Answered step by step

Verified Expert Solution

Question

1 Approved Answer

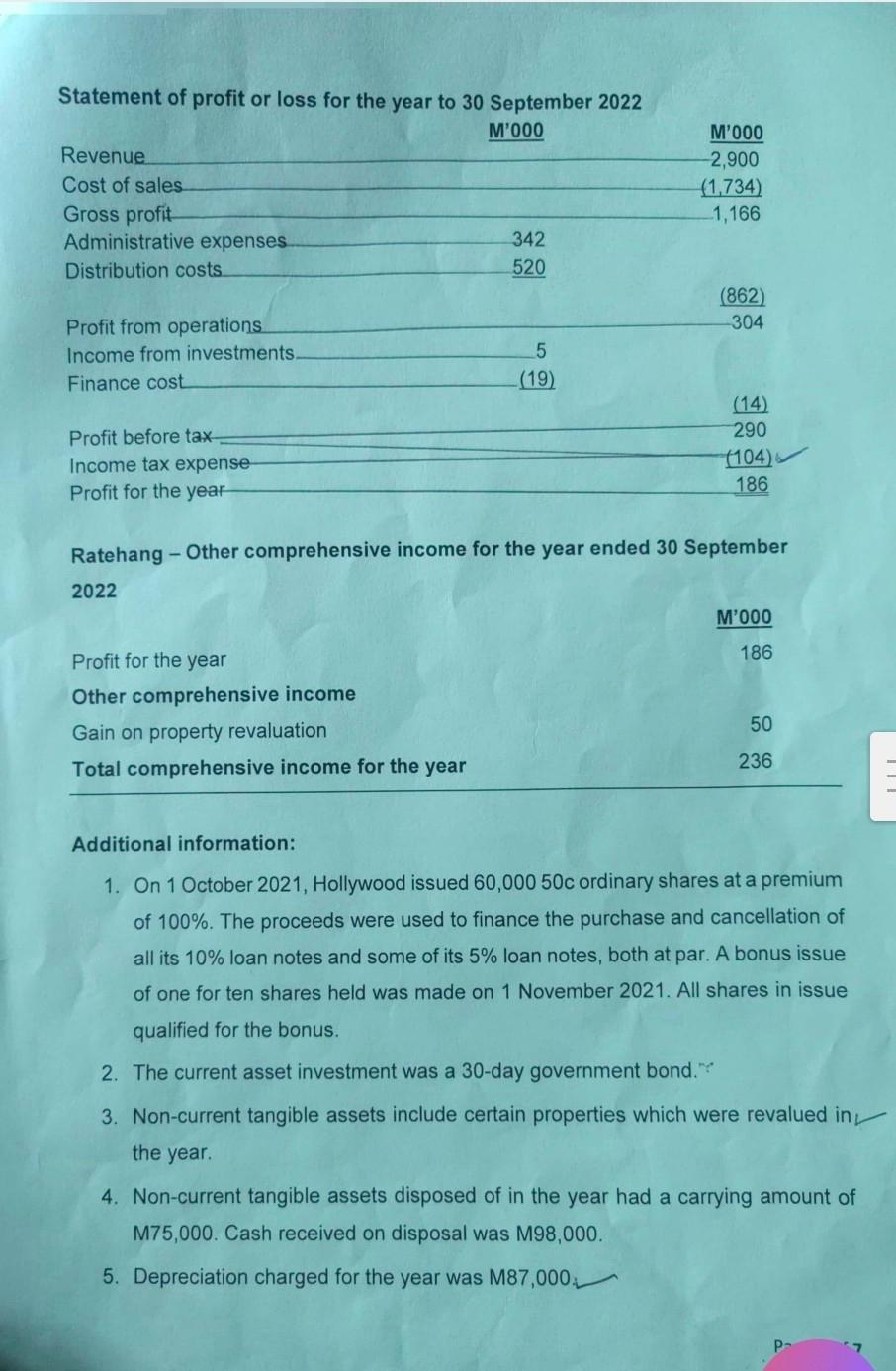

Statement of profit or loss for the year to 30 September 2022 Ratehang - Other comprehensive income for the year ended 30 September Additional information:

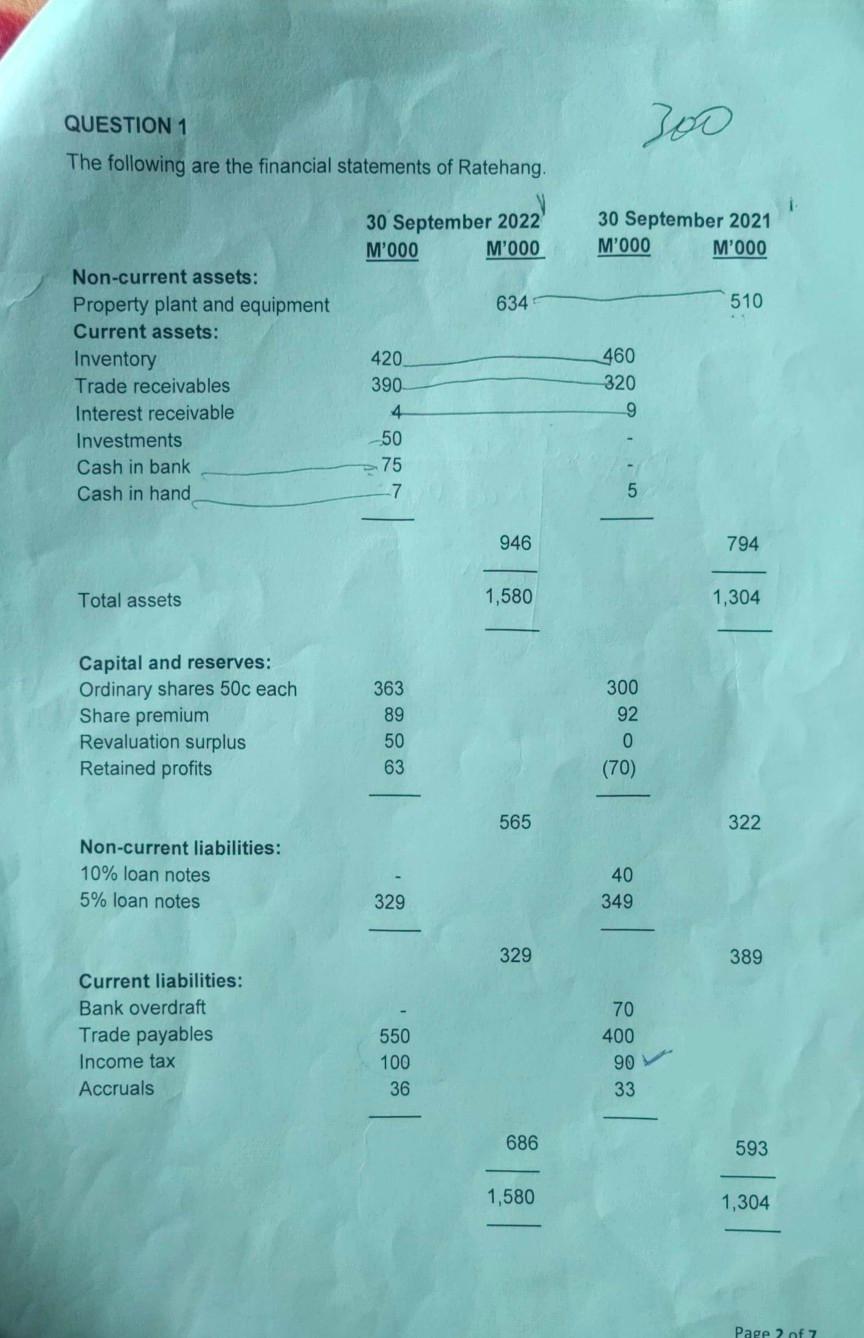

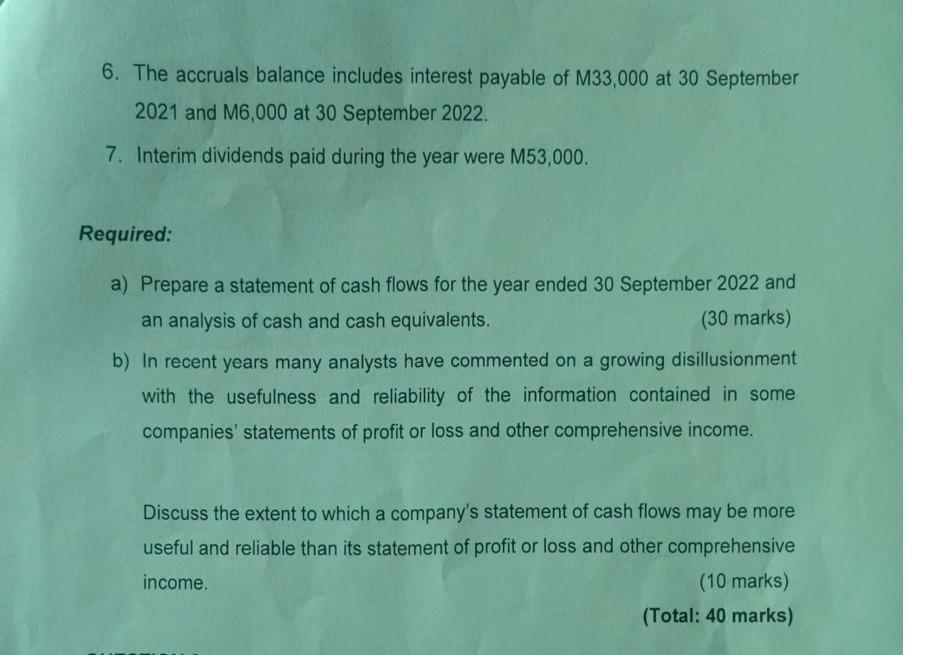

Statement of profit or loss for the year to 30 September 2022 Ratehang - Other comprehensive income for the year ended 30 September Additional information: 1. On 1 October 2021 , Hollywood issued 60,00050 c ordinary shares at a premium of \100. The proceeds were used to finance the purchase and cancellation of all its \10 loan notes and some of its \5 loan notes, both at par. A bonus issue of one for ten shares held was made on 1 November 2021. All shares in issue qualified for the bonus. 2. The current asset investment was a 30-day government bond. \\( ? \\) 3. Non-current tangible assets include certain properties which were revalued in the year. 4. Non-current tangible assets disposed of in the year had a carrying amount of M75,000. Cash received on disposal was M98,000. 5. Depreciation charged for the year was \\( M 87,000 \\). QUESTION 1 The following are the financial statements of Ratehang. 300 Non-current assets: Property plant and equipment Current assets: Inventory Trade receivables Interest receivable Investments Cash in bank Cash in hand Total assets Capital and reserves: Ordinary shares \\( 50 \\mathrm{c} \\) each Share premium Revaluation surplus Retained profits Non-current liabilities: \10 loan notes \5 loan notes 329 Current liabilities: Bank overdraft Trade payables Income tax Accruals 420 390 4 50 75 7 363 89 50 63 460 320 9 946 1,580 300 92 0 (70) 565 40 349 329 \\( \\begin{array}{r}550 \\\\ 100 \\\\ 36 \\\\ \\hline\\end{array} \\) 322 794 1,304 6. The accruals balance includes interest payable of \\( M 33,000 \\) at 30 September 2021 and M6,000 at 30 September 2022. 7. Interim dividends paid during the year were M53,000. Required: a) Prepare a statement of cash flows for the year ended 30 September 2022 and an analysis of cash and cash equivalents. (30 marks) b) In recent years many analysts have commented on a growing disillusionment with the usefulness and reliability of the information contained in some companies' statements of profit or loss and other comprehensive income. Discuss the extent to which a company's statement of cash flows may be more useful and reliable than its statement of profit or loss and other comprehensive income. (10 marks) (Total: \\( \\mathbf{4 0} \\) marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started