Answered step by step

Verified Expert Solution

Question

1 Approved Answer

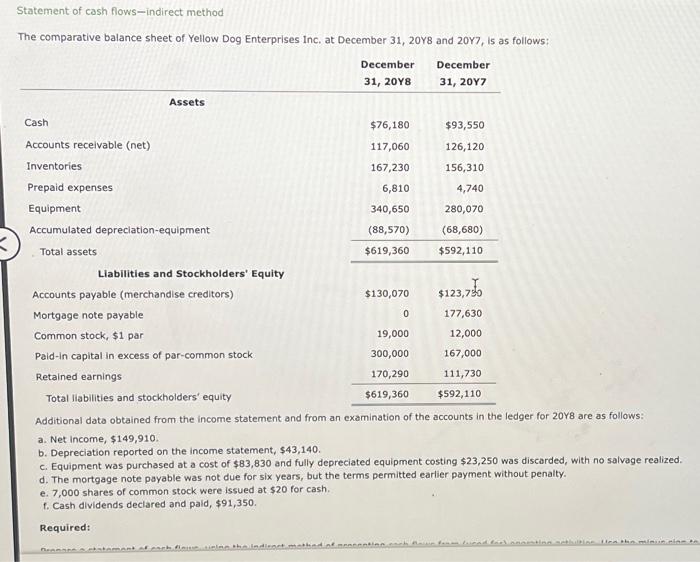

Statement of cash flows-indirect method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional dato

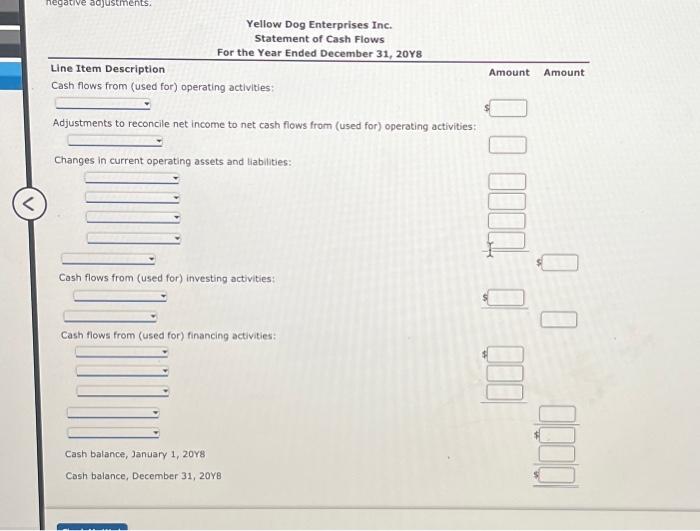

Statement of cash flows-indirect method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional dato obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, $149,910. b. Depreciation reported on the income statement, $43,140. c. Equipment was purchased at a cost of $83,830 and fully depreciated equipment costing $23,250 was discarded, with no salvage realized. d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty. e. 7,000 shares of common stock were issued at $20 for cash. f. Cash dividends declared and paid, $91,350. Required: Yellow Dog Enterprises Inc. Statement of Cash Flows For the Year Ended December 31, 20 Y8 Line Item Description Amount Amount Cash flows from (used for) operating activities: Adjustments to reconcile net income to net cash flows from (used for) operating activities: Changes in current operating assets and tiabilities: Cash flows from (used for) investing activities: Cash flows from (used for) financing activities: Cash balance, January 1, 20rg Cash balance, December 31, 20Y8

Statement of cash flows-indirect method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional dato obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, $149,910. b. Depreciation reported on the income statement, $43,140. c. Equipment was purchased at a cost of $83,830 and fully depreciated equipment costing $23,250 was discarded, with no salvage realized. d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty. e. 7,000 shares of common stock were issued at $20 for cash. f. Cash dividends declared and paid, $91,350. Required: Yellow Dog Enterprises Inc. Statement of Cash Flows For the Year Ended December 31, 20 Y8 Line Item Description Amount Amount Cash flows from (used for) operating activities: Adjustments to reconcile net income to net cash flows from (used for) operating activities: Changes in current operating assets and tiabilities: Cash flows from (used for) investing activities: Cash flows from (used for) financing activities: Cash balance, January 1, 20rg Cash balance, December 31, 20Y8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started