Answered step by step

Verified Expert Solution

Question

1 Approved Answer

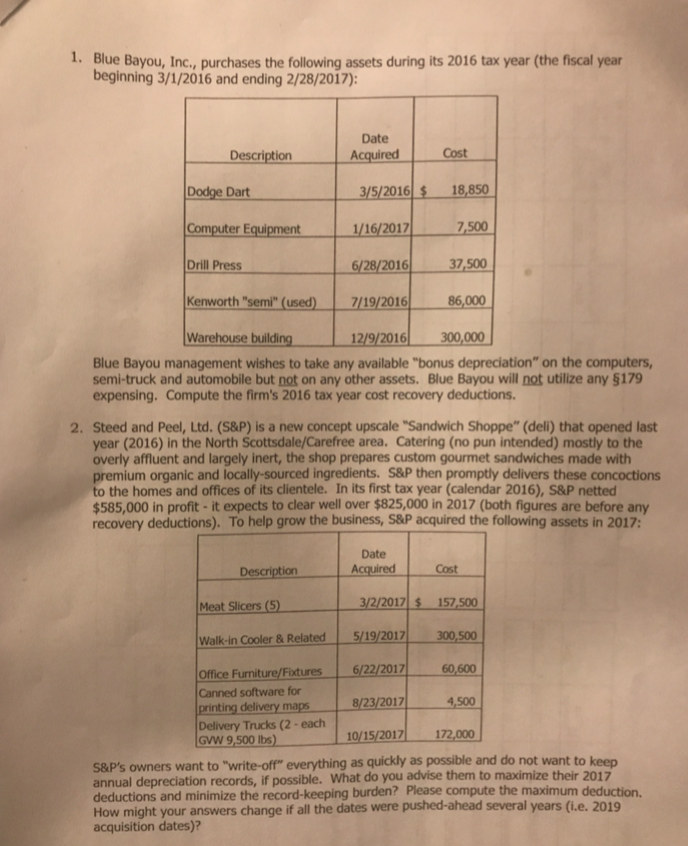

1. Blue Bayou, Inc., purchases the following assets during its 2016 tax year (the fiscal year beginning 3/1/2016 and ending 2/28/2017): Description Dodge Dart

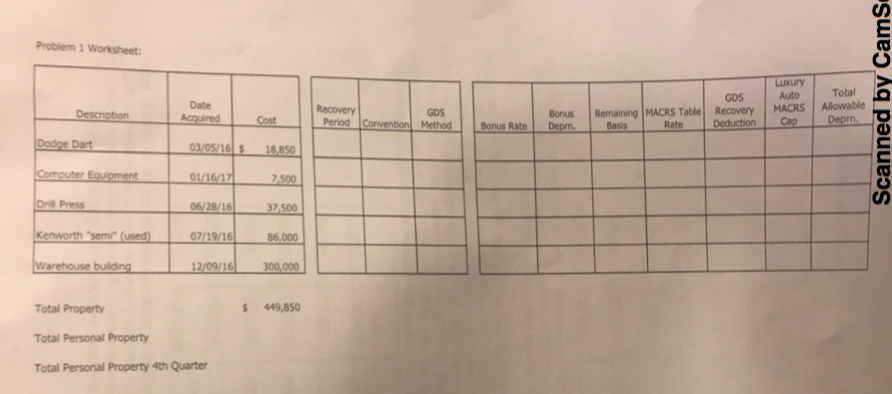

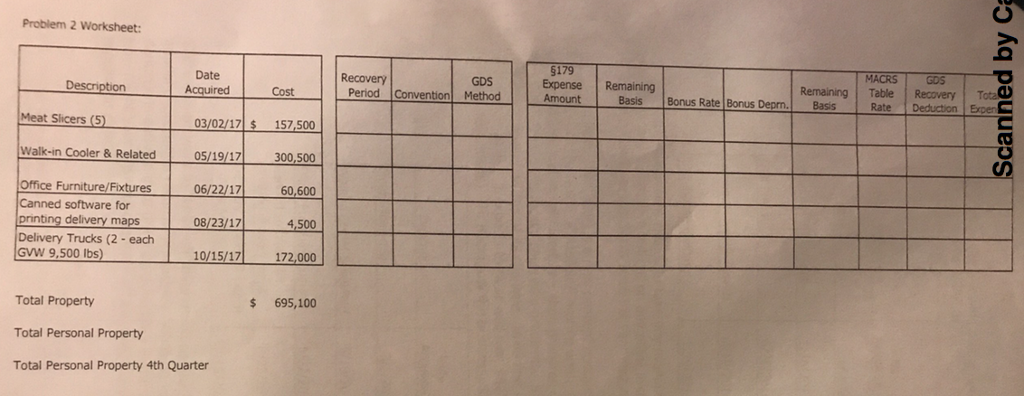

1. Blue Bayou, Inc., purchases the following assets during its 2016 tax year (the fiscal year beginning 3/1/2016 and ending 2/28/2017): Description Dodge Dart 3/5/2016 $ 18,850 1/16/2017 6/28/2016 7/19/2016 Warehouse building 12/9/2016 Blue Bayou management wishes to take any available "bonus depreciation" on the computers, semi-truck and automobile but not on any other assets. Blue Bayou will not utilize any 179 expensing. Compute the firm's 2016 tax year cost recovery deductions. Computer Equipment Drill Press Kenworth "semi" (used) Description Meat Slicers (5) Date Acquired Walk-in Cooler & Related Cost Office Furniture/Fixtures Canned software for printing delivery maps Delivery Trucks (2-each GVW 9,500 lbs) 2. Steed and Peel, Ltd. (S&P) is a new concept upscale "Sandwich Shoppe" (deli) that opened last year (2016) in the North Scottsdale/Carefree area. Catering (no pun intended) mostly to the overly affluent and largely inert, the shop prepares custom gourmet sandwiches made with premium organic and locally-sourced ingredients. S&P then promptly delivers these concoctions to the homes and offices of its clientele. In its first tax year (calendar 2016), S&P netted $585,000 in profit - it expects to clear well over $825,000 in 2017 (both figures are before any recovery deductions). To help grow the business, S&P acquired the following assets in 2017: Date Acquired 7,500 37,500 86,000 300,000 Cost 3/2/2017 $ 157,500 5/19/2017 300,500 6/22/2017 8/23/2017 10/15/2017 172,000 S&P's owners want to "write-off" everything as quickly as possible and do not want to keep annual depreciation records, if possible. What do you advise them to maximize their 2017 deductions and minimize the record-keeping burden? Please compute the maximum deduction. How might your answers change if all the dates were pushed-ahead several years (i.e. 2019 acquisition dates)? 60,600 4,500 Problem 1 Worksheet: Description Dodge Dart Computer Equipment Drill Press Kenworth "semi" (used) Warehouse building Date Acquired 03/05/16 $ 01/16/17 06/28/16 07/19/16 12/09/16 Total Property Total Personal Property Total Personal Property 4th Quarter Cost 18,850 7,500 37,500 86,000 300,000 $ 449,850 GDS Recovery Period Convention Method Bonus Rate Bonus Deprn. Remaining MACRS Table Basis Rate GDS Recovery Deduction Luxury Auto MACRS Cap Total Allowable Deprn. Scanned by CamS Problem 2 Worksheet: Description Meat Slicers (5) Walk-in Cooler & Related Office Furniture/Fixtures Canned software for printing delivery maps Delivery Trucks (2- each GVW 9,500 lbs) Date Acquired 03/02/17 $ 157,500 05/19/17 06/22/17 08/23/17 10/15/17 Total Property Total Personal Property Total Personal Property 4th Quarter Cost 300,500 60,600 4,500 172,000 $ 695,100 GDS Recovery Period Convention Method $179 Expense Amount Remaining Basis Bonus Rate Bonus Deprn. MACRS Remaining Table Basis Scanned by Ca GDS Recovery Total Rate Deduction Expen

Step by Step Solution

★★★★★

3.71 Rating (190 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION For Bayou Inc The cost recovery deductions for 2016 tax year are as follows Dodge Dart 3770 20 of 18850 Computer Equipment 2250 30 bonus depreciation Drill Press 5625 15 of 37500 Kenworth sem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started