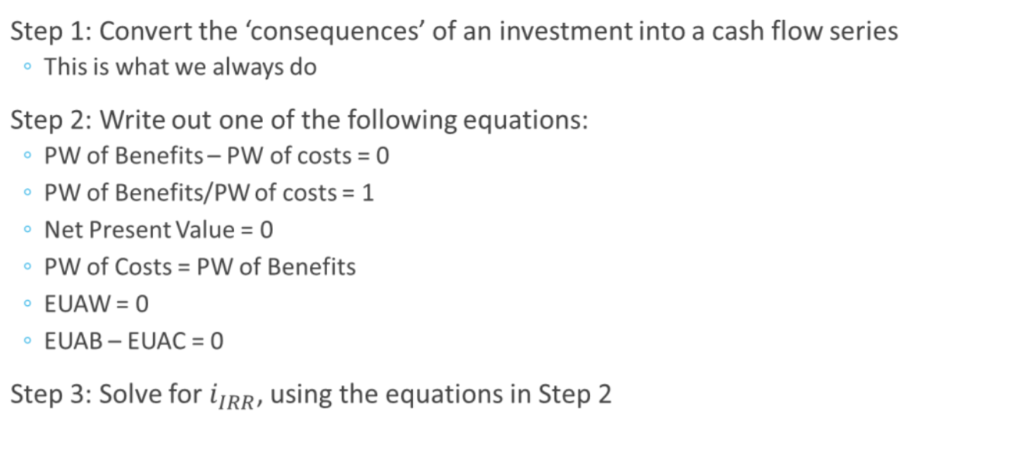

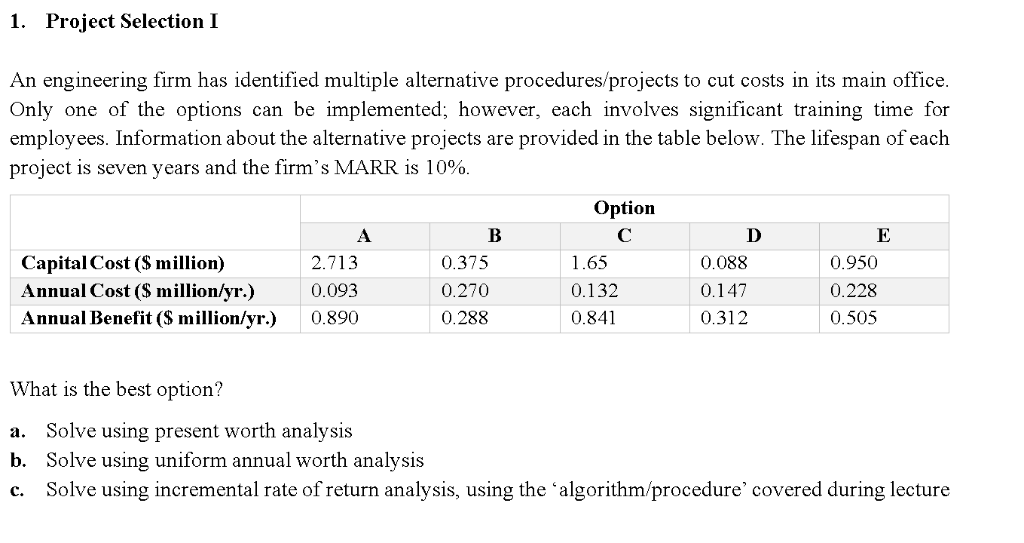

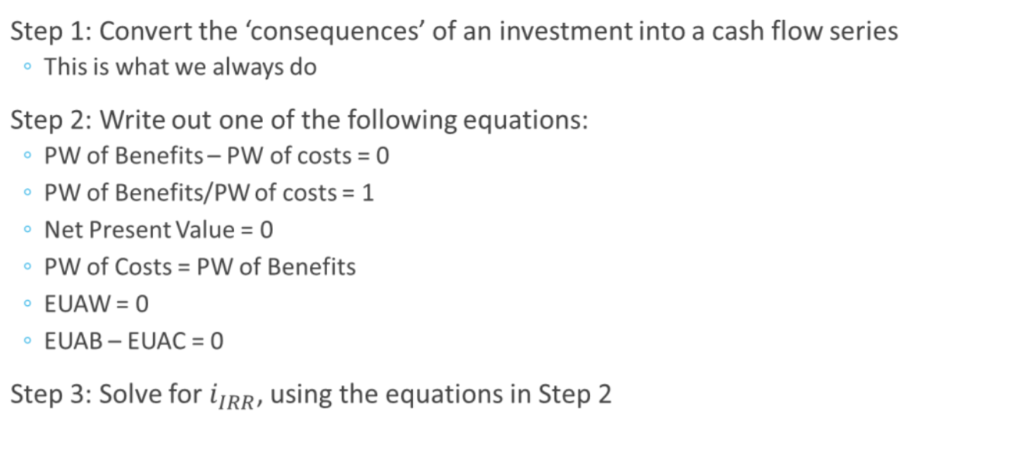

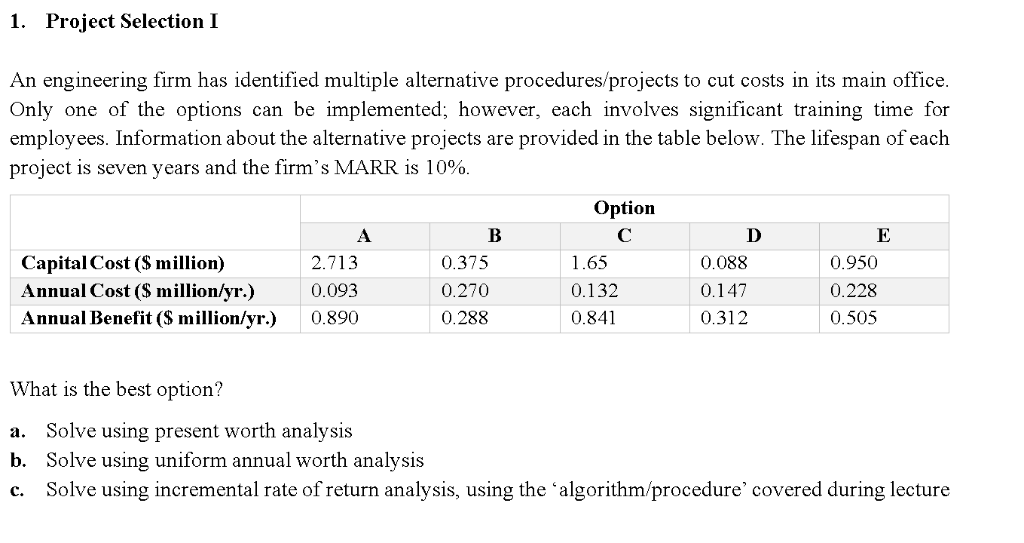

Step 1: Convert the 'consequences' of an investment into a cash flow series o This is what we always do Step 2: Write out one of the following equations: PW of Benefits-PW of costs- PW of Benefits/PW of costs 1 Net Present Value- PW of Costs PW of Benefits EUAW-O Step 3: Solve for IRR, using the equations in Step 2 1. Proiect Selection I An engineering firm has identified multiple alternative procedures/projects to cut costs in its main office Only one of the options can be implemented; however, each involves significant training time for employees. Information about the alternative projects are provided in the table below. The lifespan of each project is seven years and the firm's MARR is 10% Option Capital Cost (S million) 0.375 1.65 0.950 2.713 0.088 0.270 0.132 Annual Cost (S million/yr.) 0.093 Annual Benefit (S million/yr.)0.890 0.147 0.228 0.505 0.288 0.841 0.312 What is the best option? Solve using present worth analysis a. b. Solve using uniform annual worth analysis Solve using incremental rate of return analysis, using the 'algorithm/procedure covered during lecture c. Step 1: Convert the 'consequences' of an investment into a cash flow series o This is what we always do Step 2: Write out one of the following equations: PW of Benefits-PW of costs- PW of Benefits/PW of costs 1 Net Present Value- PW of Costs PW of Benefits EUAW-O Step 3: Solve for IRR, using the equations in Step 2 1. Proiect Selection I An engineering firm has identified multiple alternative procedures/projects to cut costs in its main office Only one of the options can be implemented; however, each involves significant training time for employees. Information about the alternative projects are provided in the table below. The lifespan of each project is seven years and the firm's MARR is 10% Option Capital Cost (S million) 0.375 1.65 0.950 2.713 0.088 0.270 0.132 Annual Cost (S million/yr.) 0.093 Annual Benefit (S million/yr.)0.890 0.147 0.228 0.505 0.288 0.841 0.312 What is the best option? Solve using present worth analysis a. b. Solve using uniform annual worth analysis Solve using incremental rate of return analysis, using the 'algorithm/procedure covered during lecture c