Question

Statement of functional expenses. From the expense accounts information and allocationschedule shown in Problem 18-8, prepare a statement of functional expenses forWe Care for theyear

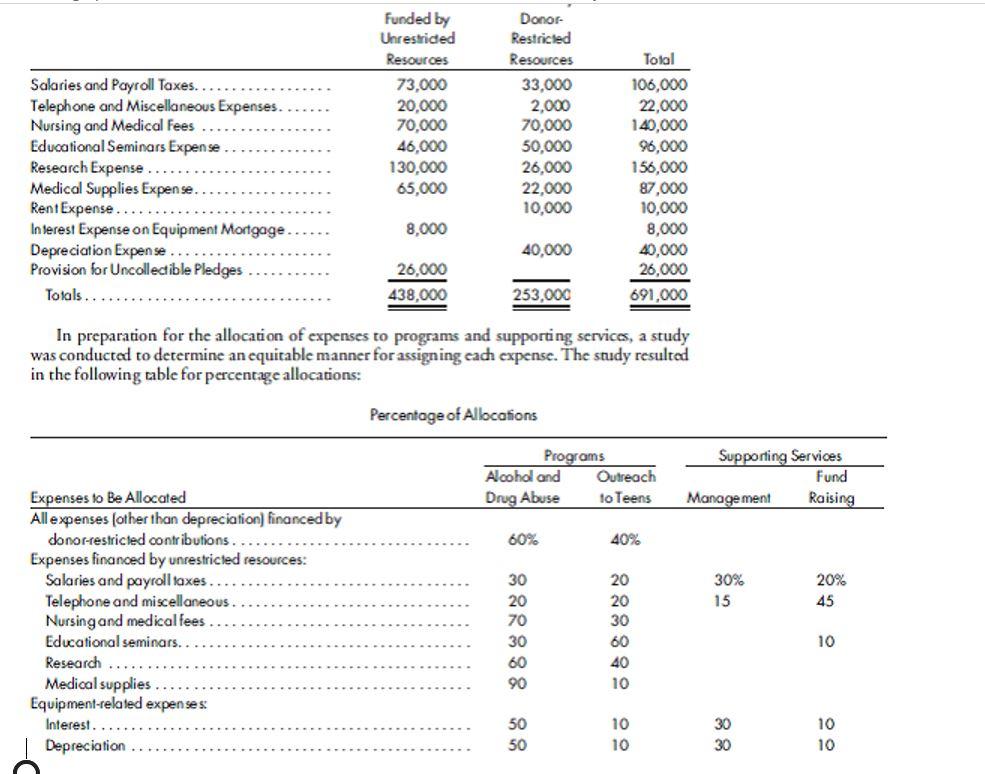

Statement of functional expenses. From the expense accounts information and allocationschedule shown in Problem 18-8, prepare a statement of functional expenses forWe Care for theyear ended December 31, 2019. REFERENCE: Allocation of expenses, journal entries. Outreach Clinic, a VHWO, conducts two programs:Alcohol and Drug Abuse and Outreach to Teens. It has the typical supporting services ofmanagement and fund raising. Expense accounts from the pre allocation trial balances as ofDecember 31, 2019, are as follows:

1. Using a total of allocable expenses financed by donor-restricted resources, prepare a journal entry to assign those expenses to the programs.

3. Prepare a journal entry to record the allocation and closing of expenses financed by unrestricted resources. 4. Prepare a journal entry to assign plant-related expenses to programs and support services.

Salaries and Payroll Taxes.. Telephone and Miscellaneous Expenses. Nursing and Medical Fees Educational Seminars Expense Research Expense Medical Supplies Expense. Rent Expense... Interest Expense on Equipment Mortgage Depreciation Expense. Provision for Uncollectible Pledges Totals. Funded by Unrestrided Resources 73,000 20,000 70,000 46,000 130,000 65,000 Donor Restricted Resources 33,000 2,000 70,000 50,000 26,000 22,000 10,000 Total 106,000 22,000 140,000 96,000 156,000 87,000 10,000 8,000 40,000 26,000 691,000 8,000 40,000 26,000 438,000 253,000 In preparation for the allocation of expenses to programs and supporting services, a study was conducted to determine an equitable manner for assigning each expense. The study resulted in the following table for percentage allocations: Percentage of Allocations Programs Alcohol and Outreach Drug Abuse to Teens Supporting Services Fund Management Raising 60% 40% 30% 15 20% 45 Expenses to Be Allocated All expenses (other than depreciation financed by donor-restricted contributions. Expenses financed by unrestricted resources: Salaries and payroll taxes Telephone and miscellaneous. Nursing and medical fees Educational seminars. Research Medical supplies Equipment-related expenses Interest. Depreciation 30 20 70 30 60 90 20 20 30 60 40 10 10 50 50 10 10 30 30 10 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started