Answered step by step

Verified Expert Solution

Question

1 Approved Answer

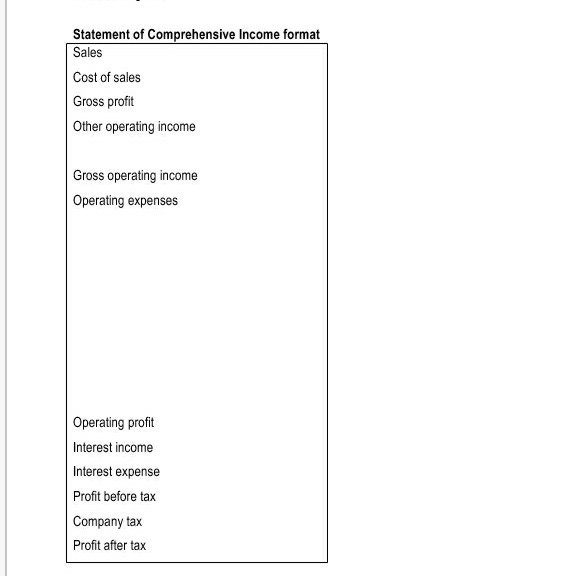

Statement of Comprehensive Income format Sales Cost of sales Gross profit Other operating income Gross operating income Operating expenses Operating profit Interest income Interest expense

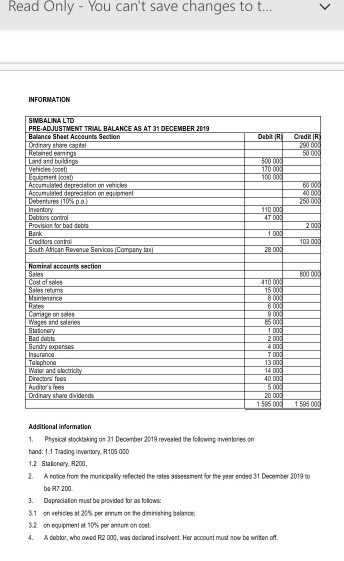

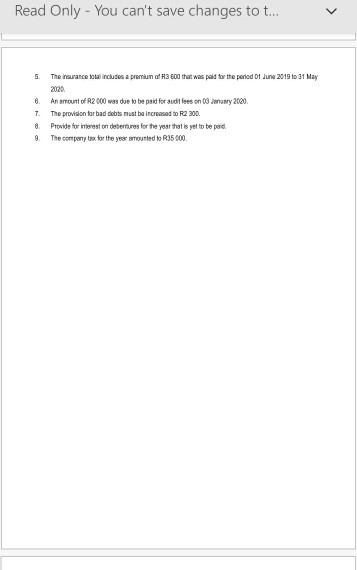

Statement of Comprehensive Income format Sales Cost of sales Gross profit Other operating income Gross operating income Operating expenses Operating profit Interest income Interest expense Profit before tax Company tax Profit after tax > Read Only - You can't save changes to t... DubitR Hannes INFORMATION SIMBALINA LTD PRE ADJUSTMENT TRIAL BALANCE AS AT 31 DECEMBER 2019 Balance Sheet Accounts Section Ordry store del Land and buio Vehides on EUR 250 Accumulated depreciation on vieles Acondercation on the Centures to pa ber entory Debtors control Provision of debts Bank Creditors cono South African Reven. Services Company at Nominal accounts section Coste stoles Sales murs Testres Credit 2900 5000 3000 170004 1600 60004 20000 110.000 47 00 2000 1 000 103 000 28 000 00 TO 150 BLOX BE 90 600 15700 Sundry Wapes and wines Stasionery Bad Insurance Telephone Wow and electrici Directors' fees Auditors fees Ord ray share widends U2 mos U2 nos 13 00: 14 DO 40 000 500 20 000 1516 000 1 566 000 Additional information 1. Physical stocktaking on 31 December 2019 revealed the flowing inventories on hand: 1.1 Trading inventory. R.105 000 1.2 Stationery, R200. 2. Anotice from the municipality reflected the rates 35 sent for the year ended 31 December 2019 to be R7 200 3. Depreciation must be provided for as follows: 31 on vides at 20% per annum on the dininishing balance 32 on equipment at 10% per mon cost 4. A debtor, who owed R2 000, was declared insolvent. Her account must now be writer of Read Only - You can't save changes to t... > 5. The insurance total includes a premium at R3 500 that was paid for the period of June 2019 to 31 May 2020 6 An amount of 2000 was due to be paid for audit fees on January 2000 7. The provision for bad debts must be increased to R2 300. a Provide for interest on dabenturas for the year that is yet to be paid 9. The company for the year amounted to R25 000 Statement of Comprehensive Income format Sales Cost of sales Gross profit Other operating income Gross operating income Operating expenses Operating profit Interest income Interest expense Profit before tax Company tax Profit after tax > Read Only - You can't save changes to t... DubitR Hannes INFORMATION SIMBALINA LTD PRE ADJUSTMENT TRIAL BALANCE AS AT 31 DECEMBER 2019 Balance Sheet Accounts Section Ordry store del Land and buio Vehides on EUR 250 Accumulated depreciation on vieles Acondercation on the Centures to pa ber entory Debtors control Provision of debts Bank Creditors cono South African Reven. Services Company at Nominal accounts section Coste stoles Sales murs Testres Credit 2900 5000 3000 170004 1600 60004 20000 110.000 47 00 2000 1 000 103 000 28 000 00 TO 150 BLOX BE 90 600 15700 Sundry Wapes and wines Stasionery Bad Insurance Telephone Wow and electrici Directors' fees Auditors fees Ord ray share widends U2 mos U2 nos 13 00: 14 DO 40 000 500 20 000 1516 000 1 566 000 Additional information 1. Physical stocktaking on 31 December 2019 revealed the flowing inventories on hand: 1.1 Trading inventory. R.105 000 1.2 Stationery, R200. 2. Anotice from the municipality reflected the rates 35 sent for the year ended 31 December 2019 to be R7 200 3. Depreciation must be provided for as follows: 31 on vides at 20% per annum on the dininishing balance 32 on equipment at 10% per mon cost 4. A debtor, who owed R2 000, was declared insolvent. Her account must now be writer of Read Only - You can't save changes to t... > 5. The insurance total includes a premium at R3 500 that was paid for the period of June 2019 to 31 May 2020 6 An amount of 2000 was due to be paid for audit fees on January 2000 7. The provision for bad debts must be increased to R2 300. a Provide for interest on dabenturas for the year that is yet to be paid 9. The company for the year amounted to R25 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started