Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Statement of Cost of Goods Manufactured and Income Statement for a Manufacturing Company The following information is available for Shanika Company for 20Y6: Inventories January

Statement of Cost of Goods Manufactured and Income Statement for a Manufacturing Company

The following information is available for Shanika Company for 20Y6:

| Inventories | January 1 | December 31 | ||

| Materials | $274,100 | $334,400 | ||

| Work in process | 493,380 | 454,780 | ||

| Finished goods | 474,190 | 464,820 | ||

| Advertising expense | $227,060 |

| Depreciation expense-office equipment | 32,100 |

| Depreciation expense-factory equipment | 43,140 |

| Direct labor | 514,980 |

| Heat, light, and power-factory | 17,050 |

| Indirect labor | 60,190 |

| Materials purchased | 504,940 |

| Office salaries expense | 176,230 |

| Property taxes-factory | 14,040 |

| Property taxes-headquarters building | 29,090 |

| Rent expense-factory | 23,740 |

| Sales | 2,364,210 |

| Sales salaries expense | 290,260 |

| Supplies-factory | 11,700 |

| Miscellaneous costs-factory | 7,360 |

Required:

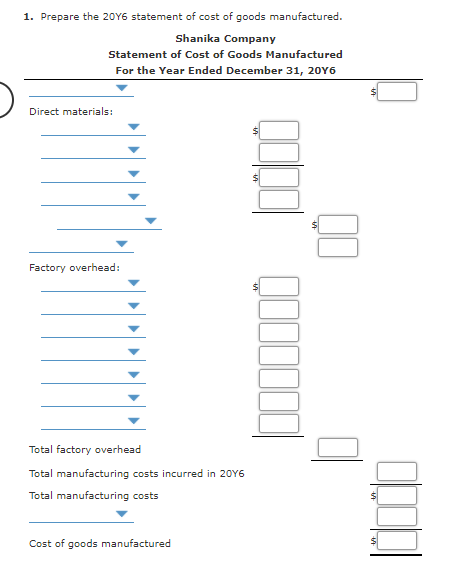

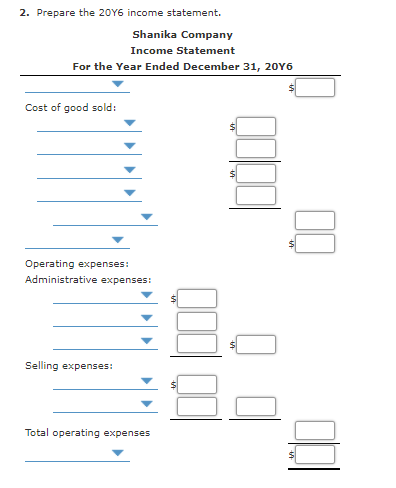

1. Prepare the 20Y6 statement of cost of goods manufactured.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started