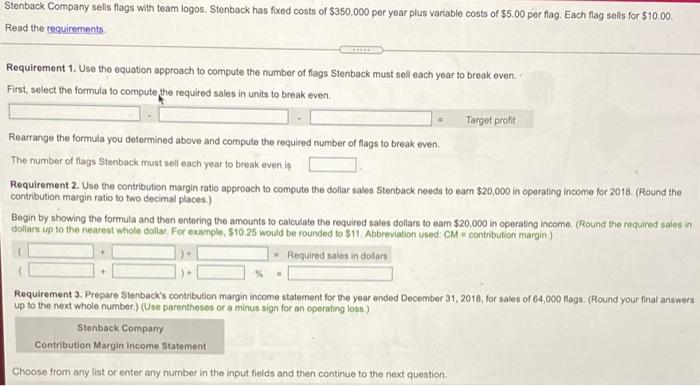

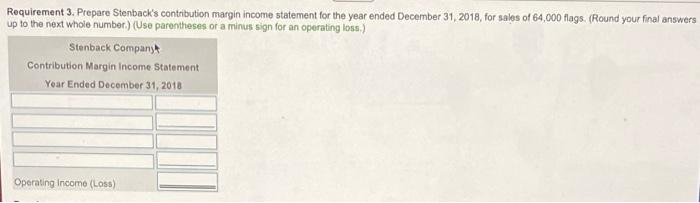

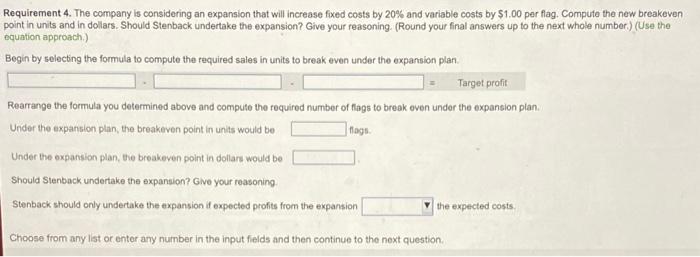

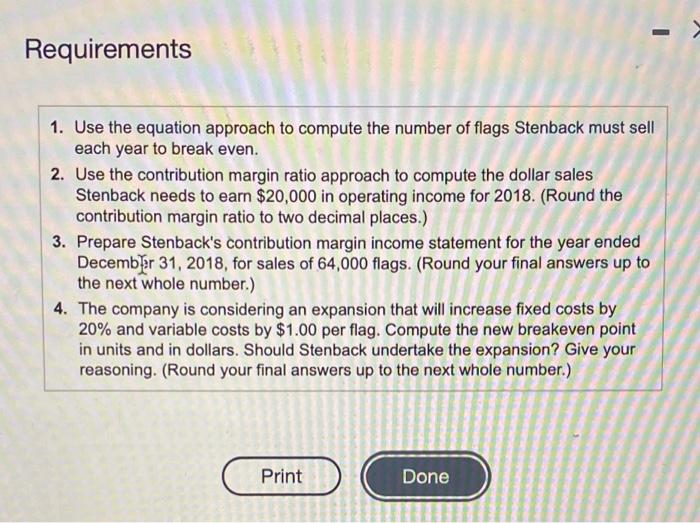

Stenback Company sells flags with team logos. Stenback has fixed costs of $350,000 per year plus variable costs of $5.00 per flag. Each flag sells for $10.00 Read the requirements Requirement 1. Use the equation approach to compute the number of flags Stenback must sell each year to break even First, select the formula to compute the required sales in units to break even. Target profit Rearrange the formula you determined above and compute the required number of flags to break even. The number of flags Stenback must sell each year to break even is Requirement 2. Use the contribution margin ratio approach to compute the dollar sales Stenback needs to earn $20,000 in operating income for 2018. (Round the contribution margin ratio to two decimal places) Begin by showing the formula and then entering the amounts to calculate the required sales dollars to earn $20,000 in operating income (Round the required sales in dollars up to the nearest whole dollar. For example, $10 25 would be rounded to $11. Abbreviation used: CM contribution margin) Required sales in dollars Requirement 3. Prepare Stenbach's contribution margin Income statement for the year ended December 31, 2018, for sales of 64,000 flags, (Round your final answers up to the next whole number) (Use parentheses or a minus sign for an operating 10.) Stenback Company Contribution Margin Income Statement Choose from any list or enter any number in the input fields and then continue to the next question Requirement 3. Prepare Stenback's contribution margin income statement for the year ended December 31, 2018, for sales of 64,000 flags. (Round your final answers up to the next whole number) (Use parentheses or a minus sign for an operating loss.) Stenback Company Contribution Margin Income Statement Year Ended December 31, 2018 Operating Income (Loss) Requirement 4. The company is considering an expansion that will increase fixed costs by 20% and variable costs by $1.00 per flag. Compute the new breakeven point in units and in dollars. Should Stenback undertake the expansion? Give your reasoning. (Round your final answers up to the next whole number) (Use the equation approach) Begin by selecting the formula to compute the required sales in units to break even under the expansion plan Target profit Rearrange the formula you determined above and compute the required number of flags to break even under the expansion plan Under the expansion plan, the breakeven point in units would be Tags Under the expansion plan, the breakeven point in dollars would be Should Sunback undertake the expansion? Give your reasoning Stenback should only undertake the expansion if expected profits from the expansion the expected costs Choose from any list or entor any number in the input fields and then continue to the next question Requirements 1. Use the equation approach to compute the number of flags Stenback must sell each year to break even. 2. Use the contribution margin ratio approach to compute the dollar sales Stenback needs to earn $20,000 in operating income for 2018. (Round the contribution margin ratio to two decimal places.) 3. Prepare Stenback's contribution margin income statement for the year ended December 31, 2018, for sales of 64,000 flags. (Round your final answers up to the next whole number.) 4. The company is considering an expansion that will increase fixed costs by 20% and variable costs by $1.00 per flag. Compute the new breakeven point in units and in dollars. Should Stenback undertake the expansion? Give your reasoning. (Round your final answers up to the next whole number.) Print Done