Question

QUESTION 3 You purchase a 2 year call option. The option gives you the right to buy the stock at $65. The current stock

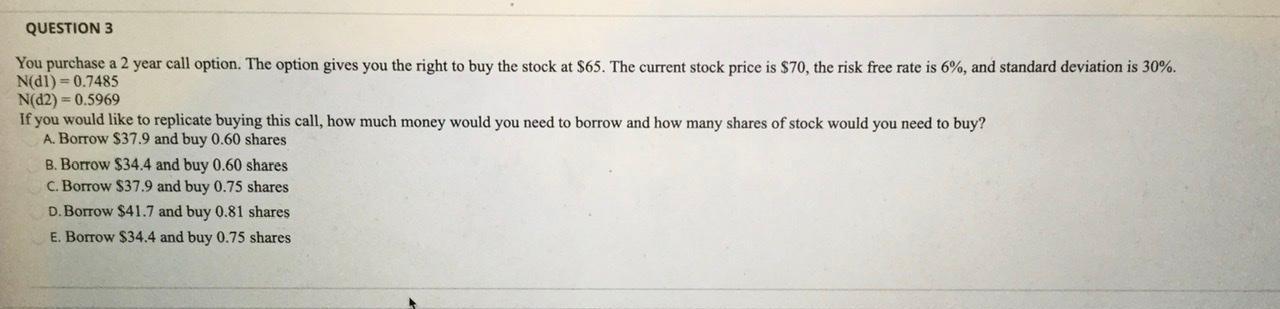

QUESTION 3 You purchase a 2 year call option. The option gives you the right to buy the stock at $65. The current stock price is $70, the risk free rate is 6%, and standard deviation is 30%. N(dl) = 0.7485 N(d2) = 0.5969 If you would like to replicate buying this call, how much money would you need to borrow and how many shares of stock would you need to buy? A. Borrow $37.9 and buy 0.60 shares B. Borrow $34.4 and buy 0.60 shares C. Borrow $37.9 and buy 0.75 shares D. Borrow $41.7 and buy 0.81 shares E. Borrow $34.4 and buy 0.75 shares

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The replicating portfolio is embedded in the BlackScholes model To replicate this call you w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Markets and Institutions

Authors: Jeff Madura

12th edition

9781337515535, 1337099740, 1337515531, 978-1337099745

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App