Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stella is planning to buy an office supply business. The purchase price is $100,000, for which she will get the existing inventory (worth $15,000

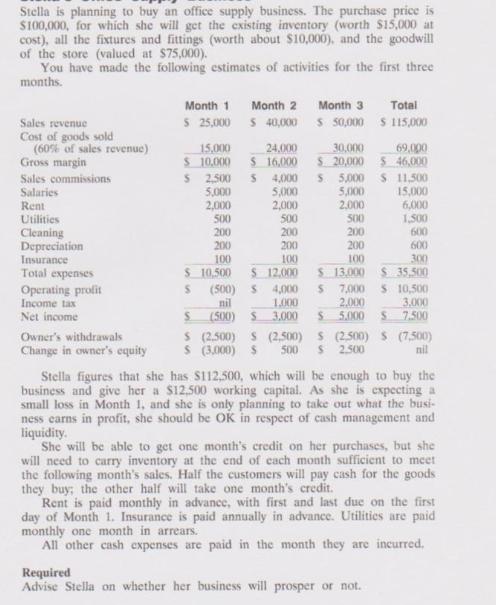

Stella is planning to buy an office supply business. The purchase price is $100,000, for which she will get the existing inventory (worth $15,000 at cost), all the fixtures and fittings (worth about $10,000), and the goodwill of the store (valued at $75,000). You have made the following estimates of activities for the first three months. Sales revenue Cost of goods sold (60% of sales revenue) Gross margin Sales commissions Salaries Rent Utilities Cleaning Depreciation Insurance Total expenses Operating profit Income tax Net income Owner's withdrawals Change in owner's equity Month 1 Month 2 $ 25,000 $ 40,000 15,000 24,000 $ 10,000 $ 16,000 S 2,500 5,000 2,000 500 200 200 100 $ 10,500 S S 4,000 5,000 2,000 500 200 200 100 $ 12,000 $4,000 1,000 3,000 (500) nil (500) S Month 3 $50,000 30,000 $ 20,000 $ 5,000 5,000 2.000 500 200 200 100 Total $ 115,000 $ 11,500 15,000 6,000 1,500 600 600 300 $ 13.000 $ 35,500 S 7,000 $ 10,500 2,000 3,000 $ 5.000 $ 7.500 69,000 $ 46,000 S S (2,500) S (2,500) S (2500) S (7,500) $ (3,000) S 500 S 2.500 nil Stella figures that she has $112,500, which will be enough to buy the business and give her a $12,500 working capital. As she is expecting a small loss in Month 1, and she is only planning to take out what the busi- ness carns in profit, she should be OK in respect of cash management and liquidity. Required Advise Stella on whether her business will prosper or not. She will be able to get one month's credit on her purchases, but she will need to carry inventory at the end of each month sufficient to meet the following month's sales. Half the customers will pay cash for the goods they buy; the other half will take one month's credit. Rent is paid monthly in advance, with first and last due on the first day of Month 1. Insurance is paid annually in advance. Utilities are paid monthly one month in arrears. All other cash expenses are paid in the month they are incurred.

Step by Step Solution

★★★★★

3.59 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

However based on the information you have provided I can give you some general advice First it is im...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started