Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Statement of Cash Flows using Indirect Method The comparative statement of financial position and statement of comprehensive income of Entity A on December 31,

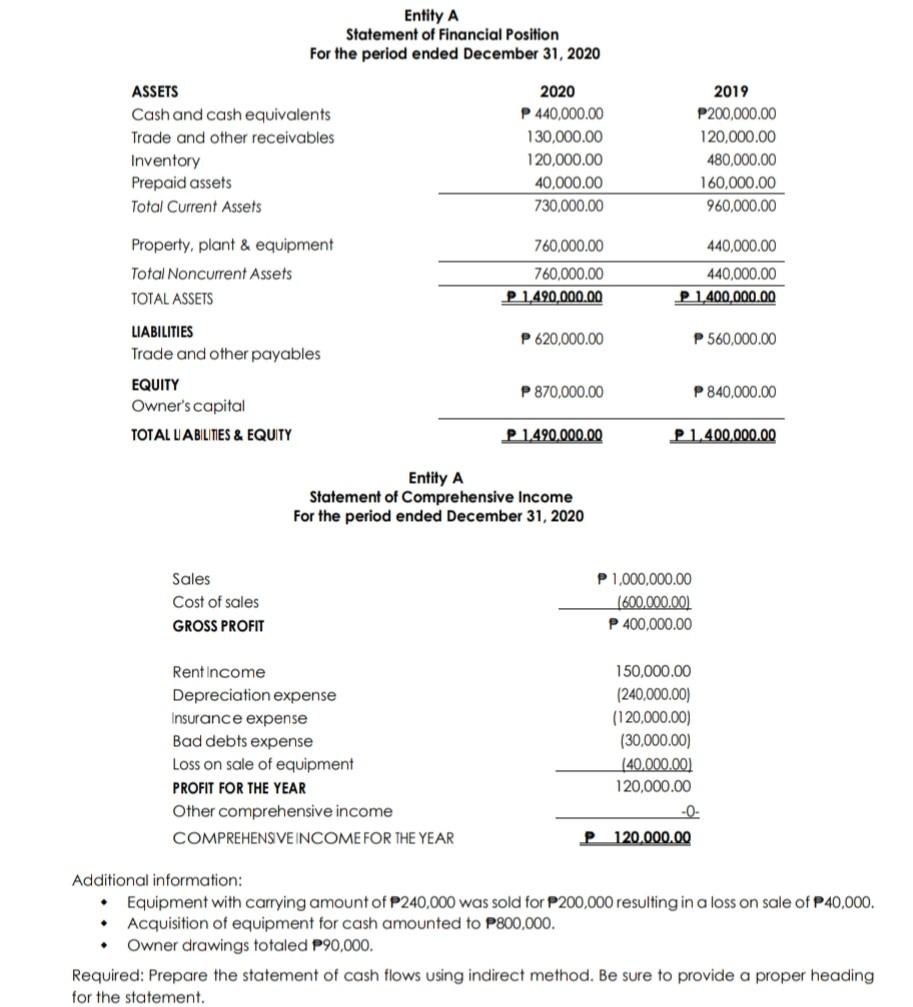

Statement of Cash Flows using Indirect Method The comparative statement of financial position and statement of comprehensive income of Entity A on December 31, 2020 are shown below: Entity A Statement of Financial Position For the period ended December 31, 2020 2020 P 440,000.00 130,000.00 120,000.00 40,000.00 730,000.00 760,000.00 760,000.00 P1,490,000.00 P 620,000.00 P 870,000.00 P 1.490.000.00 Entity A Statement of Comprehensive Income For the period ended December 31, 2020 2019 P200,000.00 120,000.00 480,000.00 160,000.00 960,000.00 440,000.00 440,000.00 P 1,400,000.00 P 560,000.00 P 840,000.00 P 1.400.000.00 ASSETS Cash and cash equivalents Trade and other receivables Inventory Prepaid assets Total Current Assets Property, plant & equipment Total Noncurrent Assets TOTAL ASSETS LIABILITIES Trade and other payables EQUITY Owner's capital TOTAL LIABILITIES & EQUITY Sales P 1,000,000.00 (600,000.00) Cost of sales GROSS PROFIT P 400,000.00 Rent Income 150,000.00 Depreciation expense (240,000.00) Insurance expense (120,000.00) Bad debts expense (30,000.00) Loss on sale of equipment (40,000.00) PROFIT FOR THE YEAR 120,000.00 Other comprehensive income -0- COMPREHENSIVE INCOME FOR THE YEAR P 120.000.00 Additional information: Equipment with carrying amount of P240,000 was sold for P200,000 resulting in a loss on sale of P40,000. Acquisition of equipment for cash amounted to P800,000. Owner drawings totaled P90,000. Required: Prepare the statement of cash flows using indirect method. Be sure to provide a proper heading for the statement.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 1 Changes in working capital Increase in trade and other receivables P130000 P120000 P1000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started