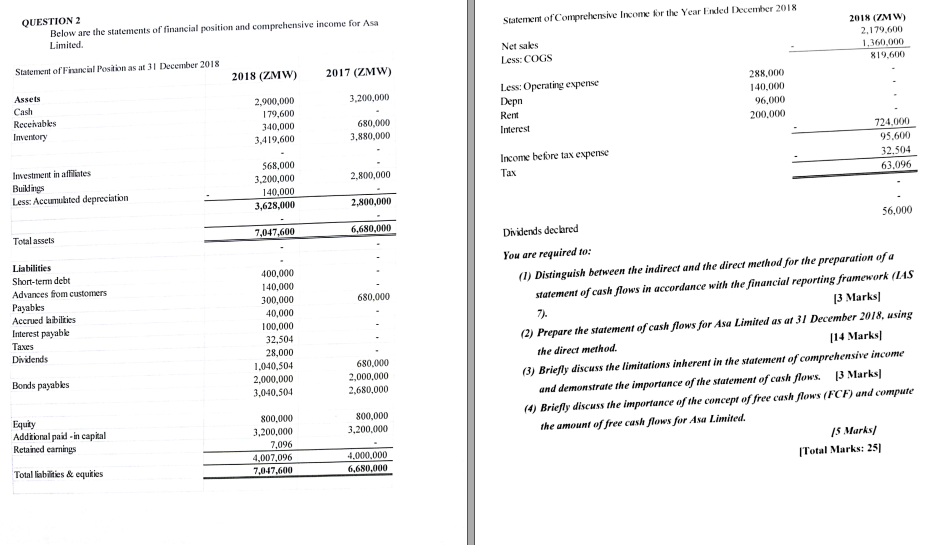

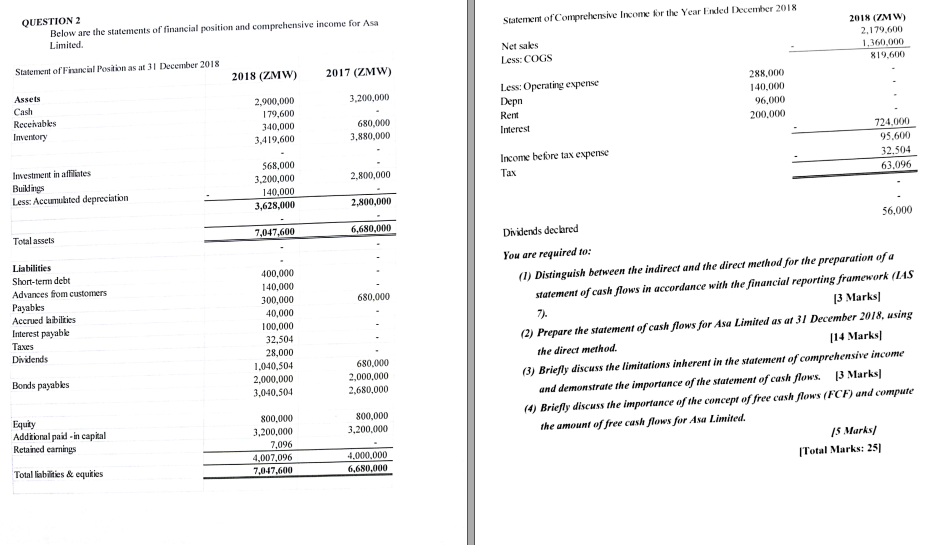

Statement of Comprehensive Income for the Year Ended December 2018 QUESTION 2 Below are the statements of financial position and comprehensive income for Asa Limited 2018 (ZMW) 2.179.600 1,360,000 819,600 Net sales Less: COGS Statement of Financial Position as at 31 December 2018 2018 (ZMW) 2017 (ZMW) Assets 3,200,000 288.000 140,000 96.000 200,000 Cash Recenables Inventory Less: Operating expense Depn Rent Interest 2,900,000 179,600 340,000 3.419,600 680,000 3.880,000 724,000 95.600 32.504 63,096 Income before tax expense 2,800,000 Tax Investment in affiliates Buildings Less: Accumulated depreciation 568,000 3.200,000 140,000 3,628,000 2,800,000 7,047,600 6,680,000 Total assets 680.000 Liabilities Short-term debt Advances from customers Payables Accrued bibilities Interest payable Taxes Dividends 400.000 140,000 300,000 40,000 100,000 32,504 28,000 1.040,504 2,000,000 3,040,504 Dividends declared 56,000 You are required to: (1) Distinguish between the indirect and the direct method for the preparation of a statement of cash flows in accordance with the financial reporting framework (IAS 13 Marks/ (2) Prepare the statement of cash flows for Asa Limited as at 31 December 2018, using the direct method. 114 Marks (3) Briefly discuss the limitations inherent in the statement of comprehensive income and demonstrate the importance of the statement of cash flows. 3 Marks (4) Briefly discuss the importance of the concept of free cash flows (FCF) and compute the amount of free cash flows for Asa Limited. 15 Marks/ Total Marks: 251 680.000 2,000,000 2,680,000 Bonds payables 800,000 3,200,000 Equty Additional paid - in capital Retained earnings 800.000 3,200,000 7,096 4.007.096 7,047,600 4.000.000 6.680.000 Total liabilities & equities Statement of Comprehensive Income for the Year Ended December 2018 QUESTION 2 Below are the statements of financial position and comprehensive income for Asa Limited 2018 (ZMW) 2.179.600 1,360,000 819,600 Net sales Less: COGS Statement of Financial Position as at 31 December 2018 2018 (ZMW) 2017 (ZMW) Assets 3,200,000 288.000 140,000 96.000 200,000 Cash Recenables Inventory Less: Operating expense Depn Rent Interest 2,900,000 179,600 340,000 3.419,600 680,000 3.880,000 724,000 95.600 32.504 63,096 Income before tax expense 2,800,000 Tax Investment in affiliates Buildings Less: Accumulated depreciation 568,000 3.200,000 140,000 3,628,000 2,800,000 7,047,600 6,680,000 Total assets 680.000 Liabilities Short-term debt Advances from customers Payables Accrued bibilities Interest payable Taxes Dividends 400.000 140,000 300,000 40,000 100,000 32,504 28,000 1.040,504 2,000,000 3,040,504 Dividends declared 56,000 You are required to: (1) Distinguish between the indirect and the direct method for the preparation of a statement of cash flows in accordance with the financial reporting framework (IAS 13 Marks/ (2) Prepare the statement of cash flows for Asa Limited as at 31 December 2018, using the direct method. 114 Marks (3) Briefly discuss the limitations inherent in the statement of comprehensive income and demonstrate the importance of the statement of cash flows. 3 Marks (4) Briefly discuss the importance of the concept of free cash flows (FCF) and compute the amount of free cash flows for Asa Limited. 15 Marks/ Total Marks: 251 680.000 2,000,000 2,680,000 Bonds payables 800,000 3,200,000 Equty Additional paid - in capital Retained earnings 800.000 3,200,000 7,096 4.007.096 7,047,600 4.000.000 6.680.000 Total liabilities & equities