Answered step by step

Verified Expert Solution

Question

1 Approved Answer

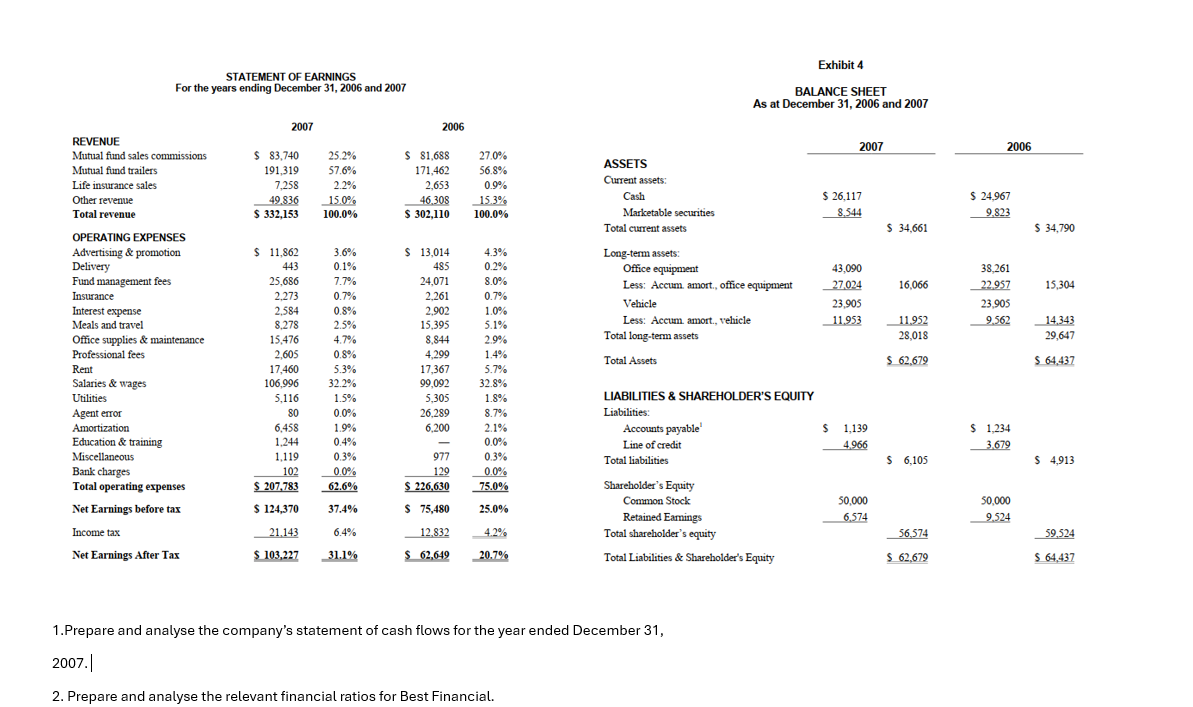

STATEMENT OF EARNINGS For the years ending December 31, 2006 and 2007 Exhibit 4 BALANCE SHEET As at December 31, 2006 and 2007 2007

STATEMENT OF EARNINGS For the years ending December 31, 2006 and 2007 Exhibit 4 BALANCE SHEET As at December 31, 2006 and 2007 2007 2006 REVENUE 2007 2006 Mutual fund sales commissions $ 83,740 Mutual fund trailers 191,319 25.2% 57.6% $ 81,688 27.0% 171,462 56.8% ASSETS Life insurance sales 7,258 2.2% 2,653 0.9% Current assets: Other revenue 49.836 15.0% 46,308 Total revenue $ 332,153 100.0% $ 302,110 15.3% 100.0% Cash $ 26,117 Marketable securities 8,544 $ 24,967 9.823 Total current assets $ 34,661 $ 34,790 OPERATING EXPENSES Advertising & promotion $ 11,862 3.6% $ 13,014 4.3% Long-term assets: Delivery 443 0.1% 485 0.2% Office equipment 43,090 38,261 Fund management fees 25,686 7.7% 24,071 8.0% Less: Accum amort., office equipment 27,024 16,066 22.957 15,304 Insurance 2,273 0.7% 2,261 0.7% Interest expense Vehicle 23,905 23,905 2,584 0.8% 2,902 1.0% Meals and travel 8,278 2.5% 15,395 5.1% Less: Accum amort., vehicle 11,953 11.952 9.562 14,343 Office supplies & maintenance 15,476 4.7% 8,844 2.9% Total long-term assets 28,018 29,647 Professional fees 2,605 0.8% 4,299 1.4% Total Assets $ 62,679 Rent 17,460 5.3% 17,367 5.7% $ 64,437 Salaries & wages 106,996 32.2% 99,092 32.8% Utilities Agent error Amortization Education & training Miscellaneous Bank charges 5,116 1.5% 5,305 1.8% LIABILITIES & SHAREHOLDER'S EQUITY 80 0.0% 26,289 8.7% Liabilities: 6,458 1.9% 6,200 2.1% Accounts payable 1,244 0.4% 0.0% Line of credit 1,119 0.3% 977 0.3% Total liabilities $ 1,139 $ 1,234 4,966 3.679 $ 6,105 $ 4,913 102 0.0% 129 0.0% Total operating expenses $ 207,783 62.6% $ 226,630 75.0% Shareholder's Equity Common Stock Net Earnings before tax Income tax $ 124,370 37.4% $ 75,480 25.0% Retained Earnings 21,143 6.4% 12,832 4.2% Total shareholder's equity Net Earnings After Tax $103,227 31.1% $ 62,649 20.7% Total Liabilities & Shareholder's Equity 50,000 6.574 50,000 9.524 56,574 59,524 $ 62,679 $ 64,437 1.Prepare and analyse the company's statement of cash flows for the year ended December 31, 2007.| 2. Prepare and analyse the relevant financial ratios for Best Financial.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 To prepare and analyze the companys statement of cash flows for the year ended December 31 2007 we need to use the information provided in Ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started