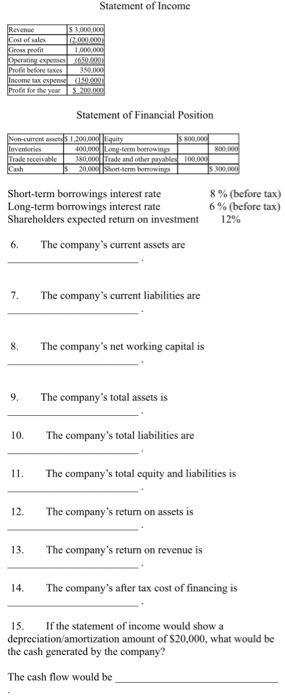

Statement of Income Revenue S 3000 Cost of sales 2,000,000 Grow petit 1 000 000 Operating caps Profit before taxes 350 Income tax expenss100.000 Profit for the year 200.00 Statement of Financial Position 800,000 Non-current sets 1,200,000 Equity 800,000 Inventories 400.000 Lenorm borrowings Trade receivable 380.000 Trade and other payable: 100.000 Cash 20.00 Short-term bomwings Short-term borrowings interest rate Long-term borrowings interest rate Shareholders expected return on investment The company's current assets are 8% (before tax) 6% (before tax) 12% 6. 7. The company's current liabilities are 8. The company's net working capital is 9. The company's total assets is 10. The company's total liabilities are 11. The company's total equity and liabilities is 12. The company's return on assets is 13. The company's return on revenue is The company's after tax cost of financing is 15. If the statement of income would show a depreciation amortization amount of $20,000, what would be the cash generated by the company? The cash flow would be 9. The company's total assets is 10. The company's total liabilities are 11. The company's total equity and liabilities is 12. The company's return on assets is 13. The company's return on revenue is 14. The company's after tax cost of financing is 15. If the statement of income would show a depreciation/amortization amount of $20,000, what would be the cash generated by the company? The cash flow would be 16. If the company's accounts receivable is lowered to $300,000, how much cash will it generate? The additional cash would be 17. If the company improves its inventory turnover to $350,000, how much cash will it generate? The additional cash would be 18. If the company's return on revenue is improved to 8.0%, how much profit for the year would be generated? The additional net income would be 19. By using the information contained in exercises 15, 16, 17, and 18, how much cash would the company generate? The additional cash would be 20. By using the information contained in exercise 18, what is the company's new return on assets? The new return on assets is 21. The company's before tax cost of financing is