Question

Stay Swift Corp. is issuing new 9-year bonds with 21 warrants attached to each $1,000 par value bond. Stay Swift Corp. wanted to issue

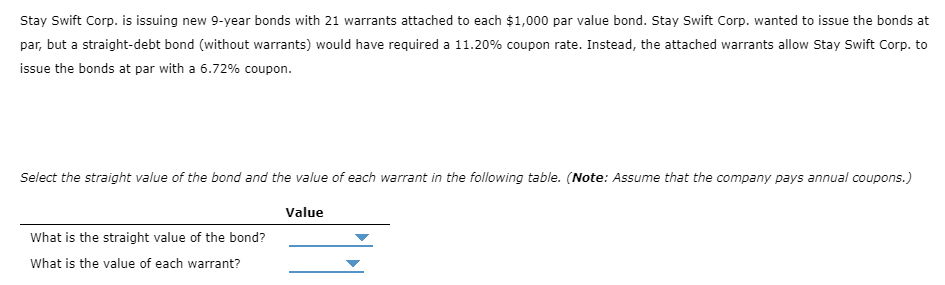

Stay Swift Corp. is issuing new 9-year bonds with 21 warrants attached to each $1,000 par value bond. Stay Swift Corp. wanted to issue the bonds at par, but a straight-debt bond (without warrants) would have required a 11.20% coupon rate. Instead, the attached warrants allow Stay Swift Corp. to issue the bonds at par with a 6.72% coupon. Select the straight value of the bond and the value of each warrant in the following table. (Note: Assume that the company pays annual coupons.) What is the straight value of the bond? What is the value of each warrant? Value

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Lets start by calculating the coupon payment on the straightdebt bond without warrants The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial management theory and practice

Authors: Eugene F. Brigham and Michael C. Ehrhardt

12th Edition

978-0030243998, 30243998, 324422695, 978-0324422696

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App