Question

Stellar Corporation's weekly payroll of $32,000 included FICA taxes withheld of $2,448, federal taxes withheld of $3,290, state taxes withheld of $830, and insurance

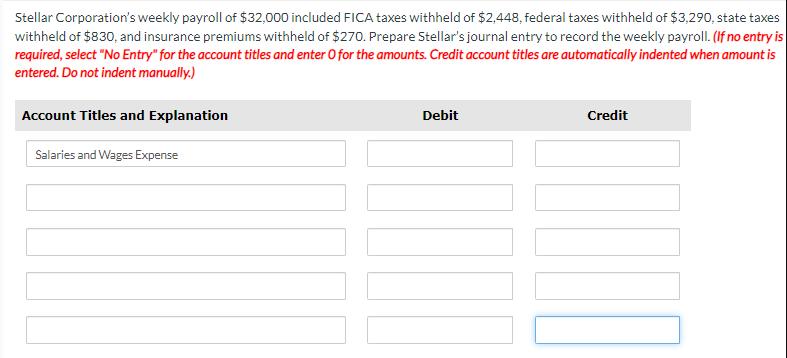

Stellar Corporation's weekly payroll of $32,000 included FICA taxes withheld of $2,448, federal taxes withheld of $3,290, state taxes withheld of $830, and insurance premiums withheld of $270. Prepare Stellar's journal entry to record the weekly payroll. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Salaries and Wages Expense OND

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Account Titles and Explanation Salaries an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting principles and analysis

Authors: Terry d. Warfield, jerry j. weygandt, Donald e. kieso

2nd Edition

471737933, 978-0471737933

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App