Answered step by step

Verified Expert Solution

Question

1 Approved Answer

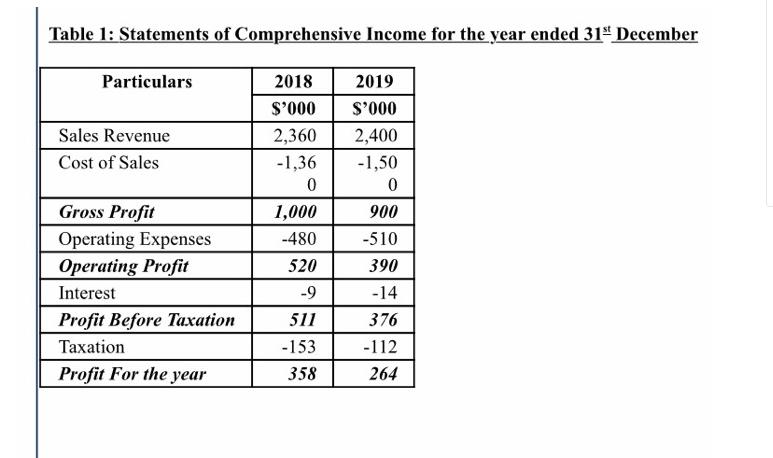

Statements of Comprehensive Income for the year ended 31 December Particulars Sales Revenue Cost of Sales Gross Profit Operating Expenses Operating Profit Interest Profit

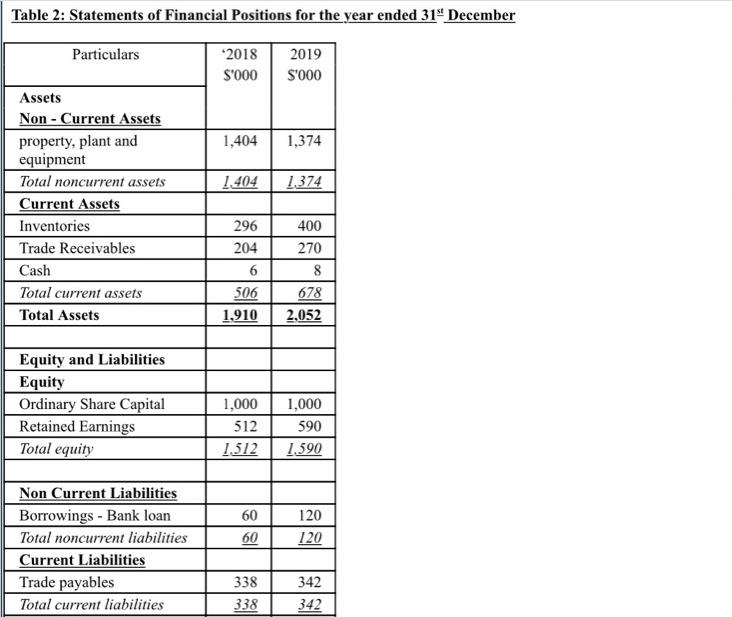

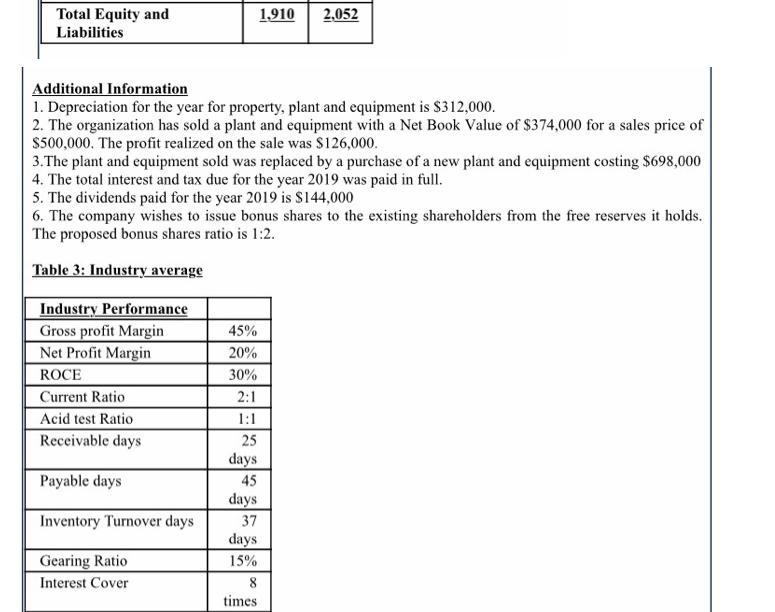

Statements of Comprehensive Income for the year ended 31 December Particulars Sales Revenue Cost of Sales Gross Profit Operating Expenses Operating Profit Interest Profit Before Taxation Taxation Profit For the year 2018 $'000 2,360 -1,36 0 1,000 -480 520 -9 511 -153 358 2019 $'000 2,400 -1,50 0 900 -510 390 -14 376 -112 264 Table 2: Statements of Financial Positions for the year ended 31 December Particulars Assets Non Current Assets - property, plant and equipment Total noncurrent assets Current Assets Inventories Trade Receivables Cash Total current assets Total Assets Equity and Liabilities Equity Ordinary Share Capital Retained Earnings Total equity Non Current Liabilities Borrowings Bank loan Total noncurrent liabilities Current Liabilities Trade payables Total current liabilities '2018 $'000 1,404 296 204 6 506 1.910 1.404 1.374 1,000 512 1.512 60 60 2019 $'000 338 338 1,374 400 270 8 678 2,052 1,000 590 1,590 120 120 342 342 Total Equity and Liabilities Additional Information 1. Depreciation for the year for property, plant and equipment is $312,000. 2. The organization has sold a plant and equipment with a Net Book Value of $374,000 for a sales price of $500,000. The profit realized on the sale was $126,000. 3.The plant and equipment sold was replaced by a purchase of a new plant and equipment costing $698,000 4. The total interest and tax due for the year 2019 was paid in full. 5. The dividends paid for the year 2019 is $144,000 6. The company wishes to issue bonus shares to the existing shareholders from the free reserves it holds. The proposed bonus shares ratio is 1:2. Table 3: Industry average Industry Performance Gross profit Margin Net Profit Margin ROCE Current Ratio Acid test Ratio Receivable days Payable days Inventory Turnover days Gearing Ratio Interest Cover 45% 20% 30% 2:1 1:1 25 days 45 days 37 days 15% 1,910 2,052 8 times You have recently joined the OSCO (LLC) as a junior accountant and asked by your line manager to prepare a report using appropriate theories and models suggest how organizations can effectively respond to existing and potential financial problems. P4 Calculate and present financial ratios for Organisational performance and investment.

Step by Step Solution

★★★★★

3.49 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started