Question

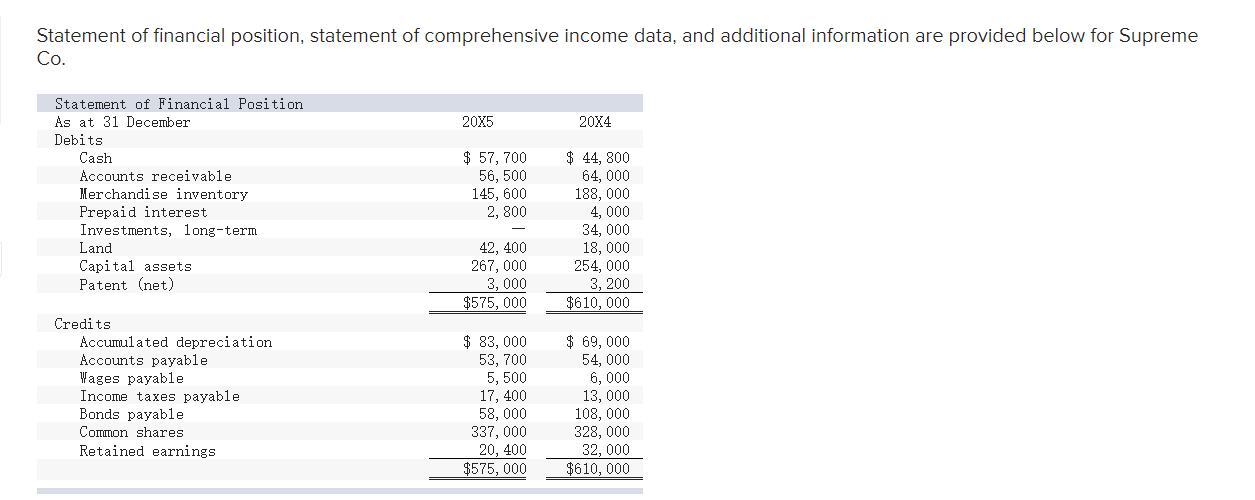

Statement of financial position, statement of comprehensive income data, and additional information are provided below for Supreme Co. Statement of Financial Position As at 31

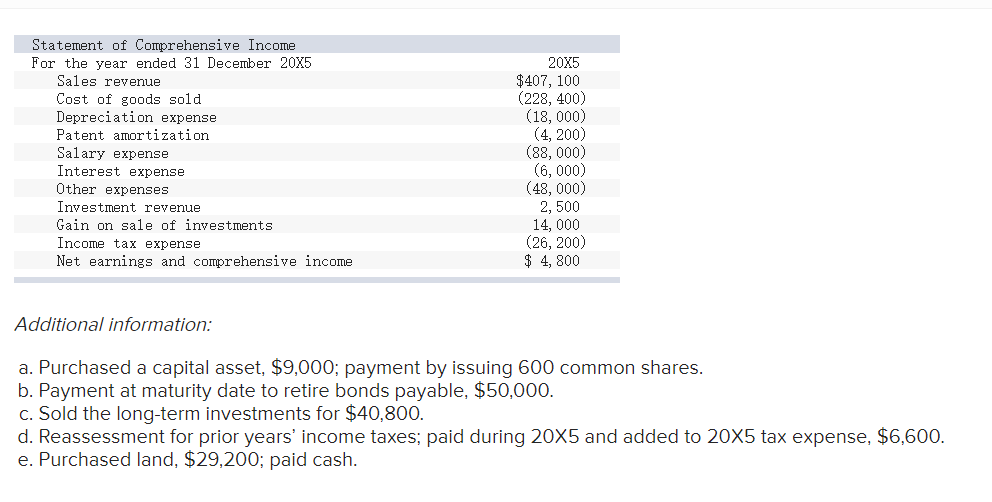

Statement of financial position, statement of comprehensive income data, and additional information are provided below for Supreme Co. Statement of Financial Position As at 31 December 20X5 20X4 Debits Cash $ 57,700 $ 44,800 Accounts receivable 56,500 64,000 Merchandise inventory 145,600 188,000 Prepaid interest 2,800 4,000 Investments, long-term 34,000 Land 42,400 18,000 Capital assets 267,000 254,000 Patent (net) 3,000 3,200 $575,000 $610,000 Credits Accumulated depreciation $ 83,000 $ 69,000 Accounts payable 53,700 54,000 Wages payable 5,500 6,000 Income taxes payable 17,400 13,000 Bonds payable 58,000 108,000 Common shares 337,000 328,000 Retained earnings 20,400 32,000 $575,000 $610,000 Statement of Comprehensive Income For the year ended 31 December 20X5 20X5 Sales revenue $407,100 Cost of goods sold (228,400 ) Depreciation expense (18,000 ) Patent amortization (4,200 ) Salary expense (88,000 ) Interest expense (6,000 ) Other expenses (48,000 ) Investment revenue 2,500 Gain on sale of investments 14,000 Income tax expense (26,200 ) Net earnings and comprehensive income $ 4,800 Additional information: Purchased a capital asset, $9,000; payment by issuing 600 common shares. Payment at maturity date to retire bonds payable, $50,000. Sold the long-term investments for $40,800. Reassessment for prior years income taxes; paid during 20X5 and added to 20X5 tax expense, $6,600. Purchased land, $29,200; paid cash.

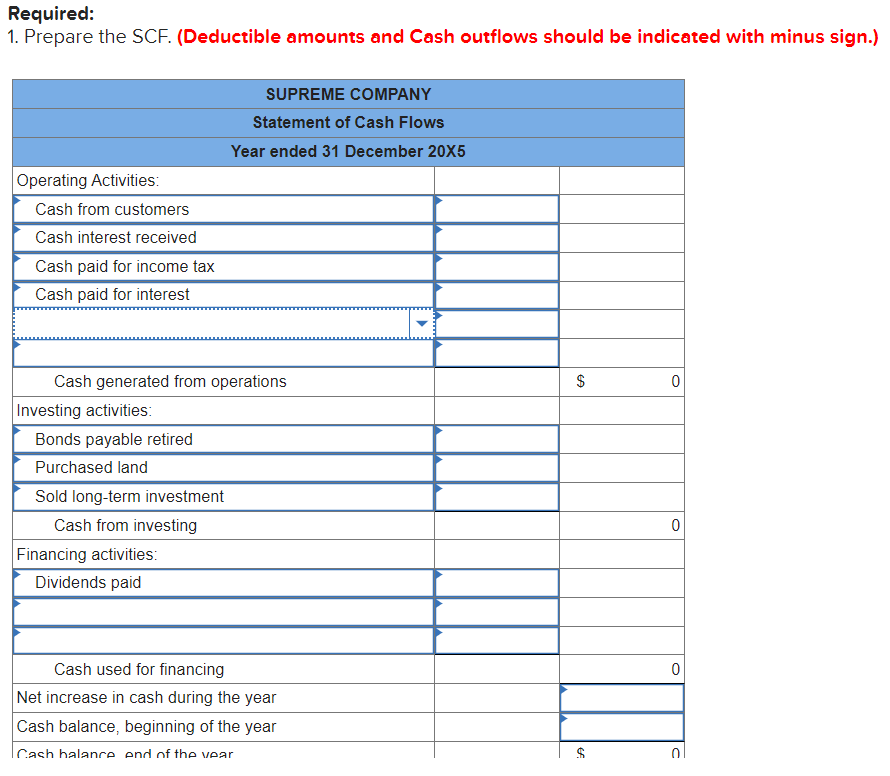

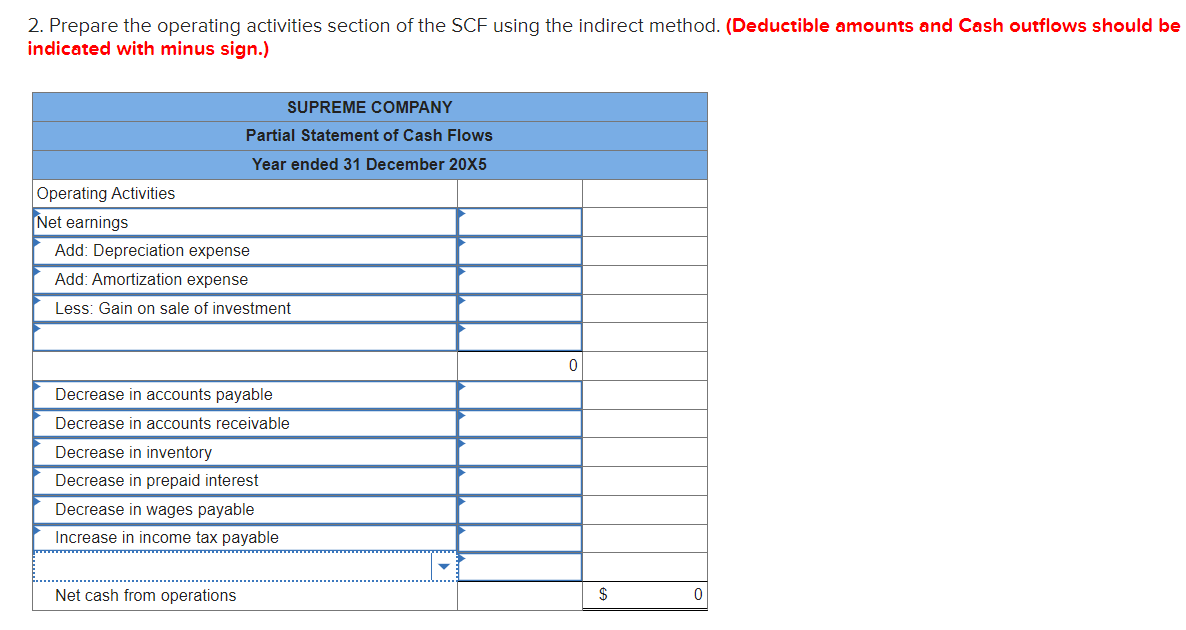

Statement of financial position, statement of comprehensive income data, and additional information are provided below for Supreme Co. Additional information: a. Purchased a capital asset, $9,000; payment by issuing 600 common shares. b. Payment at maturity date to retire bonds payable, $50,000. c. Sold the long-term investments for $40,800. d. Reassessment for prior years' income taxes; paid during 205 and added to 205 tax expense, $6,600. e. Purchased land, \$29,200; paid cash. Required: 1. Prepare the SCF. (Deductible amounts and Cash outflows should be indicated with minus sign.) 2. Prepare the operating activities section of the SCF using the indirect method. (Deductible amounts and Cash outflows should be indicated with minus sign.)

Statement of financial position, statement of comprehensive income data, and additional information are provided below for Supreme Co. Additional information: a. Purchased a capital asset, $9,000; payment by issuing 600 common shares. b. Payment at maturity date to retire bonds payable, $50,000. c. Sold the long-term investments for $40,800. d. Reassessment for prior years' income taxes; paid during 205 and added to 205 tax expense, $6,600. e. Purchased land, \$29,200; paid cash. Required: 1. Prepare the SCF. (Deductible amounts and Cash outflows should be indicated with minus sign.) 2. Prepare the operating activities section of the SCF using the indirect method. (Deductible amounts and Cash outflows should be indicated with minus sign.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started