Question

Stauffer Chemical Co. is considering five investments. The cost of each is shown below. Retained earnings of $650,000 will be available for investment purpose, and

Stauffer Chemical Co. is considering five investments. The cost of each is shown below. Retained earnings of $650,000 will be available for investment purpose, and management can issue the following securities:

1.Bonds: $270,000 can be issued at an after-flotation, before-tax cost of 8.5 percent. Above$270,000 the cost will be 9.75 percent.

2.Preferred stock: The stock can be issued at the prevailing market price. Issuance will cost $1.55per share up to an issue size of $90,000; thereafter costs will be $2.8 per share

3.Common stock: The stock will be issued at the market price. For an issue of $250,000, flotationcosts will be $1 per share. For any additional common, the flotation costs should then be $1.75per share.

The tax rate for the firm is 34 percent. Common dividends last year were $1.80 and are expected to grow at an annual rate of 9 percent. Market prices are $975 for bonds, $39 for preferred stock, and $23 for common stock.

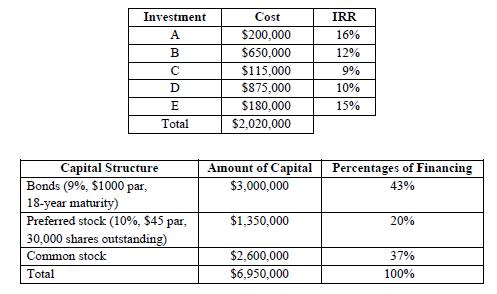

Determine which projects should be accepted, based upon a comparison of the internal rate of return (IRR) of the investments and the weighted marginal cost of capital. The firm’s capital structure is shown below, and the same mix is to be used for future investments.

Investinent Cost IRR $200,000 $650,000 $115,000 A 16% 12% 9% D $875,000 10% E 15% $180,000 $2,020,000 Total Capital Structure Bonds (9%, $1000 par, Aimount of Capital Percentages of Financing $3,000,000 43% 18-year maturity) Preferred stock (10%, $45 par, 30,000 shares outstanding) $1,350,000 20% Common stock $2,600,000 37% Total $6,950,000 100%

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Investment Cost Proportion Debt Debt Amount Cost of Debt P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started