Answered step by step

Verified Expert Solution

Question

1 Approved Answer

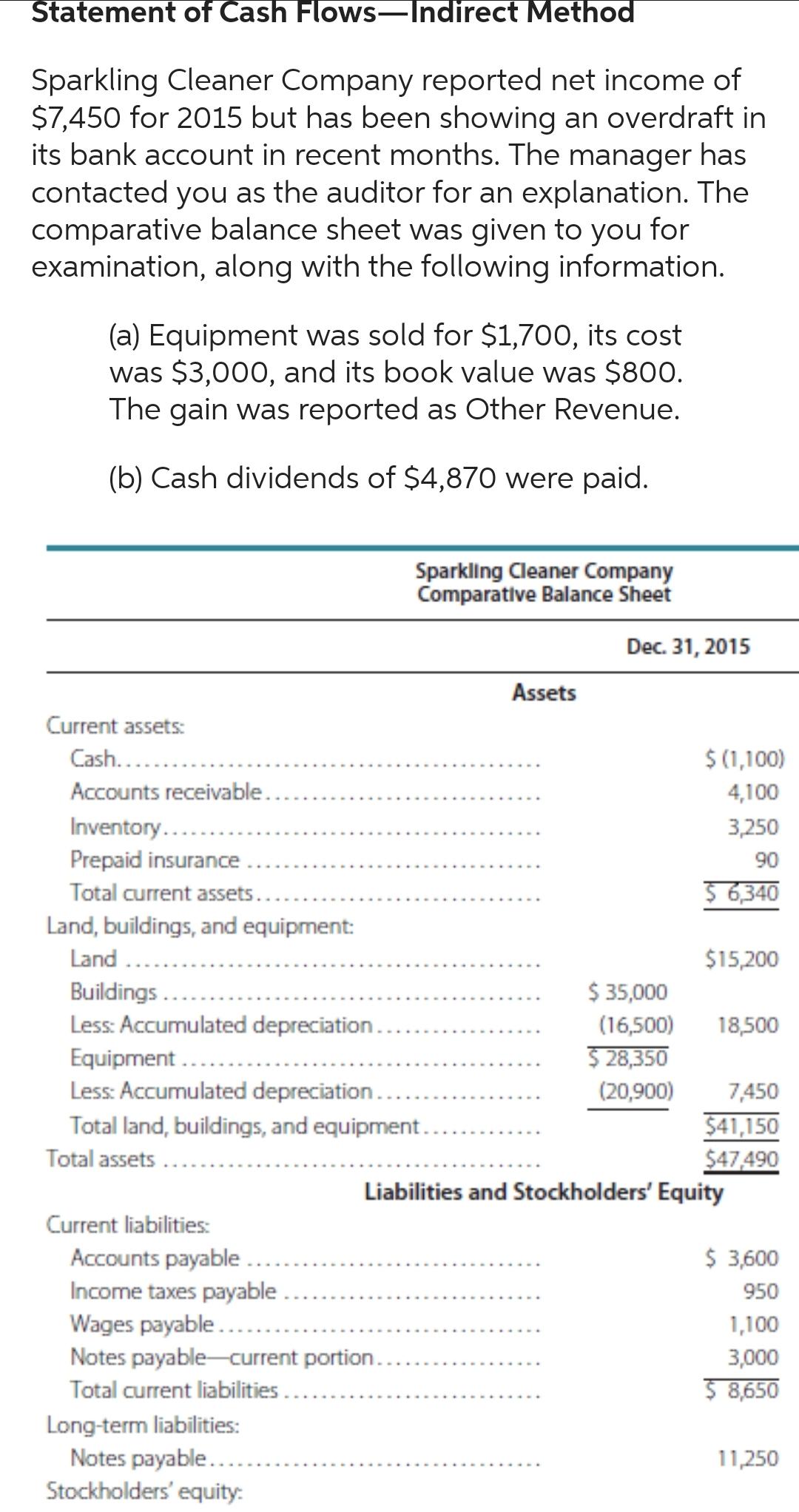

Statement of Cash FlowsIndirect Method Sparkling Cleaner Company reported net income of $7,450 for 2015 but has been showing an overdraft in its bank

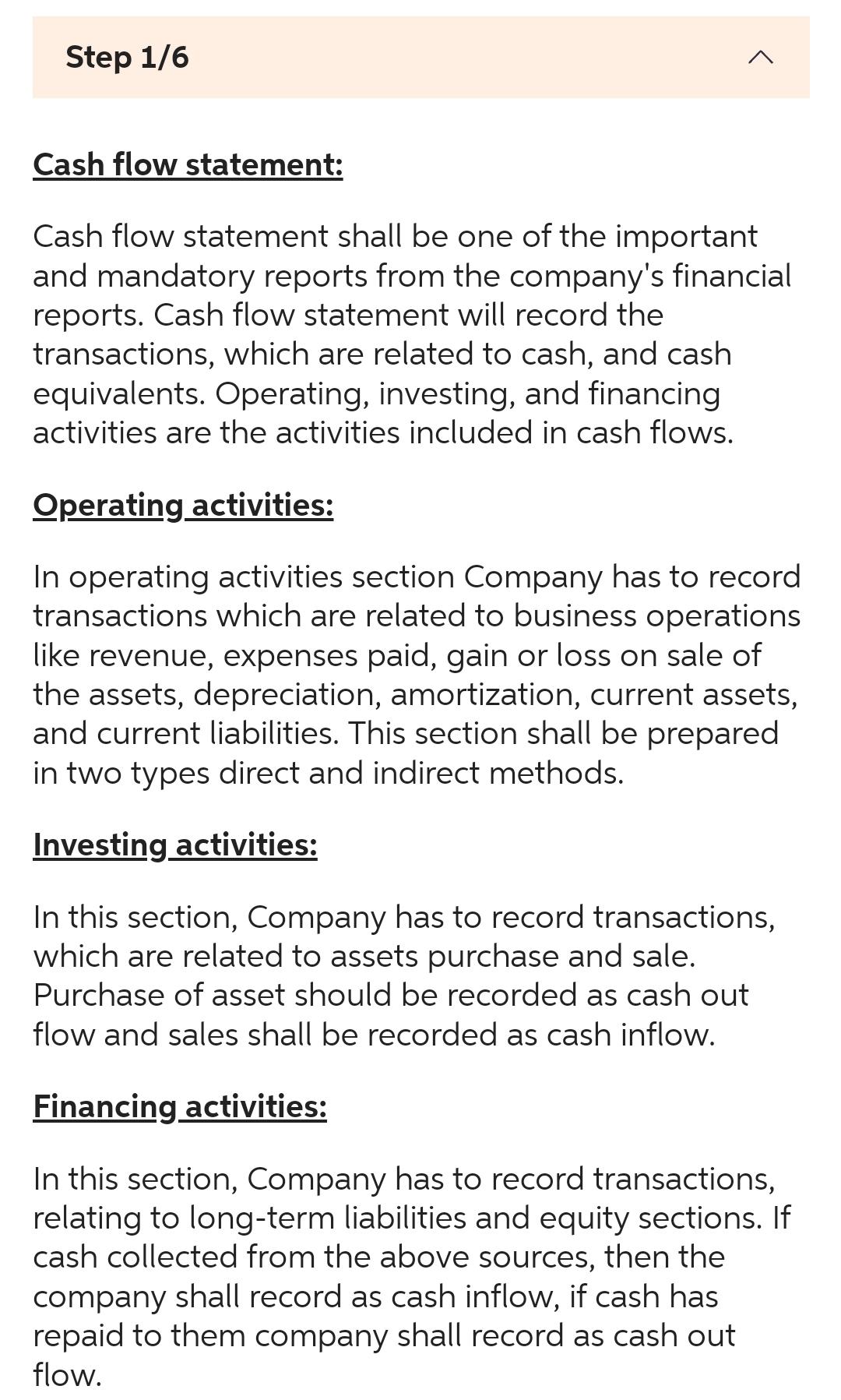

Statement of Cash FlowsIndirect Method Sparkling Cleaner Company reported net income of $7,450 for 2015 but has been showing an overdraft in its bank account in recent months. The manager has contacted you as the auditor for an explanation. The comparative balance sheet was given to you for examination, along with the following information. (a) Equipment was sold for $1,700, its cost was $3,000, and its book value was $800. The gain was reported as Other Revenue. (b) Cash dividends of $4,870 were paid. Current assets: Cash....... Accounts receivable.. Inventory... Prepaid insurance Total current assets.. Land, buildings, and equipment: Land ..... Buildings.. Less: Accumulated depreciation.. Equipment ....... Less: Accumulated depreciation... Total land, buildings, and equipment.. Total assets.... Current liabilities: Accounts payable Income taxes payable. Sparkling Cleaner Company Comparative Balance Sheet Wages payable..... Notes payable current portion.. Total current liabilities... Long-term liabilities: Notes payable..... Stockholders' equity: Assets Dec. 31, 2015 $ 35,000 (16,500) $ 28,350 (20,900) $ (1,100) 4,100 3,250 90 $ 6,340 $15,200 18,500 7,450 $41,150 $47,490 Liabilities and Stockholders' Equity $ 3,600 950 1,100 3,000 $ 8,650 11,250 Step 1/6 < Cash flow statement: Cash flow statement shall be one of the important and mandatory reports from the company's financial reports. Cash flow statement will record the transactions, which are related to cash, and cash equivalents. Operating, investing, and financing activities are the activities included in cash flows. Operating activities: In operating activities section Company has to record transactions which are related to business operations like revenue, expenses paid, gain or loss on sale of the assets, depreciation, amortization, current assets, and current liabilities. This section shall be prepared in two types direct and indirect methods. Investing activities: In this section, Company has to record transactions, which are related to assets purchase and sale. Purchase of asset should be recorded as cash out flow and sales shall be recorded as cash inflow. Financing activities: In this section, Company has to record transactions, relating to long-term liabilities and equity sections. If cash collected from the above sources, then the company shall record as cash inflow, if cash has repaid to them company shall record as cash out flow.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started