Question

On July 1, 2013, Grenada Ltd. purchased 70% of the outstanding common shares of Carriacou Company for $266,000. On that date, Carriacous shareholders equity consisted

On July 1, 2013, Grenada Ltd. purchased 70% of the outstanding common shares of Carriacou Company for $266,000. On that date, Carriacou’s shareholders’ equity consisted of common shares of $25,000 and retained earnings of $130,000.

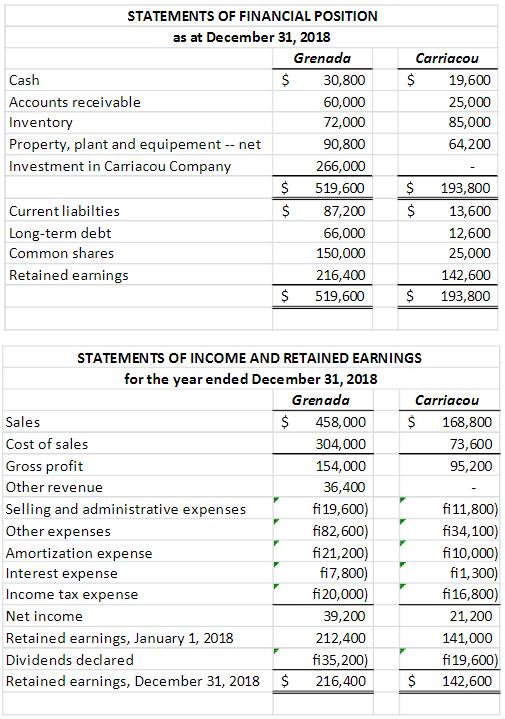

Following are the financial statements of Grenada Ltd. and Carriacou Company for 2018:

Additional information:

On the acquisition date, Grenada’s management believed that all of Carriacou’s assets were fairly valued except for inventory which was undervalued by $2,000 and equipment with a remaining useful life of ten years that was undervalued by $10,000. Current liabilities were considered to be fairly valued but long-term debt with a carrying value of $10,000 was considered to have a fair value of $11,200. That debt matured on June 30, 2019.

Goodwill impairment was considered to have occurred during 2016 and 2018 in the amounts of $4,000 and $6,000 respectively.

During 2018, Carriacou purchased inventory from Grenada for $118,000. Carriacou’s inventories contained goods purchased form Grenada for $68,000 at December 31, 2017 and $22,200 at December 31, 2018. All intercompany sales are priced to yield a gross profit of 50%.

On January 1, 2015, Grenada sold some equipment to Carriacou for $60,000 and recorded a pre-tax gain of $7,200 on the sale. This equipment had a remaining life of eight years on the date of the intercompany sale.

The parent company charges its subsidiary $1,000 a month for rent and did so throughout 2017 and 2018. Rental income is included in other revenue and rental expense is included in other expenses.

Grenada uses the cost method to account for its investment in Carriacou. It values the noncontrolling interest in Carriacou using the fair value enterprise approach.

Both companies pay income taxes at the rate of 40%.

Required:

a) Prepare a consolidated statement of income and retained earnings for the year ended December 31, 2018.

b) Calculate the following balances that would appear in the consolidated statement of financial position as at December 31, 2018:

i) inventory;

ii) deferred income tax asset;

iii) goodwill;

iv) long-term debt;

v) non-controlling interest

STATEMENTS OF FINANCIAL POSITION as at December 31, 2018 Grenada Carriacou Cash $ 30,800 $ 19,600 Accounts receivable 60,000 25,000 Inventory 72,000 85,000 Property, plant and equipement -- net 90,800 64,200 Investment in Carriacou Company 266,000 519,600 193,800 Current liabilties 87,200 13,600 Long-term debt 66,000 12,600 Common shares 150,000 25,000 Retained earnings 216,400 142,600 $ $ 519,600 193,800 STATEMEN TS OF INCOME AND RETAINED EARNINGS for the year ended December 31, 2018 Grenada Carriacou Sales $ 458,000 $ 168,800 Cost of sales 304,000 73,600 Gross profit 154,000 95,200 Other revenue 36,400 Selling and administrative expenses fi 19,600) fi11,800) Other expenses fi82,600) fi34,100) Amortization expense fi21,200) fi7,800) fi20,000) fi 10,000) fi1,300) fi16,800) Interest expense Income tax expense Net income 39,200 21, 200 Retained earnings, January 1, 2018 212,400 141,000 Dividends declared fi35,200) $ fi19,600) 2$ Retained earnings, December 31, 2018 216,400 142,600

Step by Step Solution

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Important note though the value of the property plant equipment Has been shown as net yet the method of charging depreciation has Not been disclosed In the absence of the method of depreciation the Im...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started