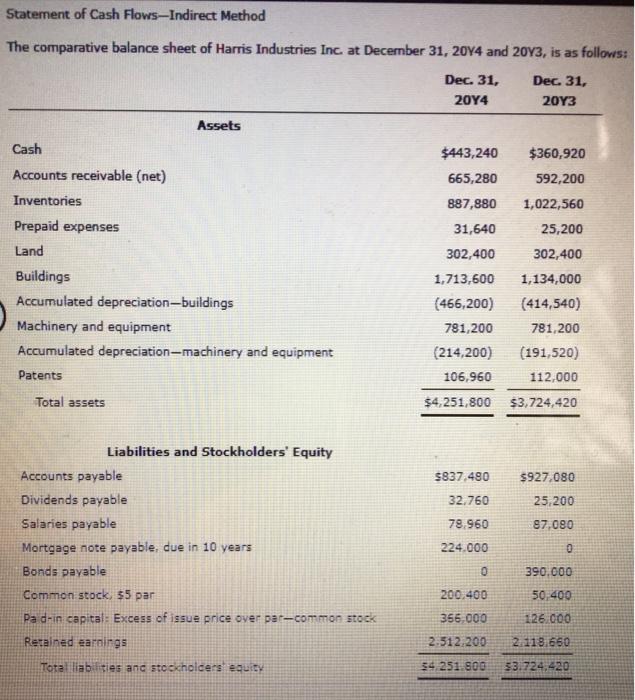

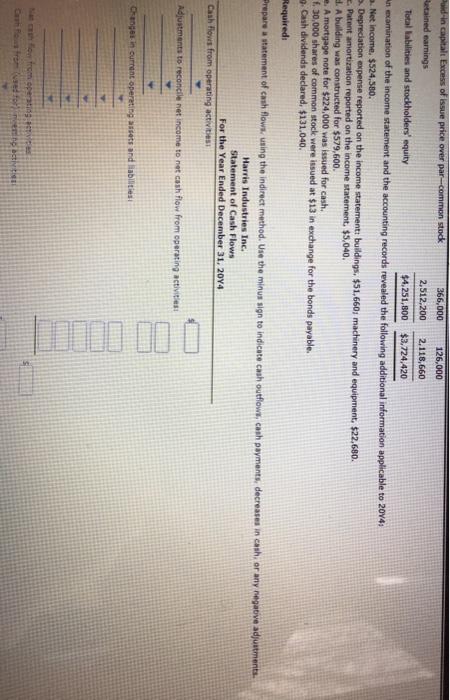

Statement of Cash Flows-Indirect Method The comparative balance sheet of Harris Industries Inc. at December 31, 2014 and 2043, is as follows: Dec. 31, Dec. 31, 2014 2013 $443,240 $360,920 592,200 665,280 887,880 31,640 Assets Cash Accounts receivable (net) Inventories Prepaid expenses Land Buildings Accumulated depreciation-buildings Machinery and equipment Accumulated depreciation-machinery and equipment Patents 302,400 1,713,600 (466,200) 781,200 (214,200) 106,960 $4,251,800 1,022,560 25,200 302,400 1,134,000 (414,540) 781,200 (191,520) 112,000 Total assets $3,724,420 5837.490 $927.080 25,200 32.760 78.960 87,080 Liabilities and Stockholders' Equity Accounts payable Dividends payable Salaries payable Mortgage note payable, due in 10 years Bonds payable Common stock, 55 par Pa d-in capital: Excess of issue price over par-common stock Retained ear gs 224.000 0 0 390.000 50,400 200.400 356.000 2:51 2.200 126.000 2 113.660 Total liabilities and stoc choicers equity 54 251.800 53.724.420 Paid in capitalt Excess of issue price over par-common stock 366,000 126,000 Petained earnings 2,512,200 2,118,660 Total abilities and stockholders' equity $4,251,800 $3,724,420 An examination of the income statement and the accounting records revealed the following additional information applicable to 2014 Net Income $524,580. Depreciation expense reported on the income statement buildings. $51,660; machinery and equipment, $22.680. Patent amortization reported on the income statement. $5.040. l. A building was constructed for $579,600. 2. A mortgage note for $224,000 was issued for cash. f. 30,000 shares of common stock were issued at $13 in exchange for the bonds payable. 9. Cash dividends declared, $131.040. Required: Prepare a statement of cash flows using the indirect method. Use the minus sign to indicate cash outflowe, cash payments, decreases in cash or any negative adjustments, Harris Industries Inc. Statement of Cash Flows For the Year Ended December 31, 2014 Cash flows from operating activities Adjustments to reconcile net income to net cash flow from operating activities Changes in current operating and liabilities for from operating Carhared to the Changes in current operating assets and liabilities: 10 II Net cash flow from operating activities Cash flows from (used for) investing activities: Net cash flow used for investing activities Cash flows from (used for) financing activities Net cash flow from financing activities Cash at the beginning of the rear Canh at the end of the year Schedule of Noncash Financing and Investing Activities