Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Step 1. Journalize the entries to record the employer's payroll tax expense for each pay period in the general journal. Step 2: Journalize the payment

Step 1. Journalize the entries to record the employer's payroll tax expense for each pay period in the general journal.

Step 2: Journalize the payment of each tax liability in the general journal.

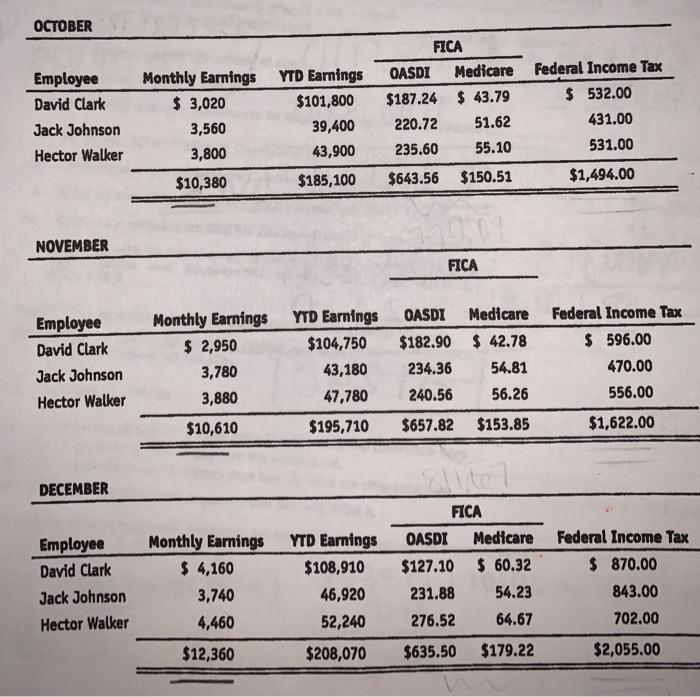

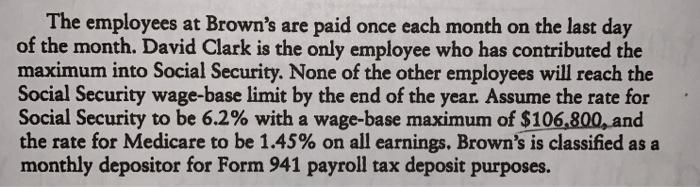

OCTOBER Employee David Clark Jack Johnson Hector Walker NOVEMBER Employee David Clark Jack Johnson Hector Walker DECEMBER Employee David Clark Jack Johnson Hector Walker Monthly Earnings $ 3,020 3,560 3,800 $10,380 Monthly Earnings $ 2,950 3,780 3,880 $10,610 Monthly Earnings $ 4,160 3,740 4,460 $12,360 YTD Earnings $101,800 39,400 43,900 $185,100 YTD Earnings $104,750 43,180 47,780 $195,710 YTD Earnings $108,910 46,920 52,240 $208,070 FICA Medicare Federal Income Tax $ 532.00 431.00 531.00 $1,494.00 OASDI $187.24 $43.79 220.72 51.62 235.60 55.10 $643.56 $150.51 FICA OASDI Medicare $182.90 $42.78 234.36 54.81 240.56 56.26 $657.82 $153.85 Elite 7 FICA OASDI Medicare $127.10 $ 60.32 231.88 54.23 276.52 64.67 $635.50 $179.22 Federal Income Tax $ 596.00 470.00 556.00 $1,622.00 Federal Income Tax $ 870.00 843.00 702.00 $2,055.00

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

48 49 50 Date 51 October 52 53 54 898584 Journalize the entries to record the employers payroll tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started