Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steam Co., an all-equity financed firm, expects to have after-tax cash flows next year of $5.25M and its free cash flows is expected to

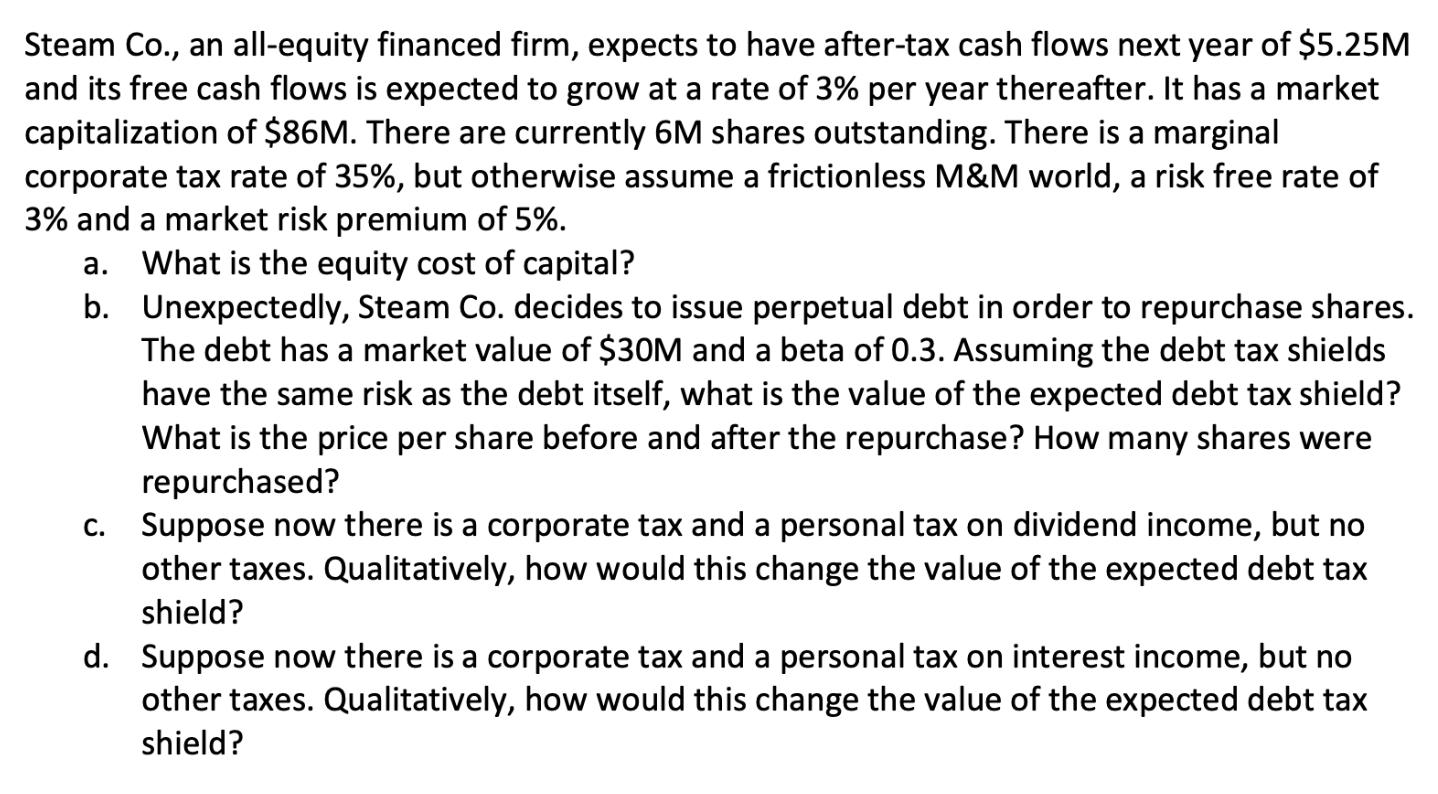

Steam Co., an all-equity financed firm, expects to have after-tax cash flows next year of $5.25M and its free cash flows is expected to grow at a rate of 3% per year thereafter. It has a market capitalization of $86M. There are currently 6M shares outstanding. There is a marginal corporate tax rate of 35%, but otherwise assume a frictionless M&M world, a risk free rate of 3% and a market risk premium of 5%. a. What is the equity cost of capital? b. Unexpectedly, Steam Co. decides to issue perpetual debt in order to repurchase shares. The debt has a market value of $30M and a beta of 0.3. Assuming the debt tax shields have the same risk as the debt itself, what is the value of the expected debt tax shield? What is the price per share before and after the repurchase? How many shares were repurchased? c. Suppose now there is a corporate tax and a personal tax on dividend income, but no other taxes. Qualitatively, how would this change the value of the expected debt tax shield? d. Suppose now there is a corporate tax and a personal tax on interest income, but no other taxes. Qualitatively, how would this change the value of the expected debt tax shield?

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a The equity cost of capital also known as the cost of equity can be calculated using the Capital Asset Pricing Model CAPM The formula for the cost of equity is Cost of Equity RiskFree Rate Beta Marke...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started