12,500; additional long-term investments were made in the amount of $20,000. b. Five acres of land to buald a parking lot were purchased for $25,000. c. Equipment that cost $37,500 with accumulated depreciation of $25,300 was sold 8 a loss of $2,300; new equipment costing $30,000 was purchased. d. Notes payable in the amount of $100,000 were repaid; an additional $30,000 wo borrowed by signing notes payable. c. Bonds payable in the amount of $100,000 were converted into 6,000 shares of cort mon stock: f. The Mortgage Payable account was reduced by $20,000. 8. Cash dividends declared and paid were $50,000. h. Treasury stock was purchased for $10,000. REQUIRED - 1. Prepare a statement of cash flows using the indirect method. 2. Compute cash flow yield, cash flows to sales, cash flows to assets, and free cash fow for 205