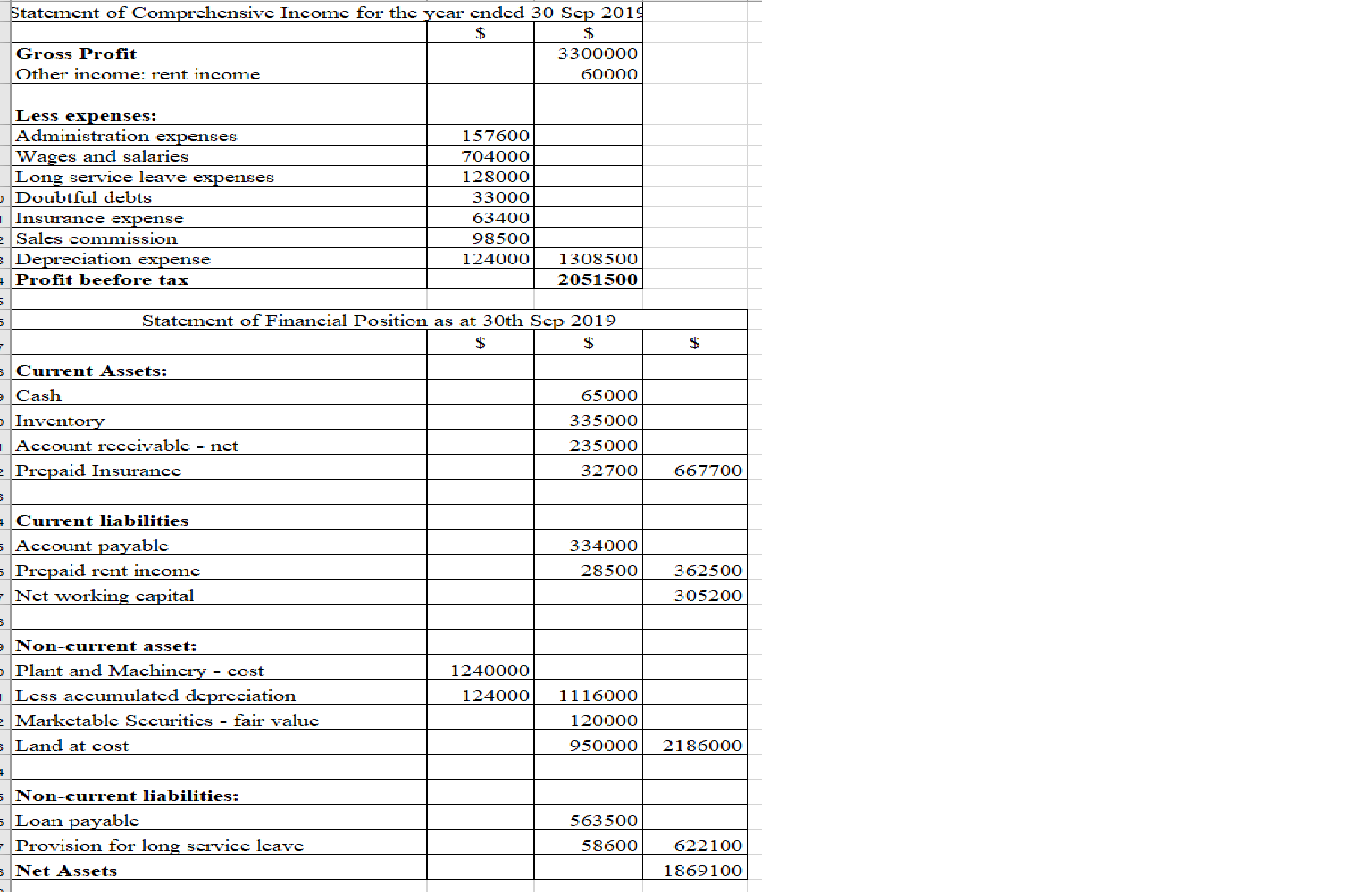

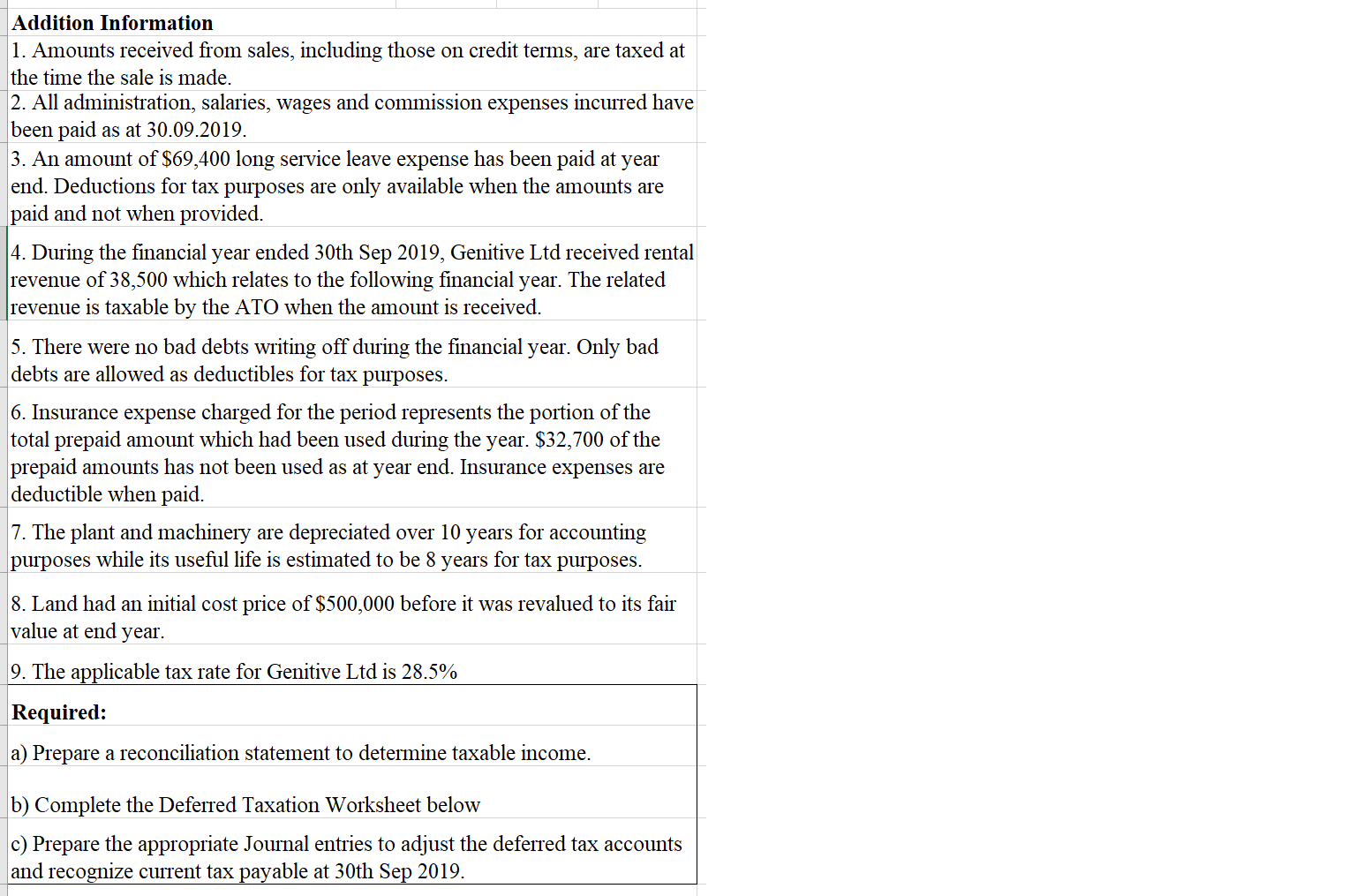

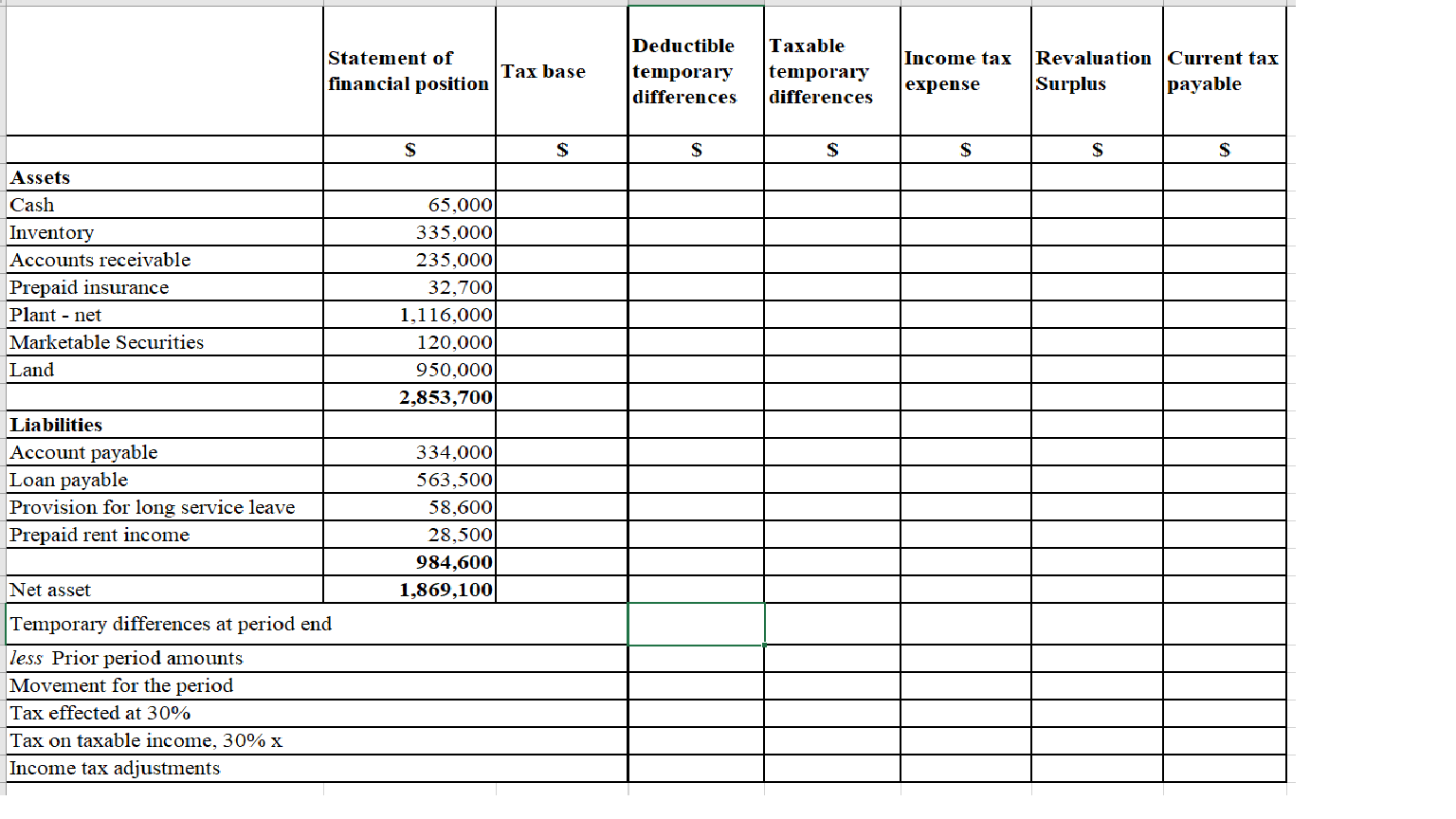

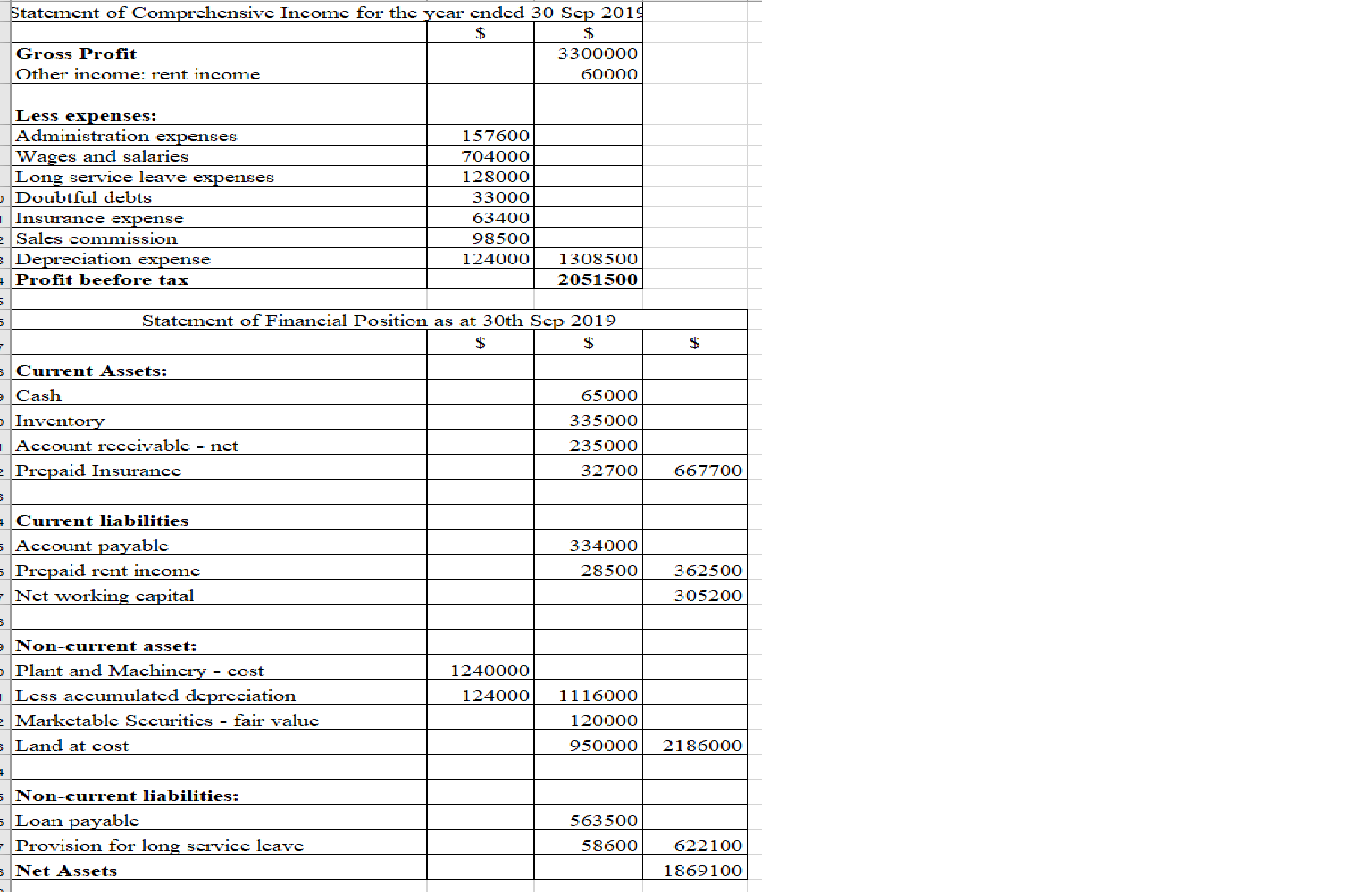

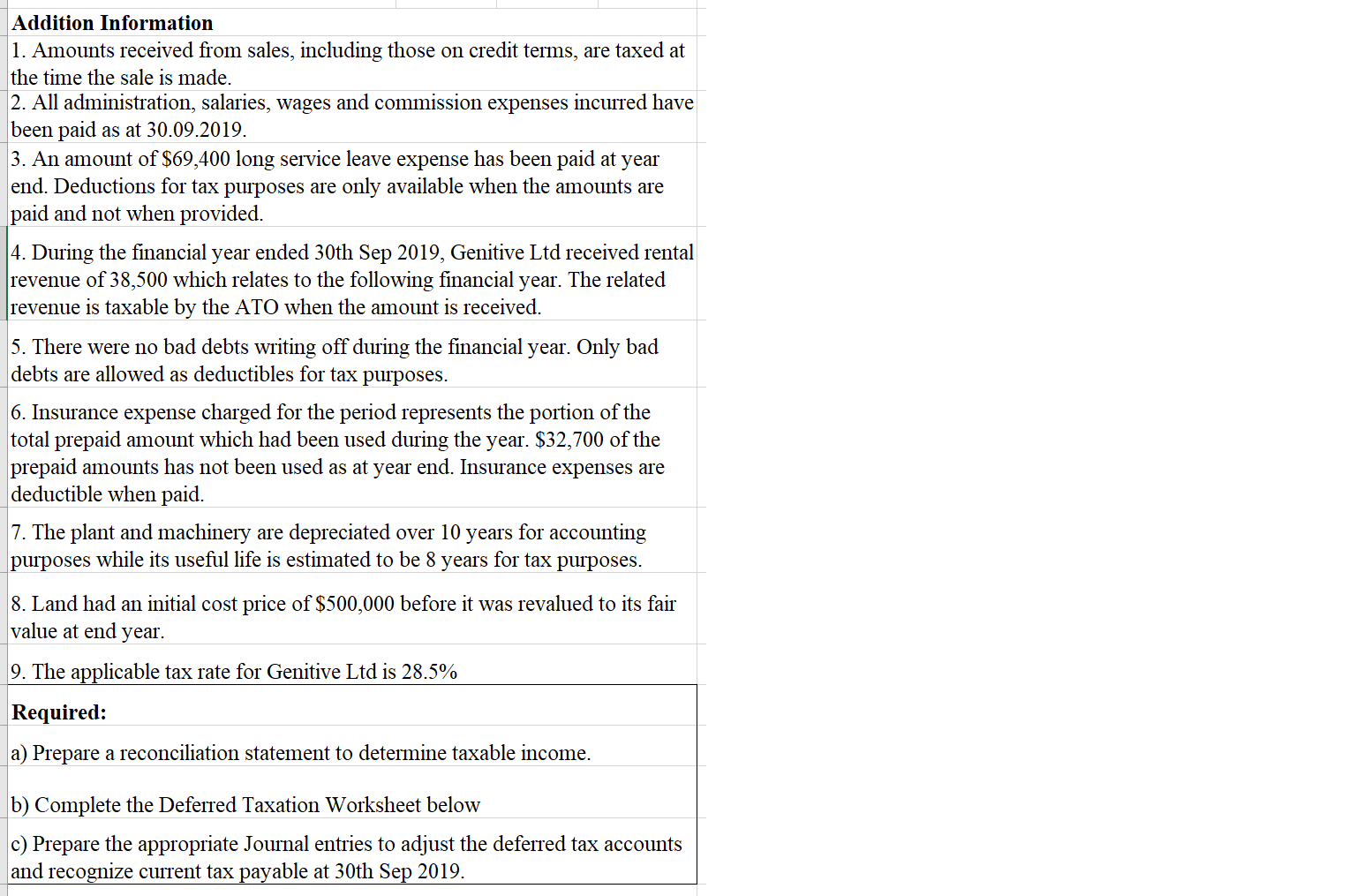

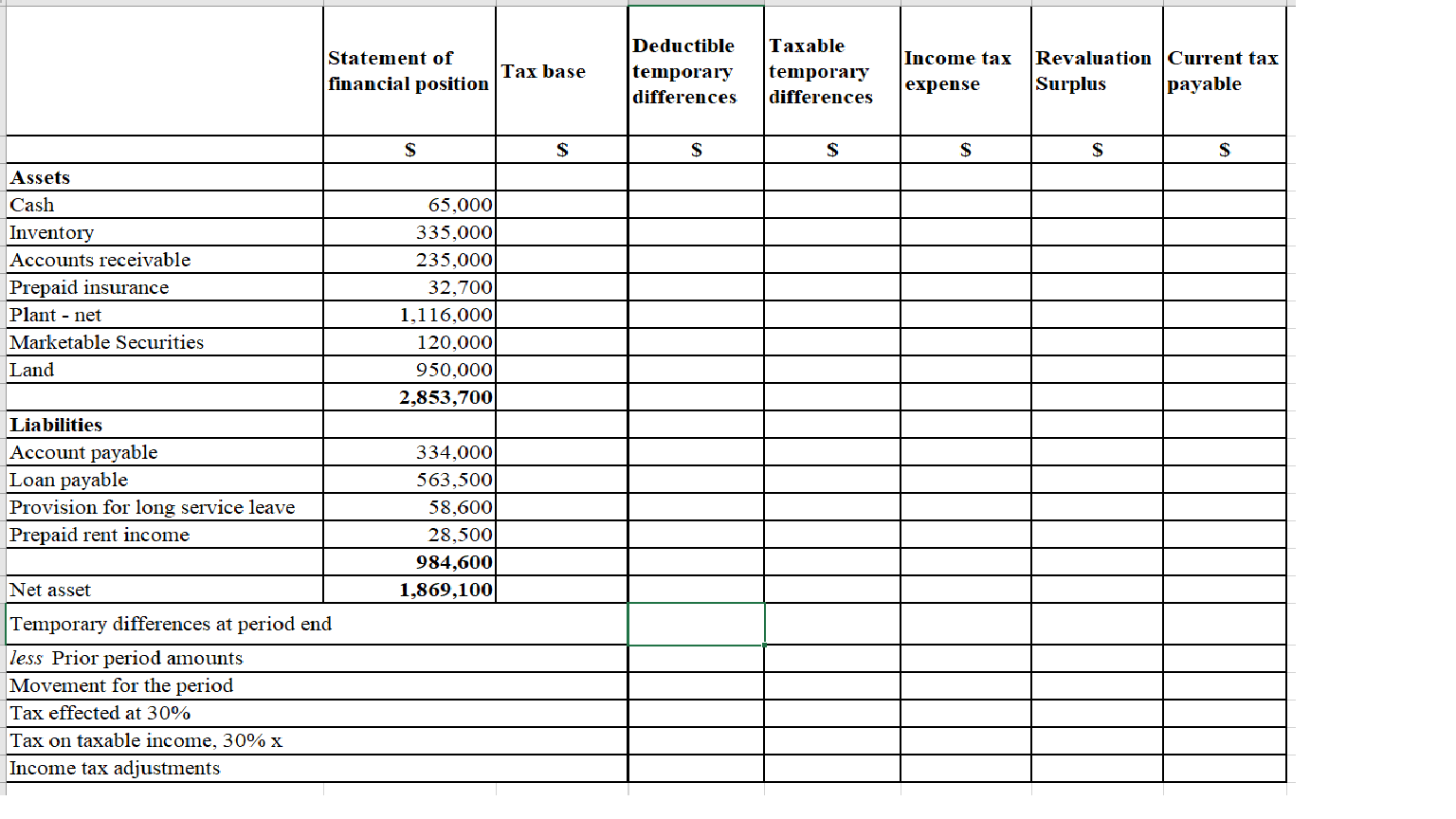

Statement of Comprehensive Income for the year ended 30 Sep 2019 Gross Profit Other income: rent income 3300000 60000 Less expenses: Adninistration expenses Wages and salaries Long service leave expenses Doubtful debts Insurance expense e Sales commission 3 Depreciation expense - Profit beefore tax 157600 704000 128000 33000 63400 98500 124000 1308500 2051500 Statement of Financial Position as at 30th Sep 2019 3 Current Assets: Cash Inventory Account receivable - net - Prepaid Insurance 65000 335000 235000 32700 667700 Current liabilities - Account payable - Prepaid rent income -Net working capital 334000 28500 362500 305200 Non-current asset: Plant and Machinery - cost Less accumulated depreciation Marketable Securities - fair value Land at cost 1240000 124000 1116000 120000 950000 2186000 - Non-current liabilities: Loan payable - Provision for long service leave 8 Net Assets 563500 58600 622100 1869100 Addition Information 1. Amounts received from sales, including those on credit terms, are taxed at the time the sale is made. 2. All administration, salaries, wages and commission expenses incurred have been paid as at 30.09.2019. 3. An amount of $69,400 long service leave expense has been paid at year end. Deductions for tax purposes are only available when the amounts are paid and not when provided. 4. During the financial year ended 30th Sep 2019, Genitive Ltd received rental revenue of 38,500 which relates to the following financial year. The related revenue is taxable by the ATO when the amount is received. 5. There were no bad debts writing off during the financial year. Only bad debts are allowed as deductibles for tax purposes. 6. Insurance expense charged for the period represents the portion of the total prepaid amount which had been used during the year. $32,700 of the prepaid amounts has not been used as at year end. Insurance expenses are deductible when paid. 7. The plant and machinery are depreciated over 10 years for accounting purposes while its useful life is estimated to be 8 years for tax purposes. 8. Land had an initial cost price of $500,000 before it was revalued to its fair value at end year. 9. The applicable tax rate for Genitive Ltd is 28.5% Required: a) Prepare a reconciliation statement to determine taxable income. b) Complete the Deferred Taxation Worksheet below c) Prepare the appropriate Journal entries to adjust the deferred tax accounts and recognize current tax payable at 30th Sep 2019. Statement of financial position Tax base Deductible temporary differences Taxable temporary differences Income tax Revaluation Current tax expense Surplus payable $ $ $ $ $ $ $ Assets Cash Inventory Accounts receivable Prepaid insurance Plant - net Marketable Securities Land 65,000 335,000 235,000 32,700 1,116,000 120,000 950,000 2,853,700 Liabilities Account payable Loan payable Provision for long service leave Prepaid rent income 334,000 563,500 58,600 28,500 984,600 1,869,100 Net asset Temporary differences at period end less Prior period amounts Movement for the period Tax effected at 30% Tax on taxable income, 30%X Income tax adjustments Statement of Comprehensive Income for the year ended 30 Sep 2019 Gross Profit Other income: rent income 3300000 60000 Less expenses: Adninistration expenses Wages and salaries Long service leave expenses Doubtful debts Insurance expense e Sales commission 3 Depreciation expense - Profit beefore tax 157600 704000 128000 33000 63400 98500 124000 1308500 2051500 Statement of Financial Position as at 30th Sep 2019 3 Current Assets: Cash Inventory Account receivable - net - Prepaid Insurance 65000 335000 235000 32700 667700 Current liabilities - Account payable - Prepaid rent income -Net working capital 334000 28500 362500 305200 Non-current asset: Plant and Machinery - cost Less accumulated depreciation Marketable Securities - fair value Land at cost 1240000 124000 1116000 120000 950000 2186000 - Non-current liabilities: Loan payable - Provision for long service leave 8 Net Assets 563500 58600 622100 1869100 Addition Information 1. Amounts received from sales, including those on credit terms, are taxed at the time the sale is made. 2. All administration, salaries, wages and commission expenses incurred have been paid as at 30.09.2019. 3. An amount of $69,400 long service leave expense has been paid at year end. Deductions for tax purposes are only available when the amounts are paid and not when provided. 4. During the financial year ended 30th Sep 2019, Genitive Ltd received rental revenue of 38,500 which relates to the following financial year. The related revenue is taxable by the ATO when the amount is received. 5. There were no bad debts writing off during the financial year. Only bad debts are allowed as deductibles for tax purposes. 6. Insurance expense charged for the period represents the portion of the total prepaid amount which had been used during the year. $32,700 of the prepaid amounts has not been used as at year end. Insurance expenses are deductible when paid. 7. The plant and machinery are depreciated over 10 years for accounting purposes while its useful life is estimated to be 8 years for tax purposes. 8. Land had an initial cost price of $500,000 before it was revalued to its fair value at end year. 9. The applicable tax rate for Genitive Ltd is 28.5% Required: a) Prepare a reconciliation statement to determine taxable income. b) Complete the Deferred Taxation Worksheet below c) Prepare the appropriate Journal entries to adjust the deferred tax accounts and recognize current tax payable at 30th Sep 2019. Statement of financial position Tax base Deductible temporary differences Taxable temporary differences Income tax Revaluation Current tax expense Surplus payable $ $ $ $ $ $ $ Assets Cash Inventory Accounts receivable Prepaid insurance Plant - net Marketable Securities Land 65,000 335,000 235,000 32,700 1,116,000 120,000 950,000 2,853,700 Liabilities Account payable Loan payable Provision for long service leave Prepaid rent income 334,000 563,500 58,600 28,500 984,600 1,869,100 Net asset Temporary differences at period end less Prior period amounts Movement for the period Tax effected at 30% Tax on taxable income, 30%X Income tax adjustments